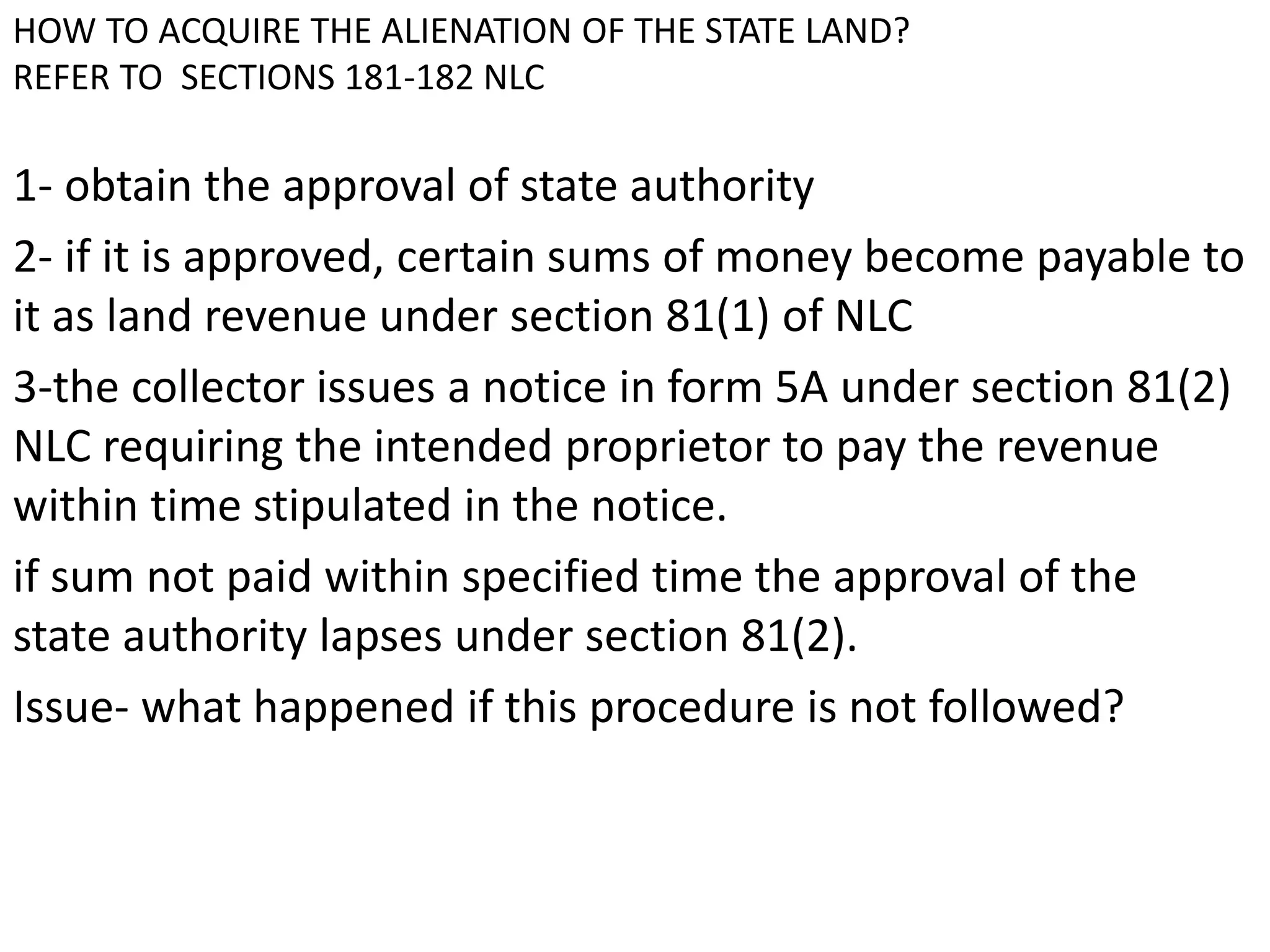

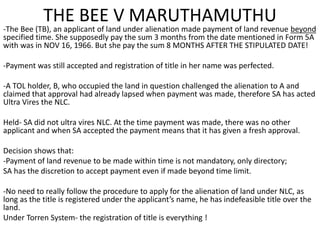

This document discusses the procedure for acquiring state land under the National Land Code (NLC) of Malaysia. It summarizes a court case where an applicant paid the land revenue amount 8 months after the specified deadline in the notice. A third party challenged the alienation, arguing the approval had lapsed. However, the court held that the state authority accepting late payment implied a fresh approval. The decision showed that paying land revenue within the deadline is not mandatory under NLC, and the registration of title is the primary consideration in establishing ownership of the land.