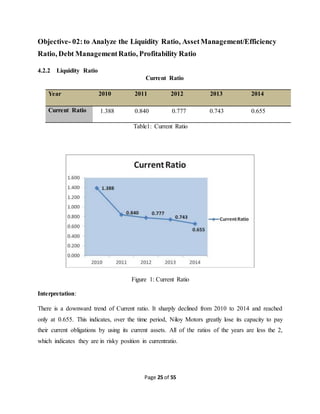

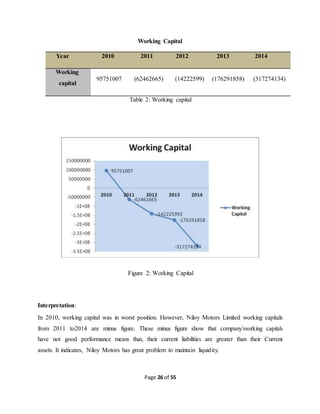

This document contains an internship report submitted by Taskin Rahman to his supervisor Dr. Md. Golam Morshed on the financial performance of Niloy Motors Limited. The report includes a letter of transmittal, student and supervisor declarations, acknowledgements, table of contents, and introduction. The introduction provides background on financial statement analysis and explains that the purpose of the report is to analyze Niloy Motors' financial performance through ratio analysis and compare key metrics to other companies.