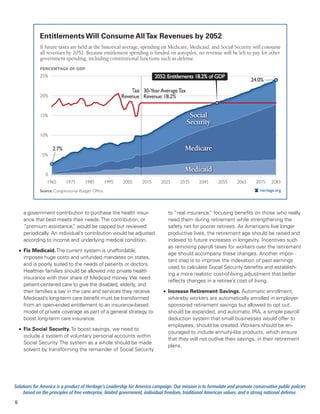

The document discusses the entitlement crisis in the U.S., primarily focusing on the unsustainable growth of programs like Social Security, Medicare, and Medicaid, which threaten the nation's fiscal stability. It suggests that Congress must implement budget controls and reforms to avoid catastrophic debt, including reviewing and capping entitlement spending and transitioning to more sustainable funding models. The document emphasizes the urgent need for comprehensive reform to prevent the inevitable financial collapse as demographics shift and spending rises.