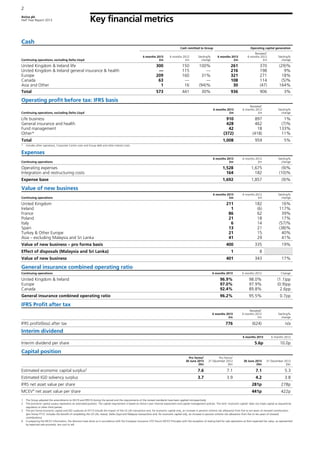

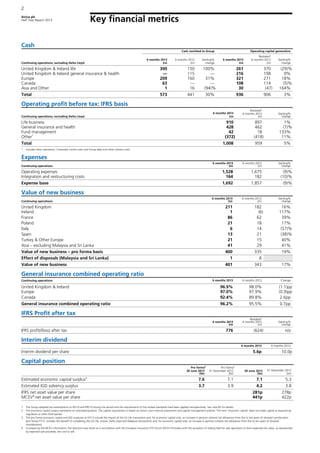

Aviva plc reported a satisfactory interim performance for the first half of 2013, achieving a profit after tax of £776 million, up from a loss of £624 million the previous year, with a 30% increase in cash remittances to the group to £573 million. The value of new business rose by 17% to £401 million, driven primarily by growth in the UK, France, Poland, Turkey, and Asia, while operating expenses decreased by 9%. The company remains focused on addressing legacy issues while unlocking value in its turnaround and growth segments.