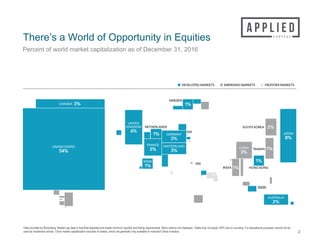

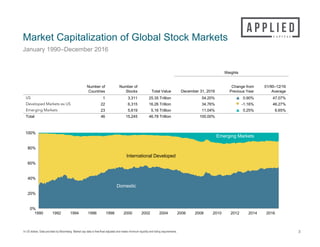

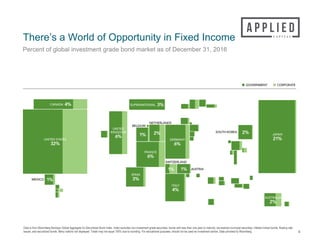

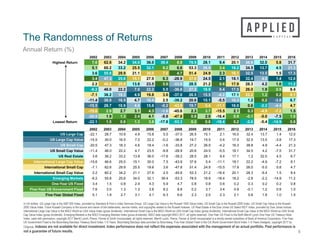

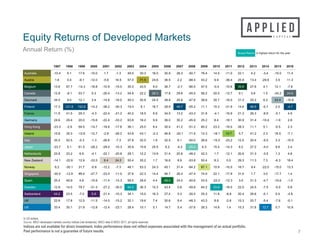

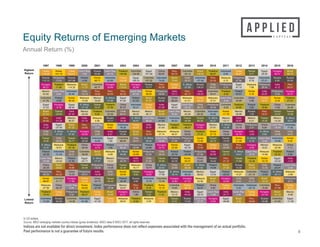

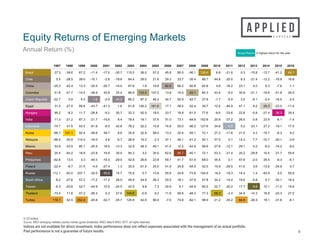

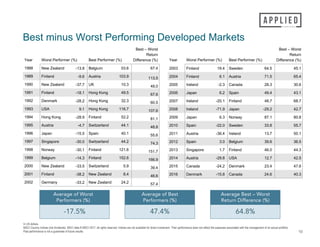

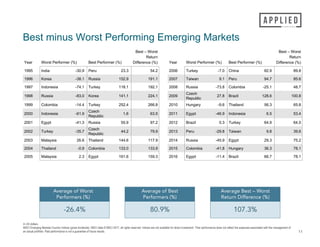

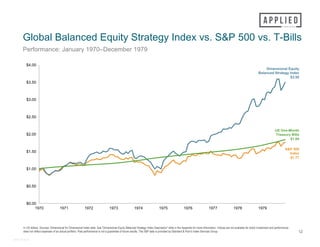

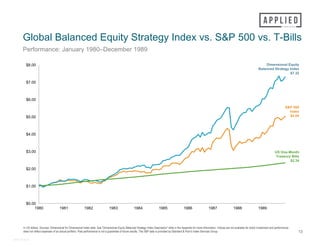

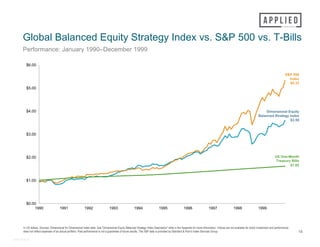

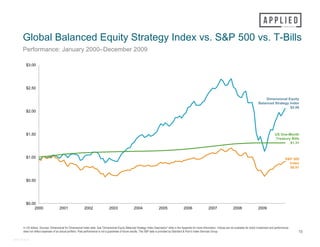

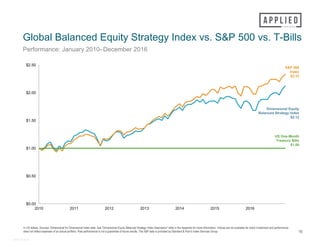

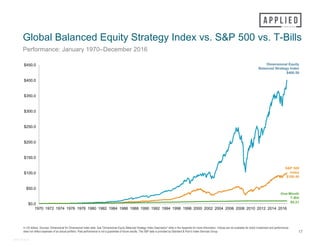

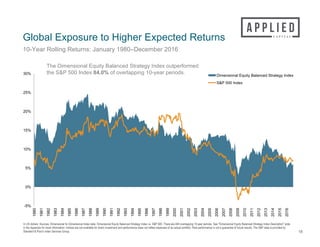

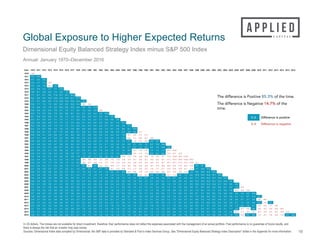

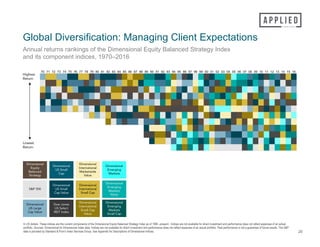

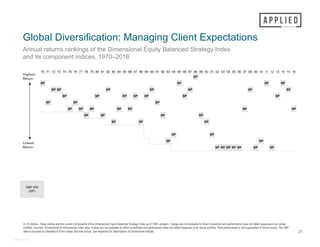

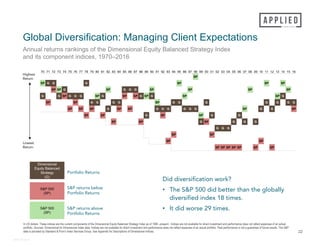

The document discusses the importance of global diversification in equities and fixed income, noting that as of December 31, 2016, the U.S. accounted for 54.20% of global stock market capitalization. It provides data on market performance, emphasizing the varying returns across different market segments, including U.S. large cap, emerging markets, and international indices. Additionally, it highlights the potential risks and volatility in stock and bond investments, underscoring that past performance is not indicative of future results.