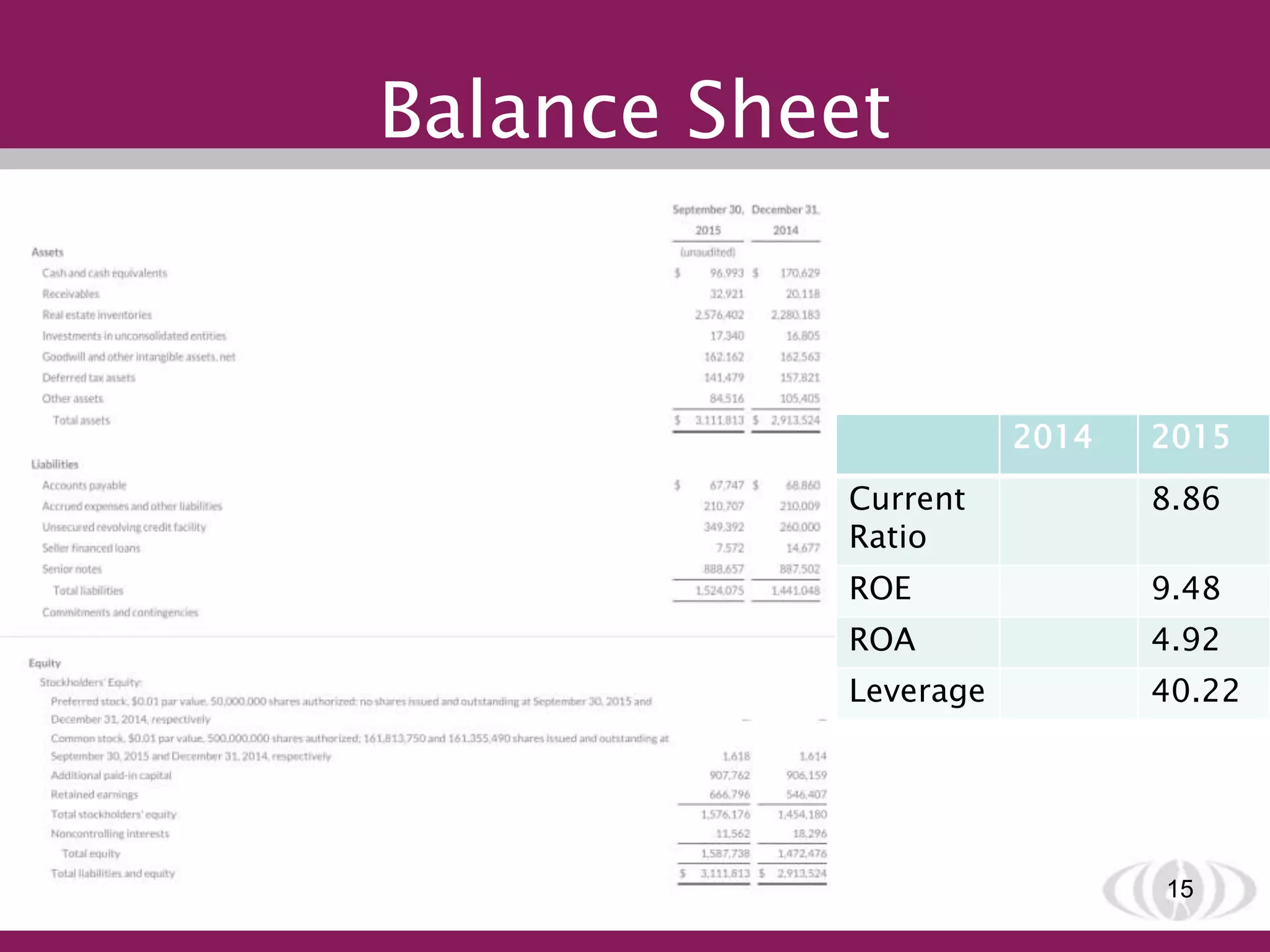

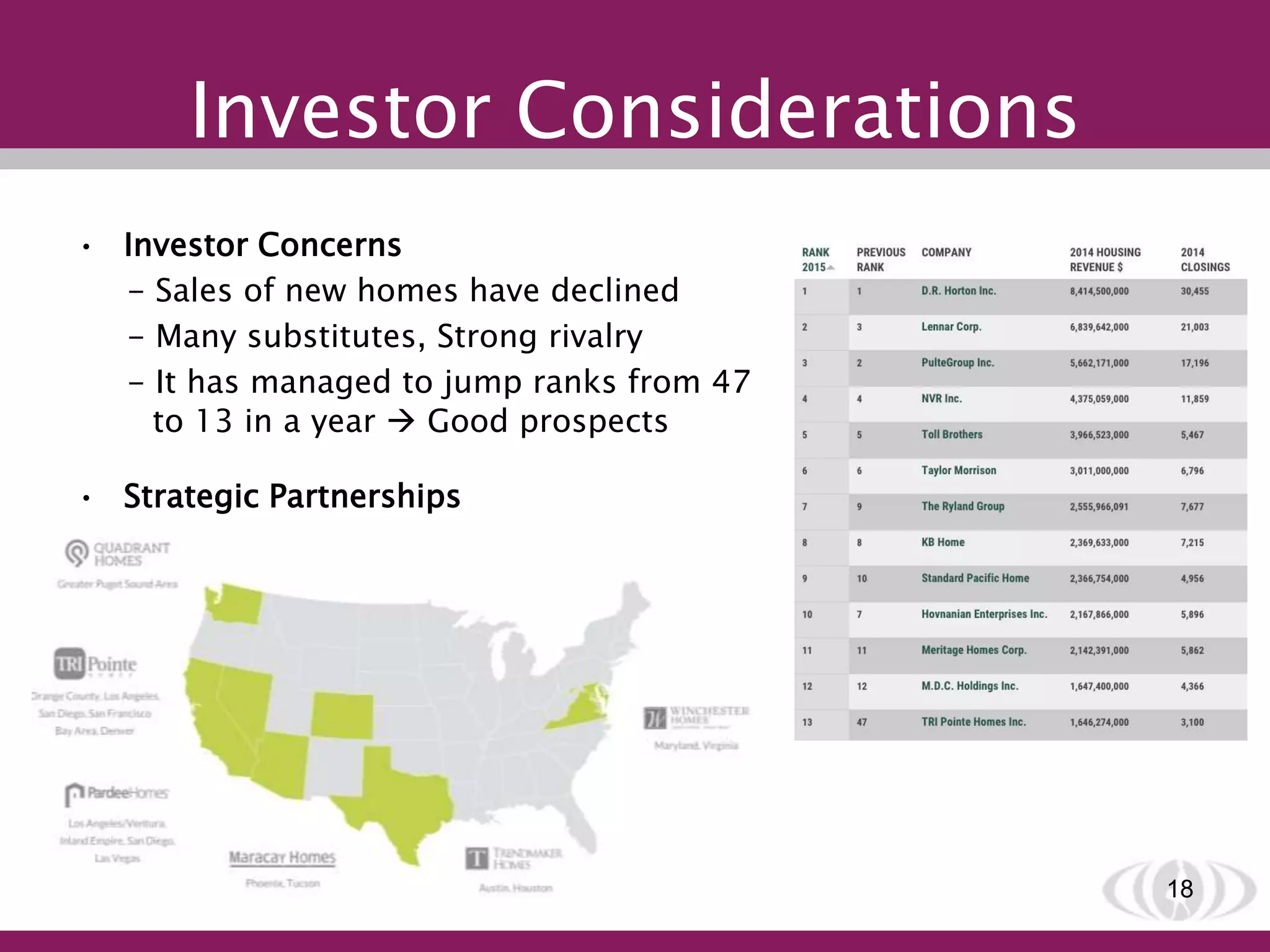

- TRI Pointe Group, Inc. is a designer, constructor and seller of single-family homes in the US, owning 6 brands across 8 states.

- It was the first homebuilding IPO to emerge after the 2008 recession and currently has over 960 employees.

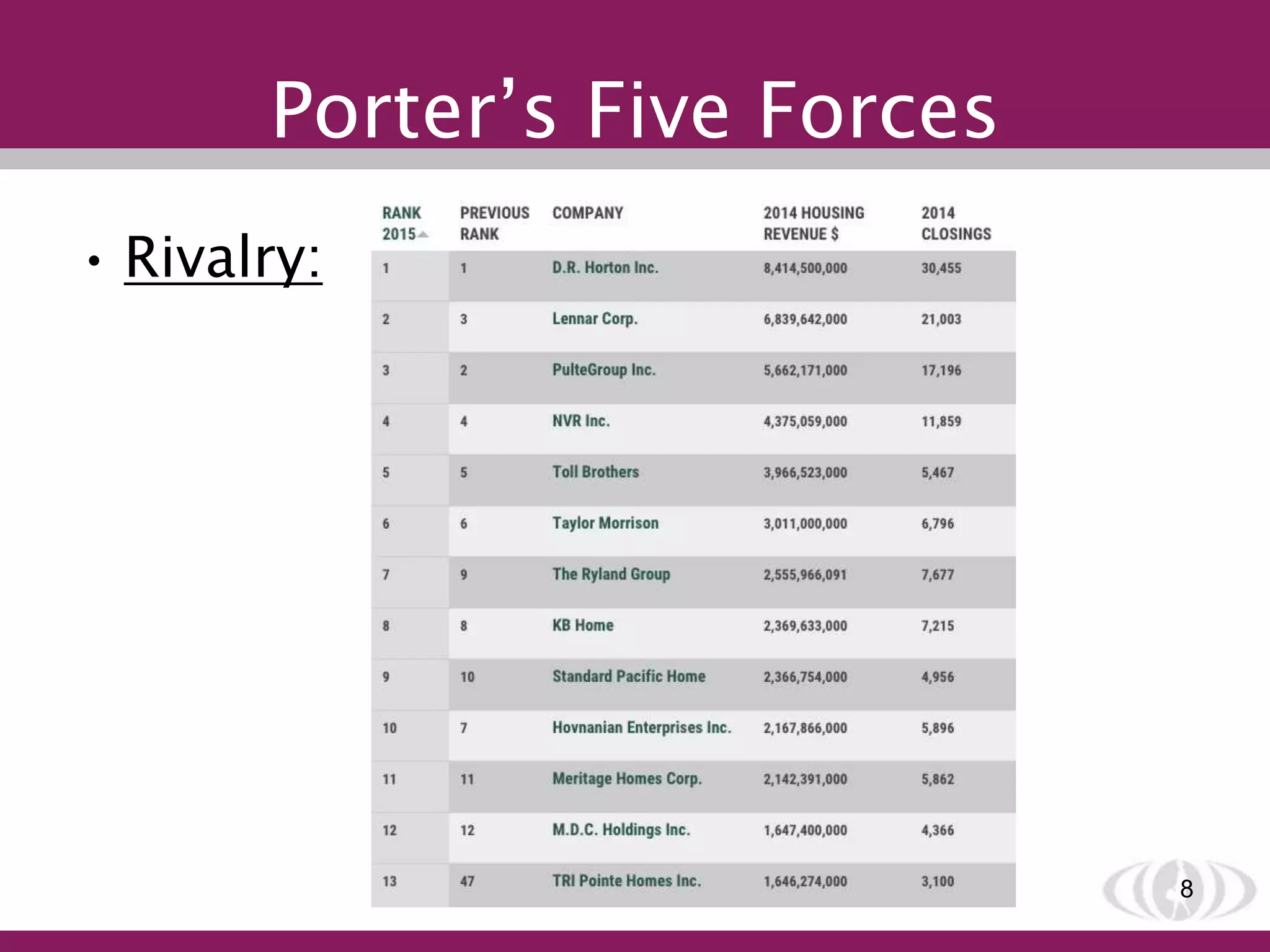

- In 2015, TPH merged with Weyerhaeuser Real Estate Company to become one of the top 10 largest public homebuilding companies in the US.