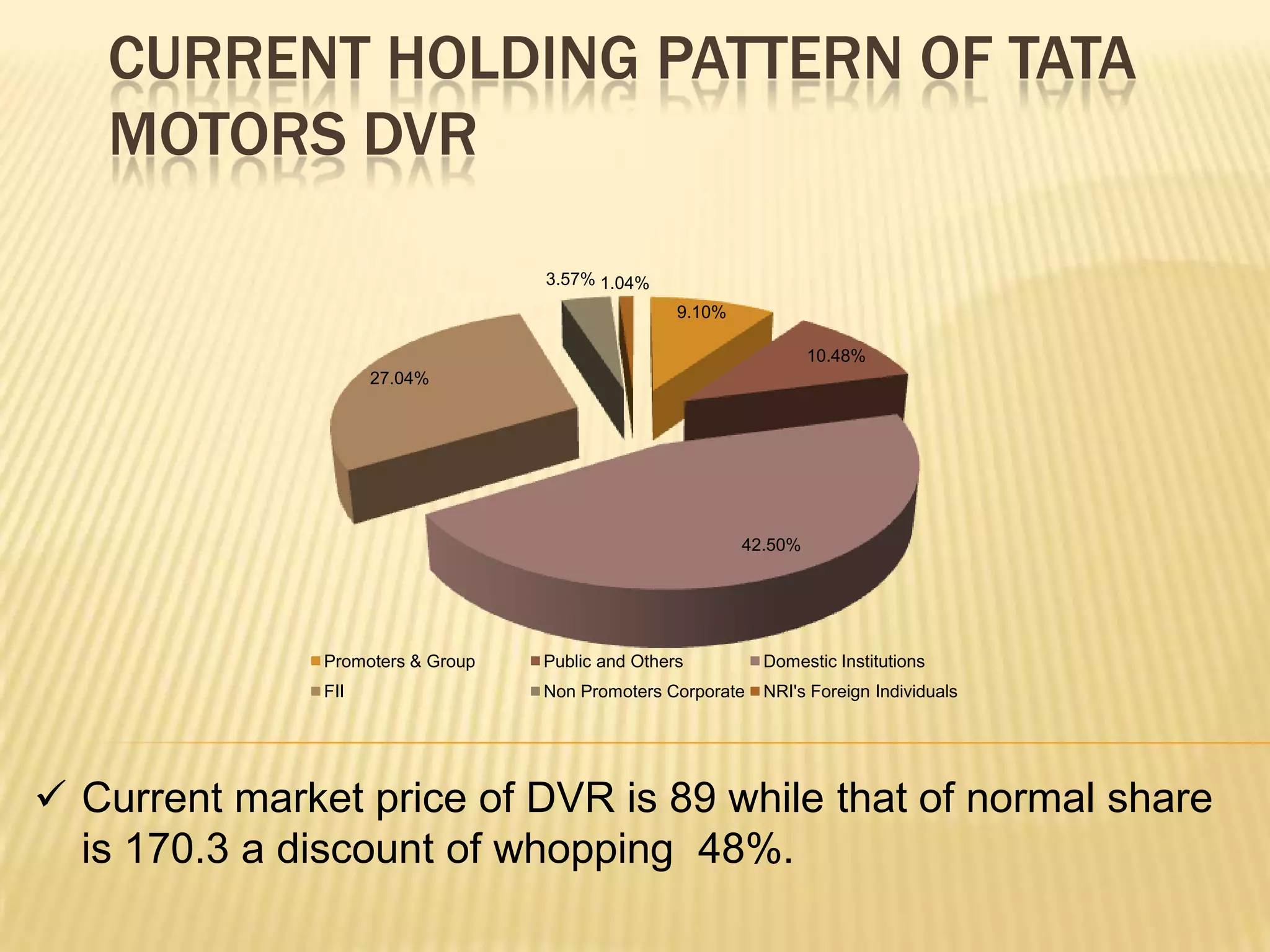

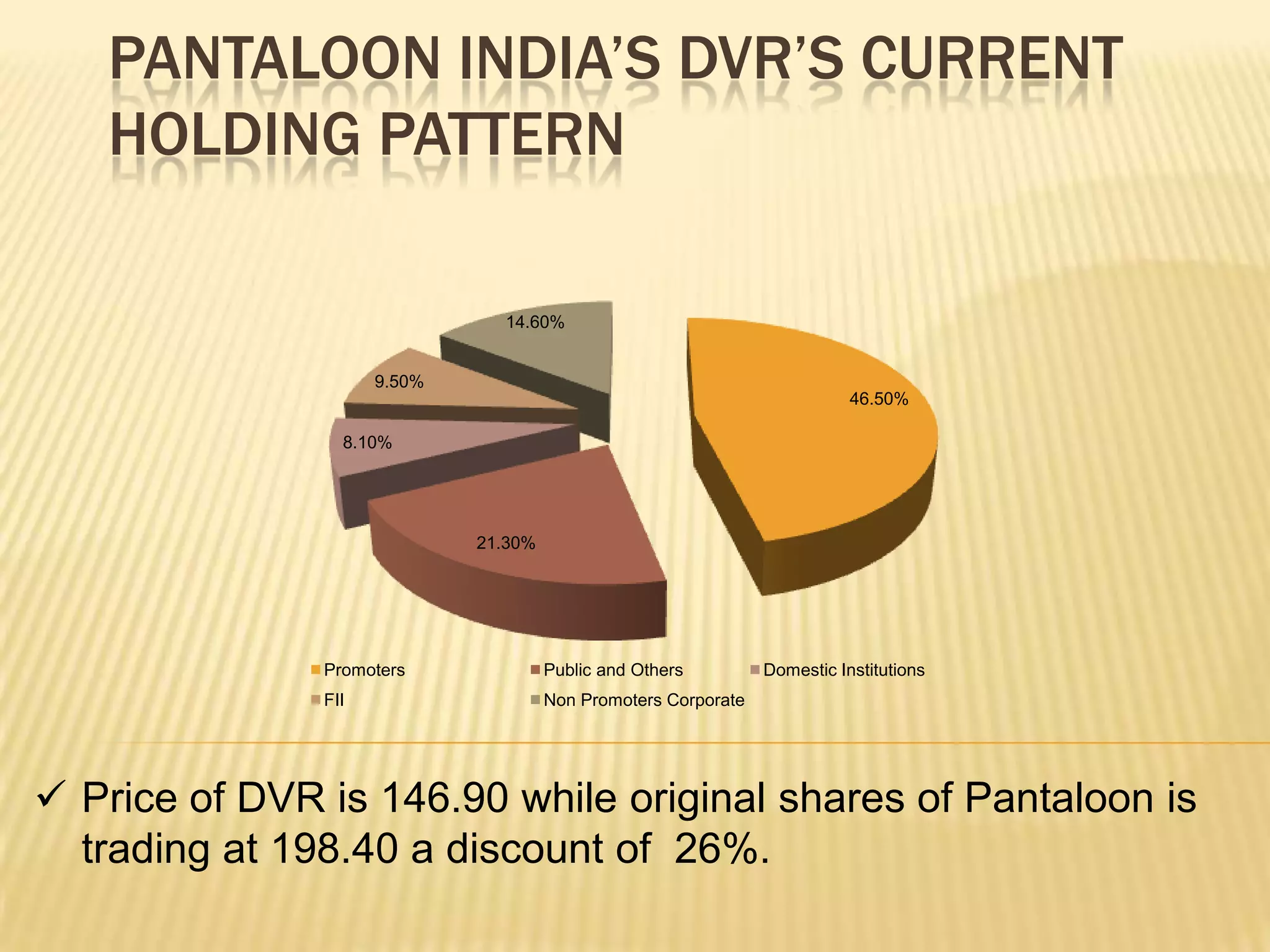

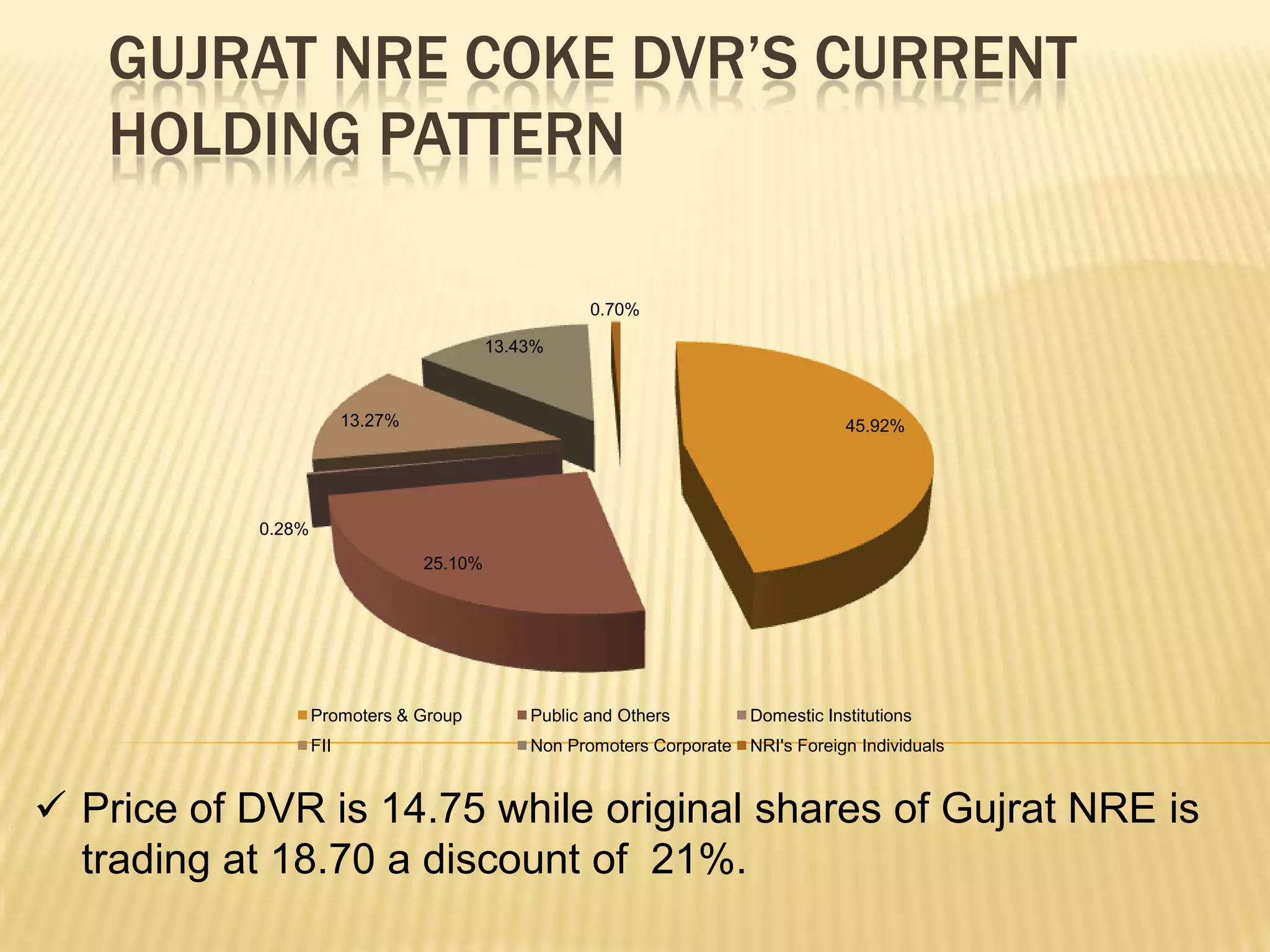

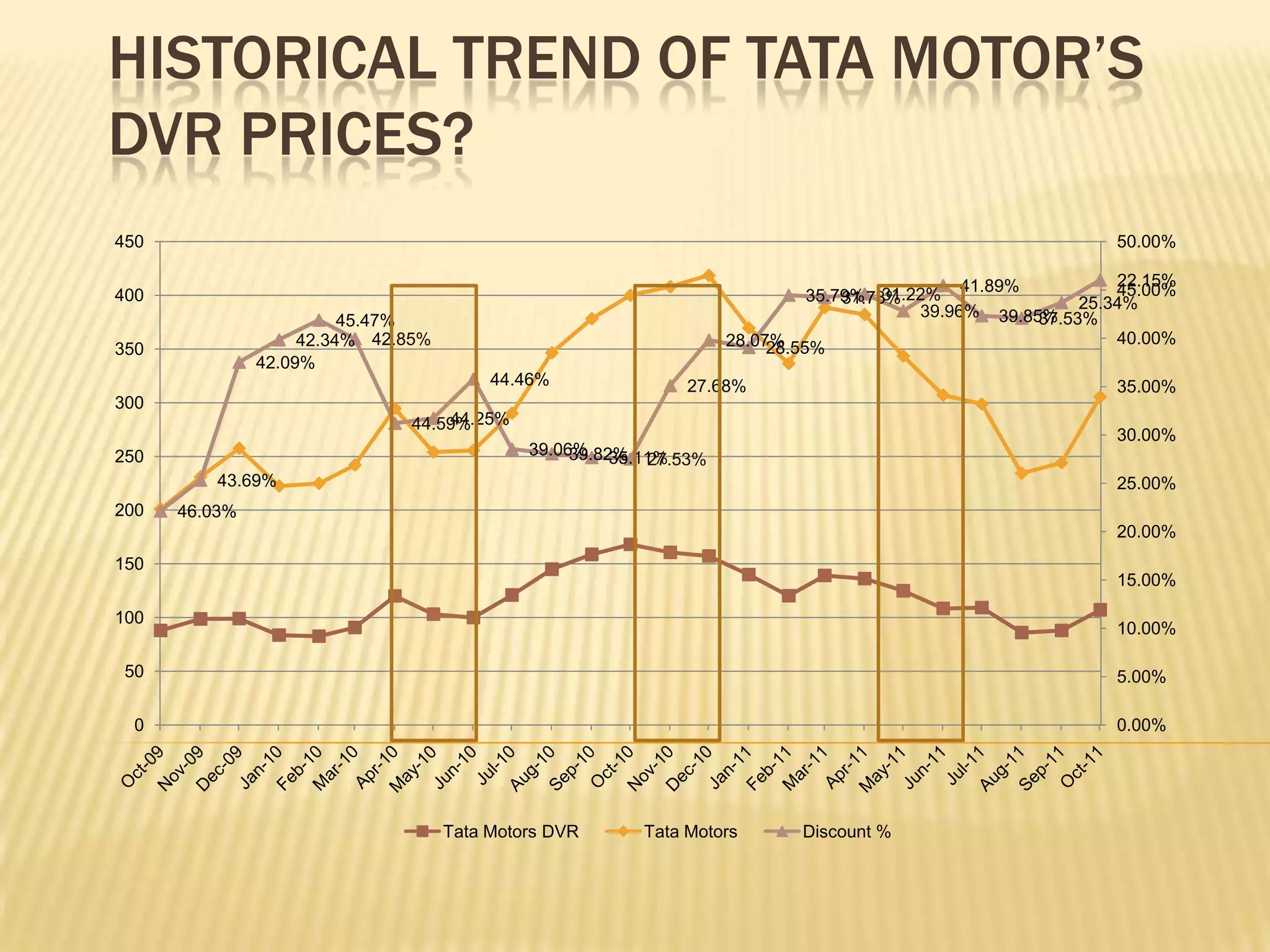

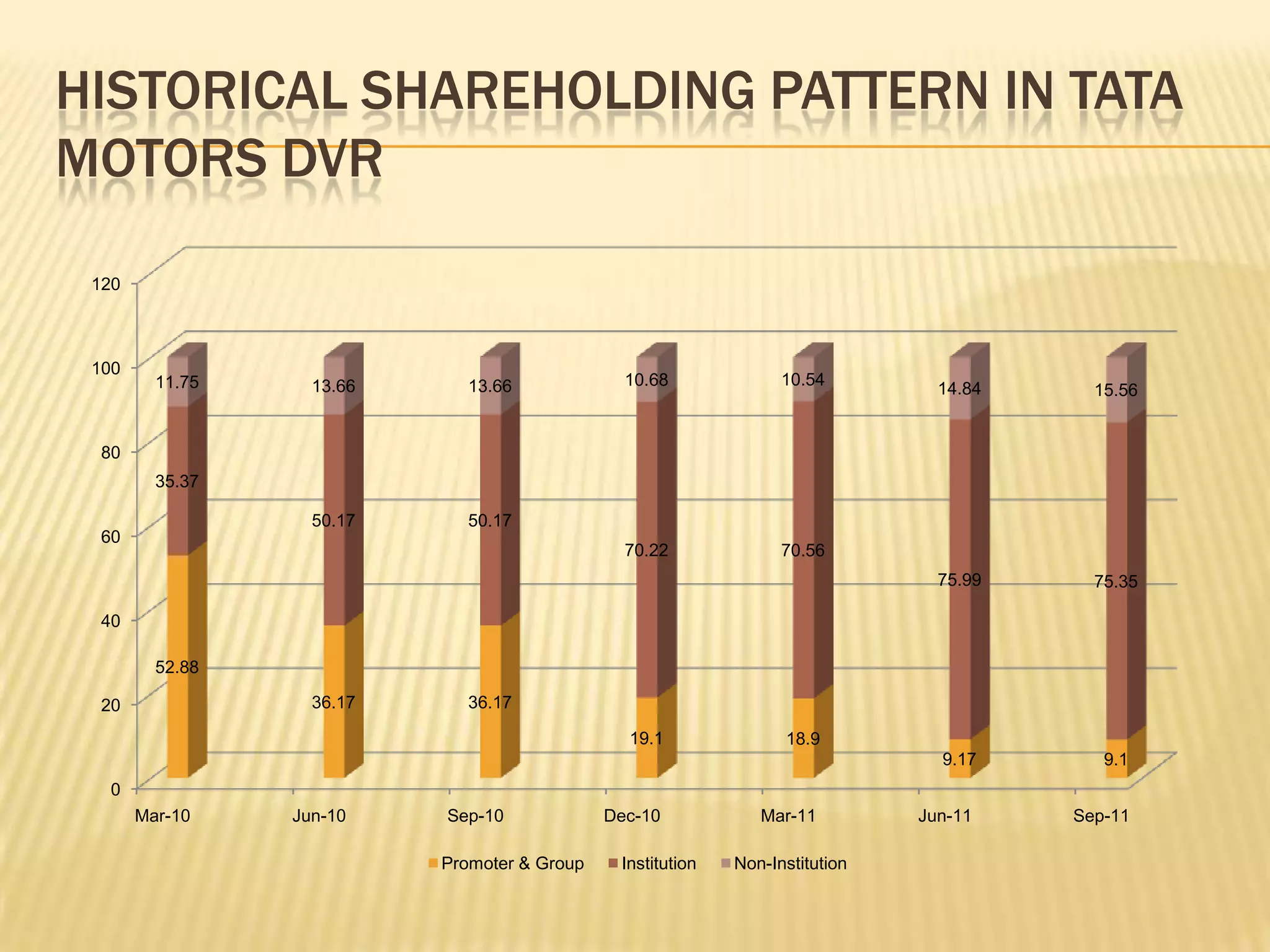

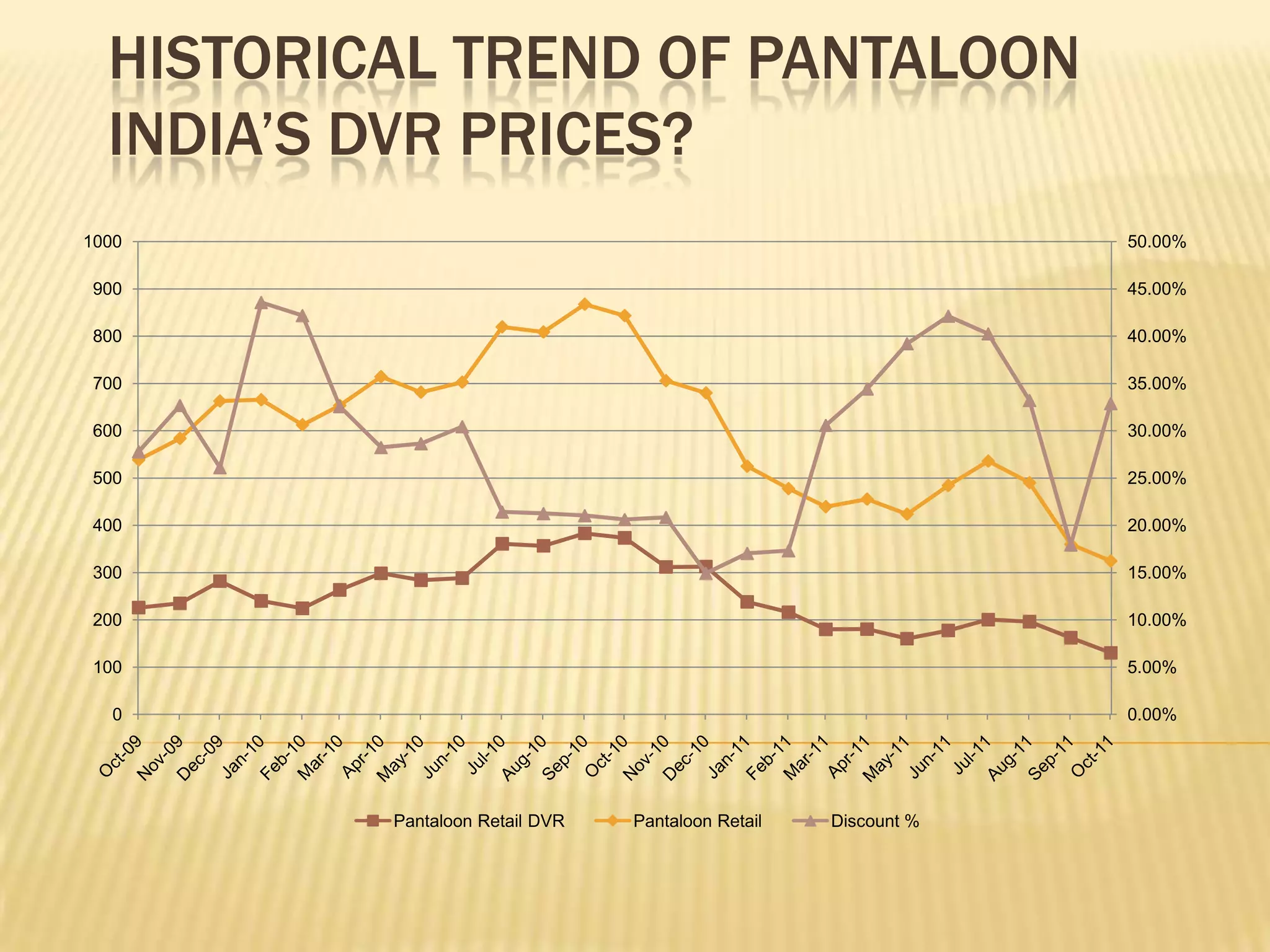

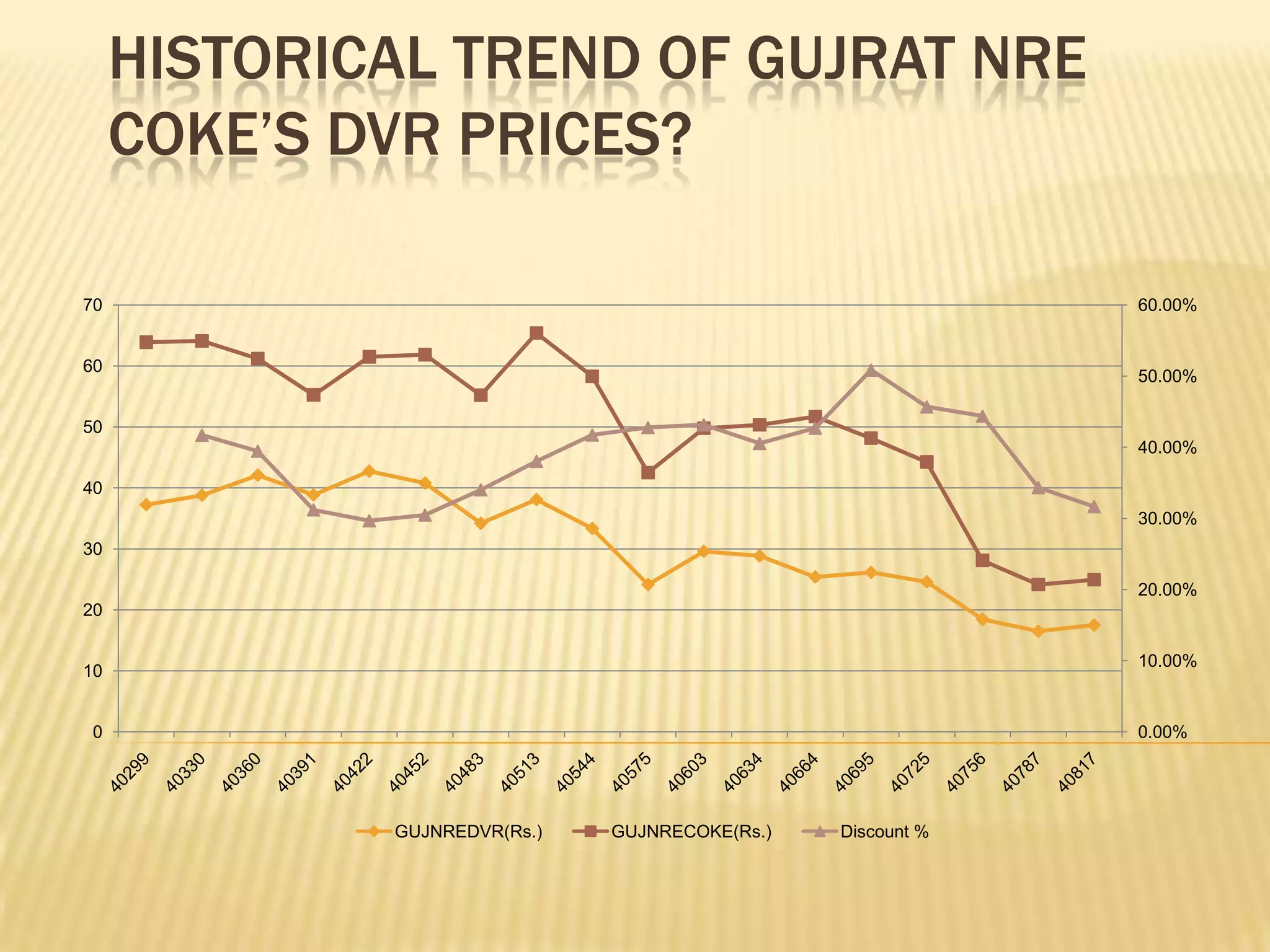

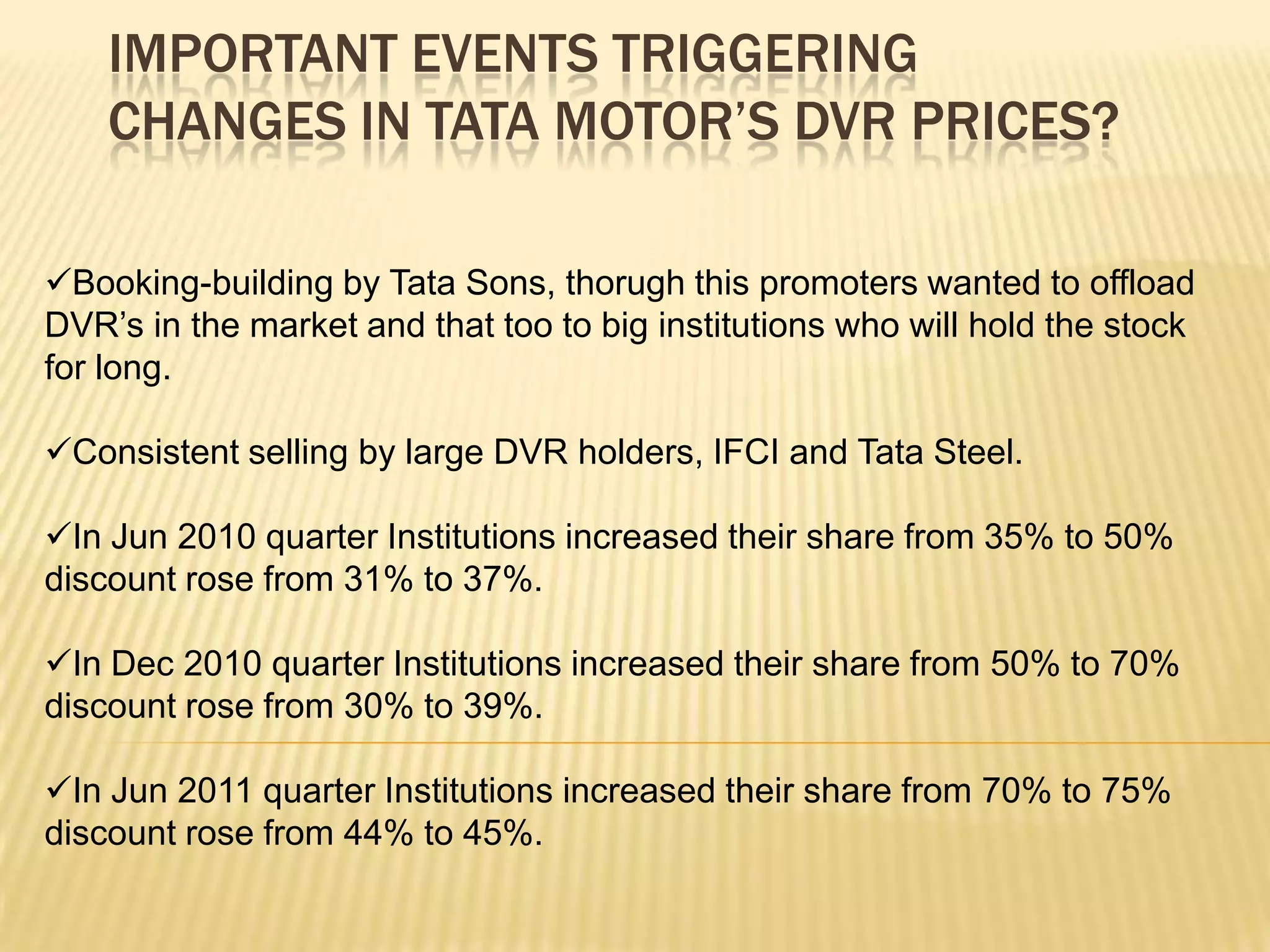

This document analyzes DVR (differential voting rights) shares issued by Tata Motors. It discusses that DVR shares have fewer voting rights but higher economic value than ordinary shares. Companies issue DVRs to raise funds without diluting voting control. Investors interested in DVRs prioritize economic returns over voting rights. The document also reviews historical DVR prices and holding patterns for Tata Motors, Pantaloon, and Gujrat NRE Coke. It finds DVR prices generally track but trade at a discount to ordinary shares. For Tata Motors, this discount widens when institutional holdings increase.