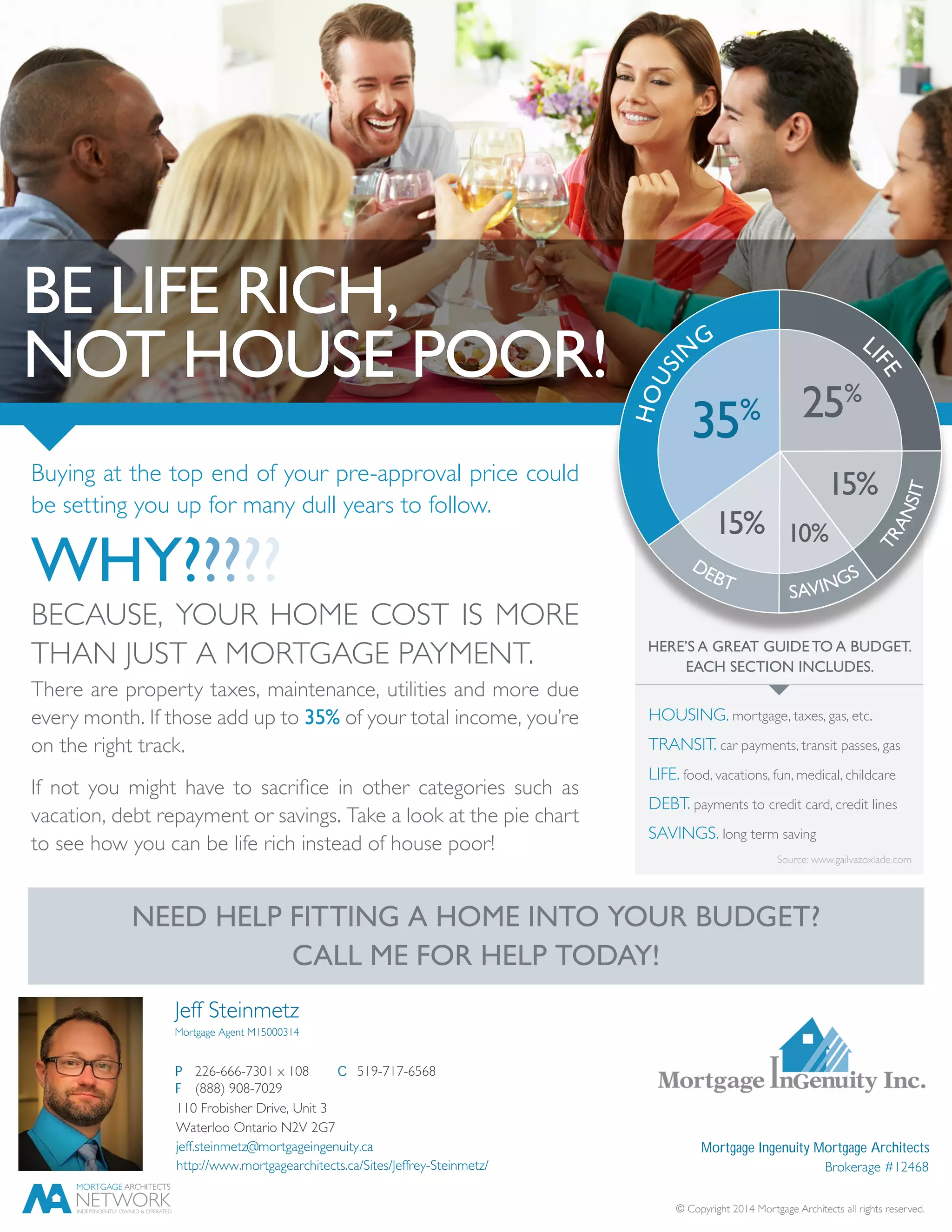

Buying a home at the top of your approved budget could lead to many dull years of sacrificing other financial goals to afford housing costs. Total housing costs, including taxes, utilities and maintenance, should not exceed 35% of total income to avoid being "house poor". A budget that allocates 10% to housing, 15% to transportation, 15% to living expenses, 25% to debt repayment, and 35% to savings can help people afford a home while staying "life rich".