- Tesco is undergoing a period of transition as Philip Clarke takes over as CEO and reshapes the organisation and management team.

- Changes have been made to address performance issues in the UK, refocus the US business, exit Japan, and slow the development of Tesco Bank.

- Governance processes have been updated with a new Board Corporate Responsibility Committee to ensure strategic focus on corporate responsibility.

- There have been board changes including new non-executive director Deanna Oppenheimer who brings international retail, banking, and digital experience.

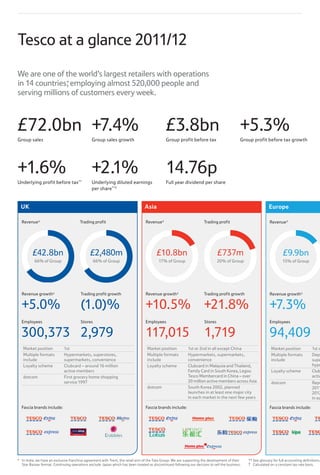

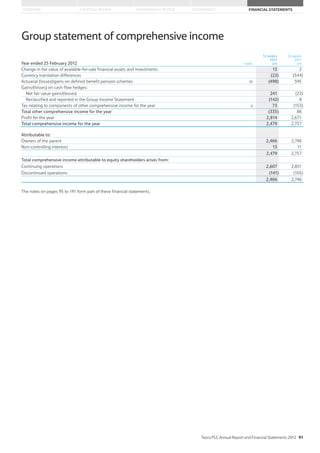

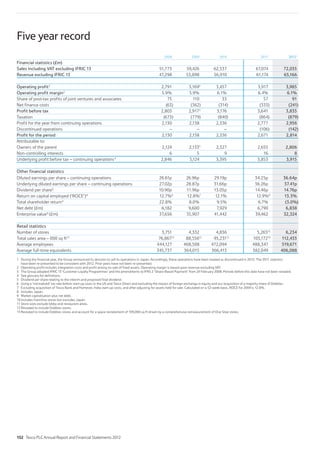

- Financial results showed 7.4% sales growth but modest profit growth of 1.3% as strong international performance was offset by a reduction in UK profits