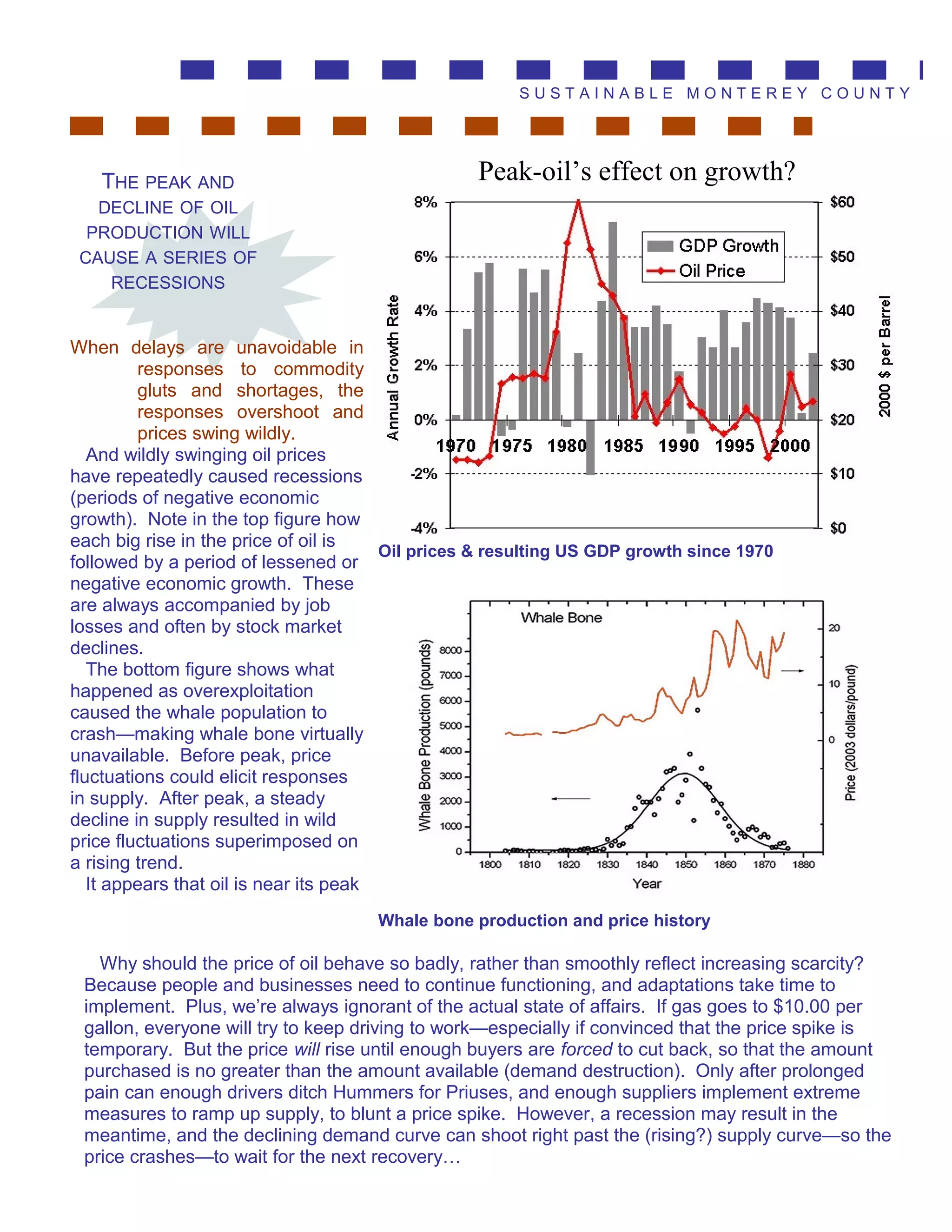

This document discusses how oil price volatility will likely increase as global oil production peaks and declines. It predicts that wild swings in oil prices up and down will cause recurring recessions as economic growth is dependent on stable, low oil prices. When oil supplies tighten, prices will spike until demand is destroyed through recession, then overshoot downward before the next cycle repeats. The unpredictable nature of supply disruptions means the public will be repeatedly reassured of only temporary shortages until prolonged high prices finally force adaptations. The effects will mirror the historical crash and fluctuations in whale bone prices after whale populations peaked and declined.