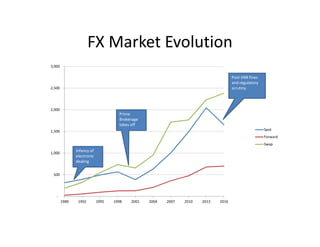

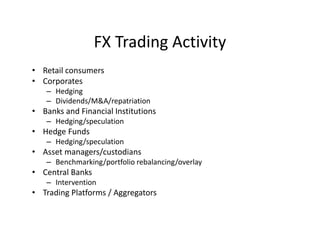

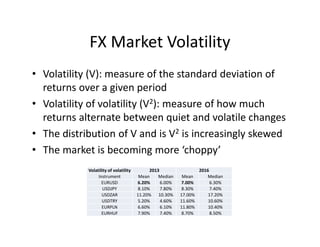

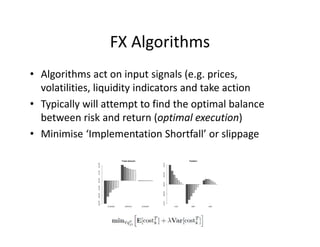

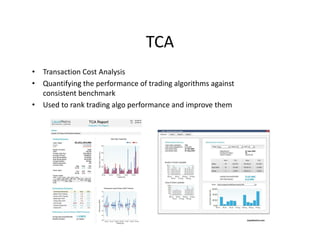

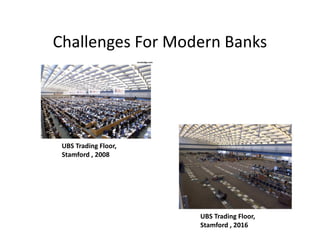

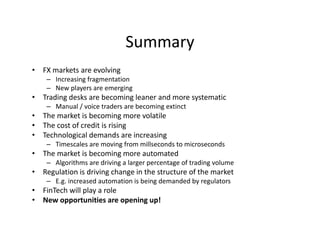

The document discusses the modern foreign exchange (FX) trading desk and market. It notes that FX trading has become highly automated, with algorithms driving an increasing percentage of trading volume. Trading desks have become leaner and more systematic over time as manual voice traders become less common. The market is also facing increasing demands from new technologies, rising costs, and evolving regulation. Overall, the FX market and trading desks are in a period of significant change and evolution driven by new technologies, regulations, and the growing role of algorithms.