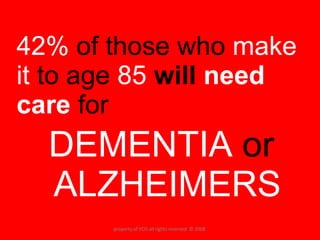

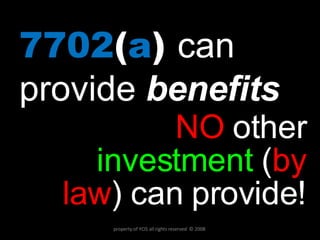

The document introduces a woman named Sue who is financially well-off in retirement due to investing $200k into a Private Plan 7702(a) at age 45. This plan provides her with $85,000 per year tax-free for life plus long-term care benefits. In contrast, her friend Mel who relied on traditional retirement plans will not have similar financial security. The document promotes Private Plan 7702(a) as a superior retirement investment vehicle over traditional tax-deferred plans.