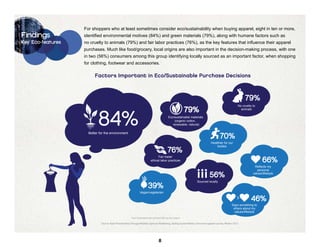

The document discusses findings from a survey of 1,000 consumers about their purchase of eco-friendly apparel. Some key findings include:

- While many consumers consider sustainability when shopping for clothes, they believe it is less important for apparel than for food or household items.

- Top decision factors for apparel are comfort, price, and quality, but eco-features are also important to many shoppers.

- Lack of availability and awareness of eco-options are seen as barriers to greater eco-apparel purchases. Many want more information at point of sale.

- Popular categories for past eco-apparel purchases include footwear, casual women's clothes, and activewear. Several categories show strong future