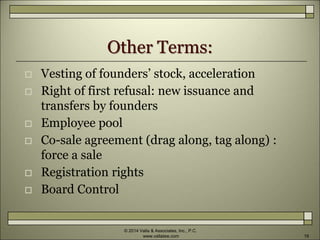

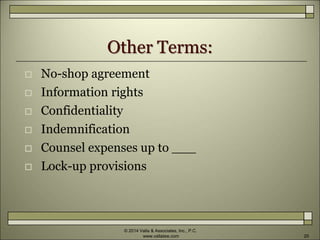

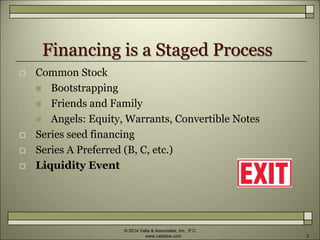

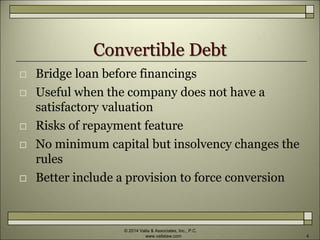

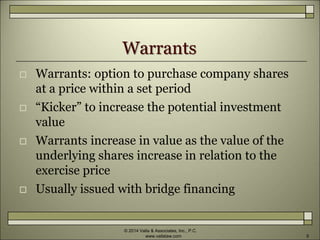

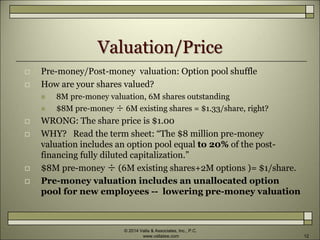

The document discusses the venture capital financing process, outlining key elements such as term sheet negotiation, types of financing, and the importance of convertible debt and warrants. It provides insights on preparing for due diligence, valuation methodologies, and structuring preferred stock agreements, including liquidation preferences and anti-dilution protections. Additionally, it emphasizes the negotiable nature of terms and the need for entrepreneurs to understand the implications of their agreements.

![Dividends

No expectation of dividends, but:

Cumulative Dividends: __ % cumulative dividend accrues over

time, whether or not the company declares it - PLUS participation

with Common Stock on an as-converted basis.

Non-cumulative Dividends: “An amount equal to $[_____] per

share of Series A Preferred when, as and if declared by the

Board”

PIK (payment-in-kind) dividends. Company option to pay

accrued and unpaid dividends in cash or in common shares

valued at fair market value.

Usually payable on liquidation or redemption, not conversion

© 2014 Valla & Associates, Inc., P.C.

www.vallalaw.com 14](https://image.slidesharecdn.com/termsheetnegotiationsmbarazzutti-140725141129-phpapp01/85/Term-Sheet-Negotiations-14-320.jpg)