tax.state.nv.us documents Quarter Blank 5-27-07

•

1 like•99 views

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot (6)

Qtr%20Ins%20Return%20(not%20for%20reporting%20Industrial%20Insurance)%5B1%5D

Qtr%20Ins%20Return%20(not%20for%20reporting%20Industrial%20Insurance)%5B1%5D

Viewers also liked

Viewers also liked (20)

tax.state.nv.us documents tax.state.nv.us documents Short_Term_Lessor_CLARK...

tax.state.nv.us documents tax.state.nv.us documents Short_Term_Lessor_CLARK...

tax.state.nv.us documents Fuson_Stamp_Order_Purchase

tax.state.nv.us documents Fuson_Stamp_Order_Purchase

Similar to tax.state.nv.us documents Quarter Blank 5-27-07

300.59 tracking and collections process for returned payment items affecting the field services operations and business licensing departments300.59 tracking and collections process for returned payment items affecting ...

300.59 tracking and collections process for returned payment items affecting ...No Kill Shelter Alliance

Similar to tax.state.nv.us documents Quarter Blank 5-27-07 (20)

Intermediate Care Facility (ICF) Assessment Return

Intermediate Care Facility (ICF) Assessment Return

tax.state.nv.us documents 10%20LTD%201%20Liquor%20Excise%20Tax%20Rtn

tax.state.nv.us documents 10%20LTD%201%20Liquor%20Excise%20Tax%20Rtn

300.59 tracking and collections process for returned payment items affecting ...

300.59 tracking and collections process for returned payment items affecting ...

tax.state.nv.us documents 5%20LTD04%20ET%20Suppliers%20Liq%20Excise%20Tax%20...

tax.state.nv.us documents 5%20LTD04%20ET%20Suppliers%20Liq%20Excise%20Tax%20...

Monthly Report of Taxes & Surcharge Fees Collected on Transfer of Real Property

Monthly Report of Taxes & Surcharge Fees Collected on Transfer of Real Property

Railroad Tax Return Booklet, Includes DP-255-ES Quarterly Payment Forms

Railroad Tax Return Booklet, Includes DP-255-ES Quarterly Payment Forms

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS Live

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(07-May-2024(PSS)VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Recently uploaded (20)

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Business Model Canvas (BMC)- A new venture concept

Business Model Canvas (BMC)- A new venture concept

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

BAGALUR CALL GIRL IN 98274*61493 ❤CALL GIRLS IN ESCORT SERVICE❤CALL GIRL

BAGALUR CALL GIRL IN 98274*61493 ❤CALL GIRLS IN ESCORT SERVICE❤CALL GIRL

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

tax.state.nv.us documents Quarter Blank 5-27-07

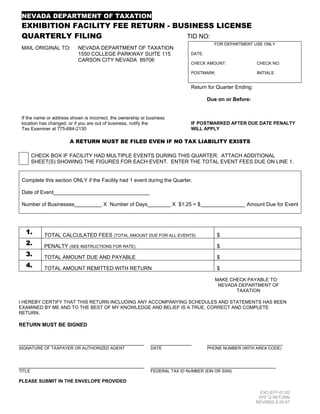

- 1. NEVADA DEPARTMENT OF TAXATION EXHIBITION FACILITY FEE RETURN - BUSINESS LICENSE QUARTERLY FILING TID NO: FOR DEPARTMENT USE ONLY MAIL ORIGINAL TO: NEVADA DEPARTMENT OF TAXATION 1550 COLLEGE PARKWAY SUITE 115 DATE: CARSON CITY NEVADA 89706 CHECK AMOUNT: CHECK NO: POSTMARK: INITIALS Return for Quarter Ending: Due on or Before: If the name or address shown is incorrect, the ownership or business IF POSTMARKED AFTER DUE DATE PENALTY location has changed, or if you are out of business, notify the Tax Examiner at 775-684-2130 WILL APPLY A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS CHECK BOX IF FACILITY HAD MULTIPLE EVENTS DURING THIS QUARTER. ATTACH ADDITIONAL SHEET(S) SHOWING THE FIGURES FOR EACH EVENT. ENTER THE TOTAL EVENT FEES DUE ON LINE 1. Complete this section ONLY if the Facility had 1 event during the Quarter. Date of Event_________________________________ Number of Businesses X Number of Days X $1.25 = $ Amount Due for Event 1. TOTAL CALCULATED FEES (TOTAL AMOUNT DUE FOR ALL EVENTS) $ 2. PENALTY (SEE INSTRUCTIONS FOR RATE) $ 3. TOTAL AMOUNT DUE AND PAYABLE $ 4. TOTAL AMOUNT REMITTED WITH RETURN $ MAKE CHECK PAYABLE TO: NEVADA DEPARTMENT OF TAXATION I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING SCHEDULES AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN. RETURN MUST BE SIGNED ___________________________________________ ______________ __________________________ SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT DATE PHONE NUMBER (WITH AREA CODE) ___________________________________________ ___________________________________________ TITLE FEDERAL TAX ID NUMBER (EIN OR SSN) PLEASE SUBMIT IN THE ENVELOPE PROVIDED EXC-EFF-01.02 EFF Q RETURN REVISED 5-25-07

- 2. EXHIBITION FACILITY FEE INSTRUCTIONS QUARTERLY FILING A person or governmental entity that operates a facility at which one or more exhibitions are held is responsible for the payment of a licensing fee on behalf of the persons who do not have a State Business License but who take part in the exhibition for a purpose related to the conduct of a business. “Exhibition” to mean a trade show or convention, craft show, sporting event or any other similar event involving the exhibition of property, products, goods, services, or athletic or physical skill. DUE DATE: Per NRS 360.787 (3)(a) the operator of the facility shall, on or before the last day of each calendar quarter in which an exhibition is held at that facility, remit to the Department the licensing fee in the amount required. CALCULATION OF EVENT(S): NUMBER OF BUSINESSES: Total number of businesses at the event without a Nevada Business License: Example (4) NUMBER OF DAYS: The total number of days the event was held: Example (5) $1.25 is the amount charged per day for each business not registered for a Nevada Business License. Example: 4 X 5 X $1.25 = $25.00 (number of businesses times the number of days times $1.25 = Fees owed) The above calculations need to be shown for each event held during the Quarter and attached to the return when filing. CALCULATION OF AMOUNT DUE: LINE 1. Enter the total amount due for all events held during the Quarter. LINE 2. If this return is not submitted/postmarked and the fees are not paid on or before the due date as shown on the face of this return, the amount of penalty due is: a) For returns with Period(s) due prior to and including 6/30/07, there is no Penalty. b) For returns with Period(s) due 7/1/07 or after; the amount of penalty due is based on the number of days the payment is late, per NAC 360.395 (see table below). The maximum penalty amount is 10%. Number of days late Penalty Percentage Multiply by: 1 - 10 2% 0.02 11 - 15 4% 0.04 16 - 20 6% 0.06 21- 30 8% 0.08 31 + 10% 0.10 Determine the number of days late the payment is, and multiply the total fees owed (line 1) by the appropriate rate based on the table above. The result is the amount of penalty that should be entered. Example: the fees due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. LINE 3. Add lines 1 and 2 and enter the result. LINE 4. Enter the amount remitted with return. ADDITIONAL INFORMATION: If you have questions concerning this return, please call the Tax Examiner at 775-684-2130. Carson City Office Main Number 775-684-2000 Fax Number 775-684-2020. Website Address - http://tax.state.nv.us EXC-EFF-01.02 EFF Q RETURN REVISED 5-25-07