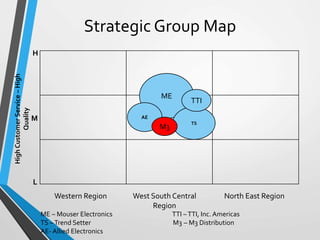

M3 Distribution is an electronic components distributor targeting the oil, gas, medical, and HVAC industries. It was established in 2004 and has since expanded its product offerings and facilities. The company aims to provide high customer service and quality. It faces moderate competitive pressures in its industry and sees opportunities in regional expansion and leveraging its certifications and connections to employers. Its strategy focuses on low costs, differentiation through goodwill and communication, and related diversification through maximizing synergies across capital resources. Both short-term and long-term strategic issues center around gaining customers, retaining suppliers, and improving competitive advantages.