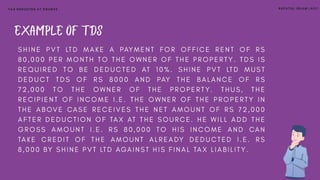

This document provides information about tax deducted at source (TDS) rates for the tax years 2022-2023 and 2023-2024 in Pakistan. It outlines the TDS rates for various sections like section 52, 89, 53H, 56, and introduces some new sections like section 125 and 119. The key changes are an increase in TDS rates for services such as mobile networks, shipping agencies, and payments to non-residents. A TDS chart for 2023-2024 is also presented.