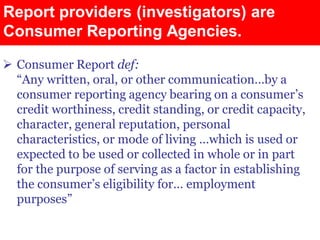

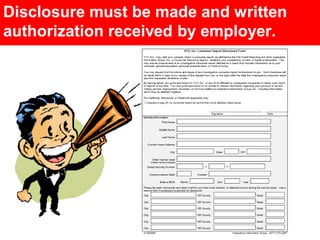

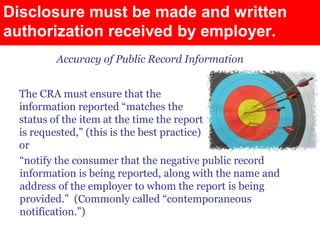

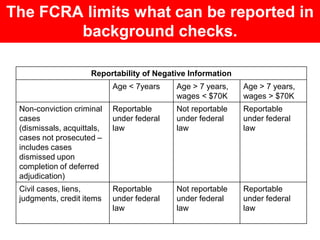

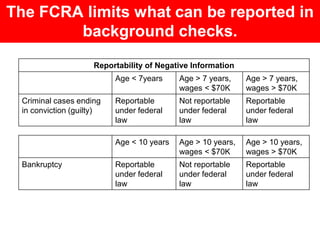

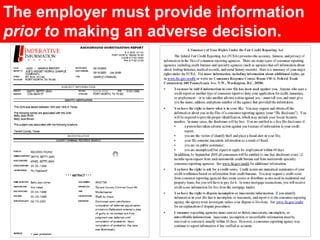

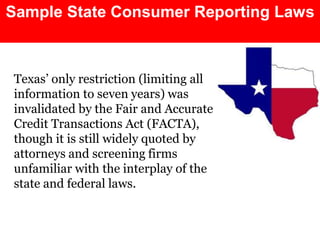

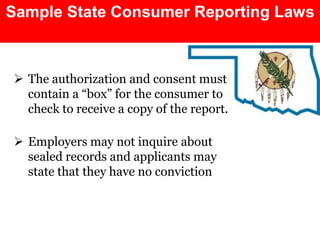

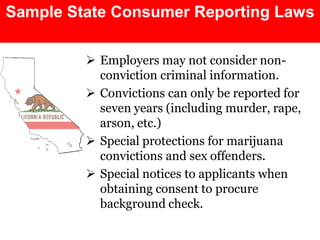

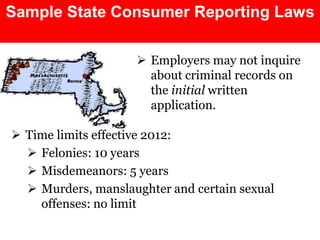

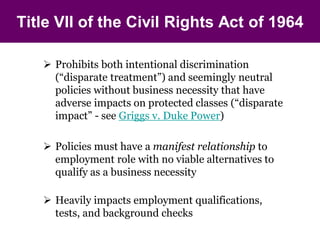

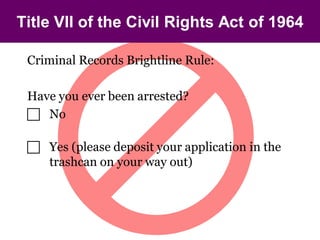

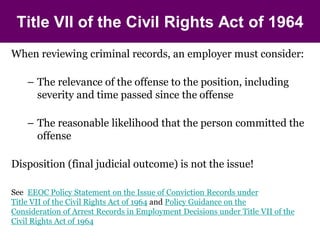

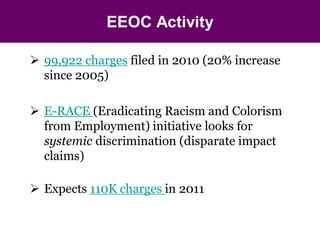

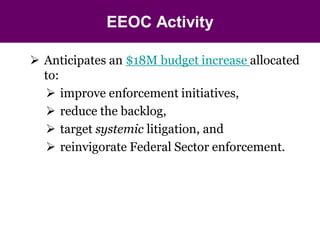

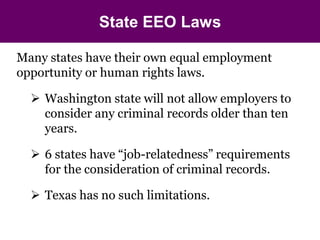

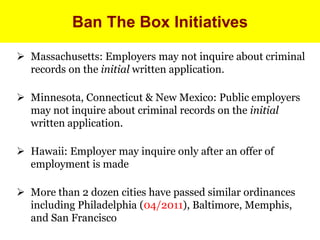

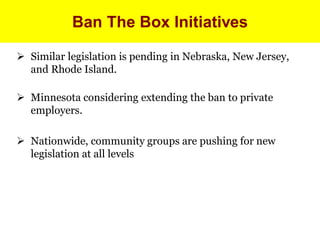

This document provides a brief overview of laws affecting employment background investigations. It discusses the Federal Fair Credit Reporting Act (FCRA) which governs consumer reports used for employment purposes. It also summarizes Title VII of the Civil Rights Act of 1964 and how it impacts the use of criminal records and protected classes in hiring decisions. Finally, it reviews state laws and "Ban the Box" initiatives affecting criminal background checks.