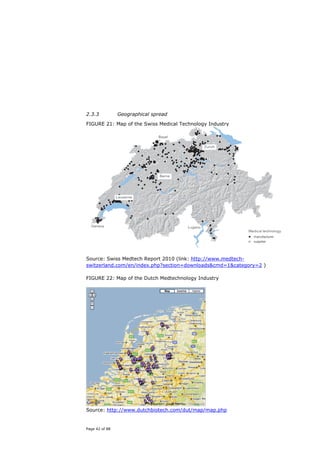

Switzerland has a strong life sciences ecosystem centered around biotechnology, microtechnology, and nanotechnology industries. These industries, particularly biotechnology and pharmaceuticals, are major contributors to Switzerland's high research and development spending and output. The country's innovation system is characterized by close collaboration between private companies, universities, and public research institutions to drive innovation in key technology fields.