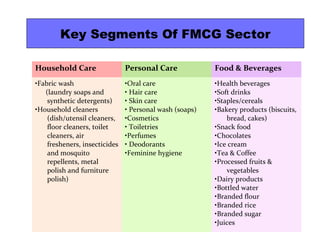

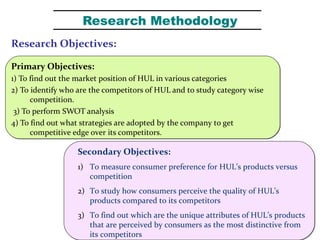

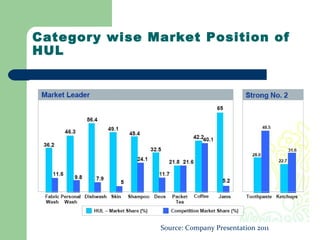

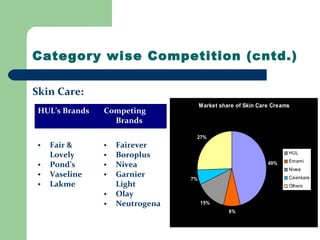

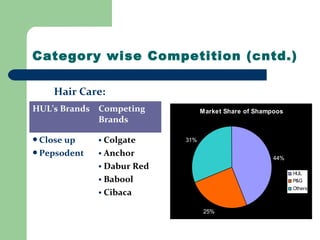

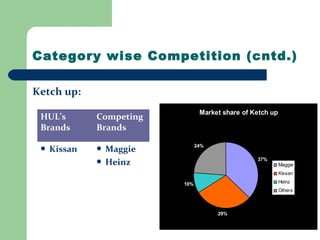

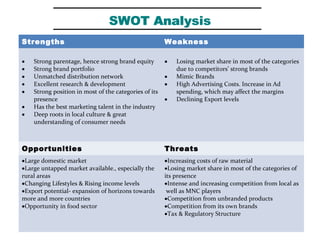

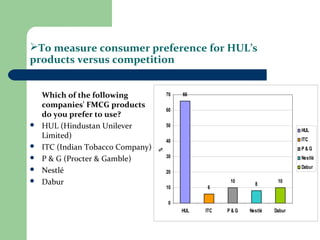

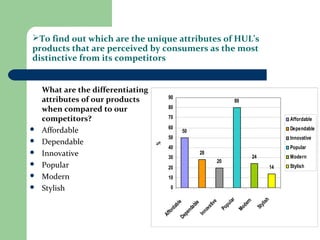

Hindustan Unilever Limited (HUL) is India's largest fast moving consumer goods (FMCG) company. It has a majority market share in personal care and household products categories. However, HUL faces intense competition from other major FMCG players such as ITC, Procter & Gamble, and Nestle. A SWOT analysis found that HUL has strong brands and distribution but is losing market share in some categories. The document recommends that HUL focus on expanding in food, continue innovating, and launch products for lower income segments to maintain its competitive advantage.