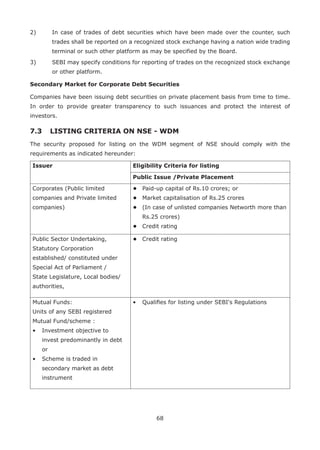

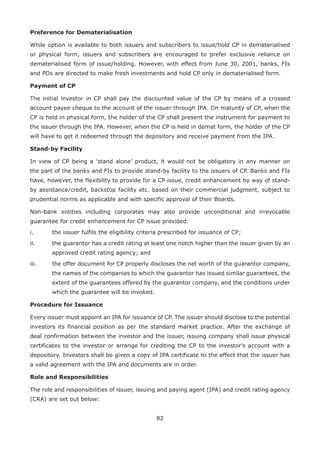

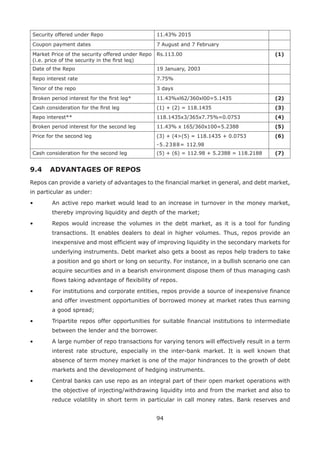

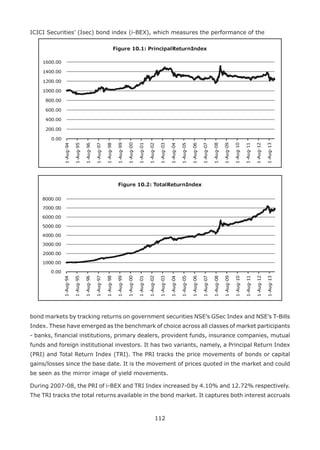

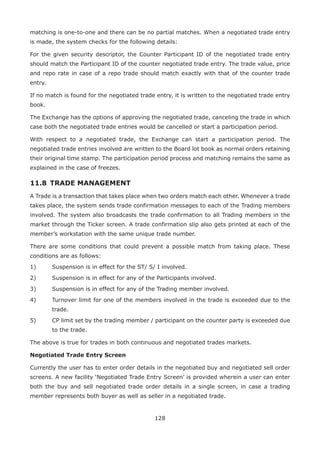

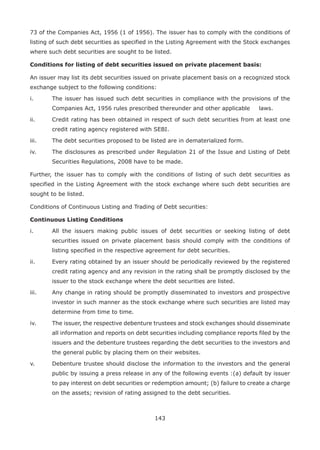

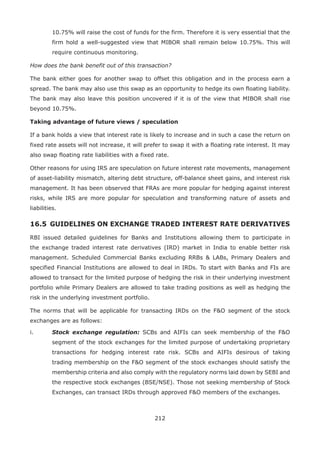

This document provides details about the FIMMDA-NSE Debt Market (Basic) Module certification exam, including test details, fees, duration, number of questions, pass marks, and certificate validity for different levels (foundation, intermediate, advanced) and types (NISM modules) of certification exams. It also lists the chapter headings for the exam workbook, which cover topics like debt instruments, the Indian debt market structure, central government securities (bonds and T-bills), state government bonds, and call money markets.

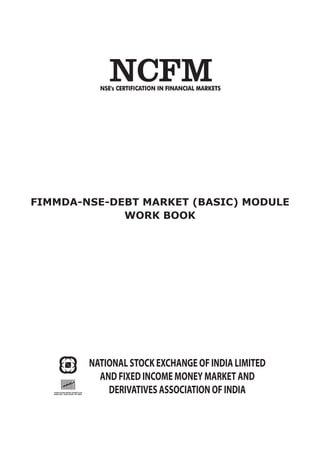

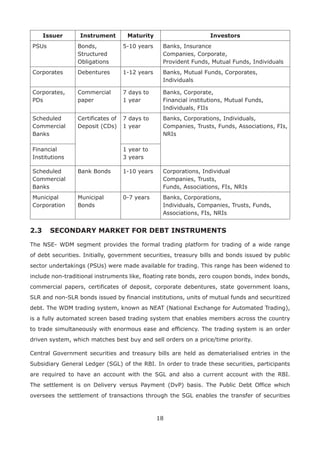

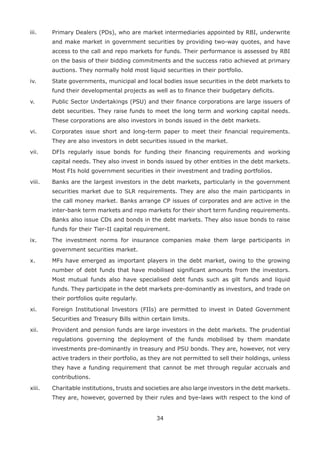

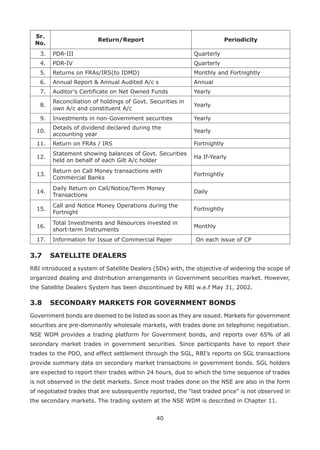

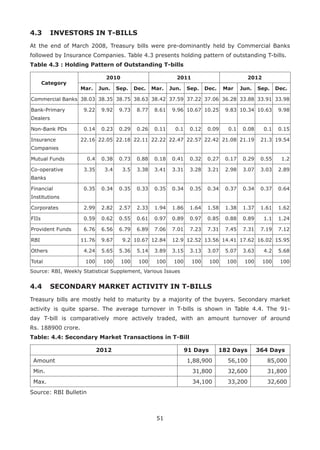

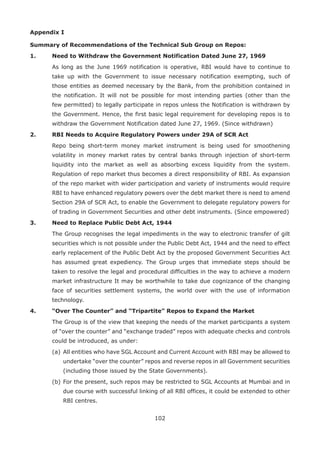

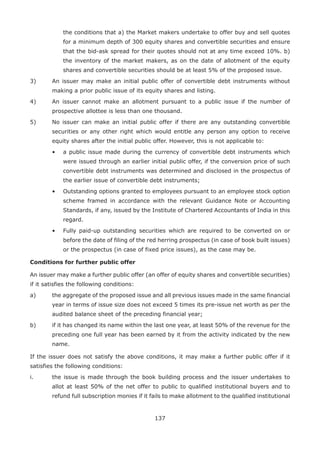

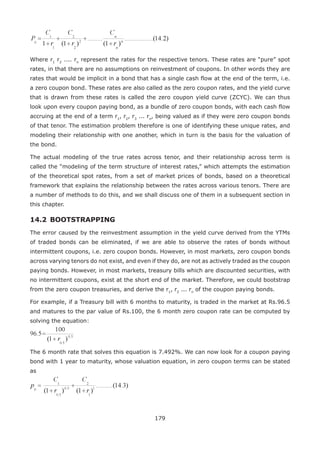

![Test Details:

Sr.

No.

Name of Module Fees (Rs.) Test Duration

(in minutes)

No. of

Questions

Maximum

Marks

Pass

Marks

(%)

Certificate

Validity

(in yrs)

FOUNDATION

1 Financial Markets: A Beginners’ Module ^ 1686 * 120 60 100 50 5

2 Mutual Funds : A Beginners' Module 1686 * 120 60 100 50 5

3 Currency Derivatives: A Beginner’s Module 1686 * 120 60 100 50 5

4 Equity Derivatives: A Beginner’s Module 1686 * 120 60 100 50 5

5 Interest Rate Derivatives: A Beginner’s Module 1686 * 120 60 100 50 5

6 Commercial Banking in India: A Beginner’s Module 1686 * 120 60 100 50 5

7 FIMMDA-NSE Debt Market (Basic) Module 1686 * 120 60 100 60 5

8 Securities Market (Basic) Module 1686 * 120 60 100 60 5

INTERMEDIATE

1 Capital Market (Dealers) Module ^ 1686 * 105 60 100 50 5

2 Derivatives Market (Dealers) Module ^ [Please refer to footnote no. (i)] 1686 * 120 60 100 60 3

3 Investment Analysis and Portfolio Management Module 1686 * 120 60 100 60 5

4 Fundamental Analysis Module 1686 * 120 60 100 60 5

5 Options Trading Strategies Module 1686 * 120 60 100 60 5

6 Operations Risk Management Module 1686 * 120 75 100 60 5

7 Banking Sector Module 1686 * 120 60 100 60 5

8 Insurance Module 1686 * 120 60 100 60 5

9 Macroeconomics for Financial Markets Module 1686 * 120 60 100 60 5

10 NSDL–Depository Operations Module 1686 * 75 60 100 60 # 5

11 Commodities Market Module 2022 * 120 60 100 50 3

12 Surveillance in Stock Exchanges Module 1686 * 120 50 100 60 5

13 Corporate Governance Module 1686 * 90 100 100 60 5

14 Compliance Officers (Brokers) Module 1686 * 120 60 100 60 5

15 Compliance Officers (Corporates) Module 1686 * 120 60 100 60 5

16

Information Security Auditors Module (Part-1) 2528 * 120 90 100 60

2

Information Security Auditors Module (Part-2) 2528 * 120 90 100 60

17 Technical Analysis Module 1686 * 120 60 100 60 5

18 Mergers and Acquisitions Module 1686 * 120 60 100 60 5

19 Back Office Operations Module 1686 * 120 60 100 60 5

20 Wealth Management Module 1686 * 120 60 100 60 5

21 Project Finance Module 1686 * 120 60 100 60 5

22 Venture Capital and Private Equity Module 1686 * 120 70 100 60 5

23 Financial Services Foundation Module ### 1123 * 120 45 100 50 NA

24 NSE Certified Quality Analyst $ 1686 * 120 60 100 50 NA

25 Certified Credit Research Analyst – Level 1 ~ 1686 * 120 80 120 50 NA

ADVANCED

1 Financial Markets (Advanced) Module 1686 * 120 60 100 60 5

2 Securities Markets (Advanced) Module 1686 * 120 60 100 60 5

3 Derivatives (Advanced) Module [Please refer to footnote no. (i) ] 1686 * 120 55 100 60 5

4 Mutual Funds (Advanced) Module 1686 * 120 60 100 60 5

5 Options Trading (Advanced) Module 1686 * 120 35 100 60 5

6 FPSB India Exam 1 to 4** 2247 per exam * 120 75 140 60 NA

7 Examination 5/Advanced Financial Planning ** 5618 * 240 30 100 50 NA

8 Equity Research Module ## 1686 * 120 49 60 60 2

9 Issue Management Module ## 1686 * 120 55 70 60 2

10 Market Risk Module ## 1686 * 120 40 65 60 2

11 Financial Modeling Module ### 1123 * 120 30 100 50 NA

NISM MODULES

1 NISM-Series-I: Currency Derivatives Certification Examination ^ 1250 120 100 100 60 3

2

NISM-Series-II-A: Registrars to an Issue and Share Transfer Agents –

Corporate Certification Examination

1250 120 100 100 50 3

3

NISM-Series-II-B: Registrars to an Issue and Share Transfer Agents –

Mutual Fund Certification Examination

1250 120 100 100 50 3

4

NISM-Series-III-A: Securities Intermediaries Compliance (Non-Fund)

Certification Examination

1250 120 100 100 60 3

5 NISM-Series-IV: Interest Rate Derivatives Certification Examination 1250 120 100 100 60 3

6 NISM-Series-V-A: Mutual Fund Distributors Certification Examination ^ 1250 120 100 100 50 3

7 NISM Series-V-B: Mutual Fund Foundation Certification Examination 1000 120 50 50 50 3

8

NISM-Series-V-C: Mutual Fund Distributors (Level 2)

Certification Examination

1405 * 120 68 100 60 3

9 NISM-Series-VI: Depository Operations Certification Examination 1250 120 100 100 60 3

10

NISM Series VII: Securities Operations and Risk Management

Certification Examination

1250 120 100 100 50 3

11 NISM-Series-VIII: Equity Derivatives Certification Examination 1250 120 100 100 60 3

12 NISM-Series-IX: Merchant Banking Certification Examination 1250 120 100 100 60 3

13 NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination 1250 120 100 100 60 3

14 NISM-Series-X-B: Investment Adviser (Level 2) Certification Examination 1405 * 120 68 100 60 3

15 NISM-Series-XI: Equity Sales Certification Examination 1405 * 120 100 100 50 3

16 NISM-Series-XII: Securities Markets Foundation Certification Examination 1405 * 120 100 100 60 3

* in the ‘Fees’ column - indicates module fees inclusive of service tax

^ Candidates have the option to take the tests in English, Gujarati or Hindi languages.

# Candidates securing 80% or more marks in NSDL-Depository Operations Module ONLY will be certified as ‘Trainers’.

** Following are the modules owf Financial Planning Standards Board India (Certified Financial Planner Certification)

- FPSB India Exam 1 to 4 i.e. (i) Risk Analysis & Insurance Planning (ii) Retirement Planning & Employee Benefits (iii) Investment Planning and (iv) Tax

Planning & Estate Planning

- Examination 5/Advanced Financial Planning

## Modules of Finitiatives Learning India Pvt. Ltd. (FLIP)

### Module of IMS Proschool

$ Module of SSA Business Solutions (P) Ltd.

~ Module of Association of International Wealth Management of India

The curriculum for each of the modules (except Modules of Financial Planning Standards Board India, Finitiatives Learning India Pvt. Ltd. and IMS

Proschool) is available on our website: www.nseindia.com > Education > Certifications.

Note: (i) SEBI / NISM has specified the NISM-Series-VIII-Equity Derivatives Certification Examination as the requisite standard for associated persons

functioning as approved users and sales personnel of the trading member of an equity derivatives exchange or equity derivative segment of a recognized

stock exchange.](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-2-320.jpg)

![35

bonds they can buy and the manner in which they can trade on their debt portfolios.

xiv. Since January 2002, retail investors have been permitted to submit non-competitive

bids at primary auction through any bank or PD. They submit bids for amounts of

Rs. 10,000 and multiples thereof, subject to the condition that a single bid does not

exceed Rs. 1 crore. The non-competitive bids upto a maximum of 5% of the notified

amount are accepted at the weighted average cut off price/yield.

xv. NDS, CCIL and WDM segment of NSEIL are other important platforms for the debt

market which are discussed in greater detail in subsequent sections.

3.5 CONSTITUENT SGL ACCOUNTS

Subsidiary General Ledger (SGL) account is a facility provided by RBI to large banks and

financial institutions to hold their investments in government securities and treasury bills in

the electronic book entry form. Such institutions can settle their trades for securities held

in SGL through a delivery-versus-payment (DvP) mechanism, which ensures simultaneous

movement of funds and securities. As all investors in government securities do not have

access to the SGL system, RBI has permitted such investors to open a gilt with any entity

authorized by RBI for this purpose and thus avail of the DvP settlement. RBI has permitted

NSCCL, NSDL, CDSL, SHCIL, banks and PDs to offer constituent SGL account facility to an

investor who is interested in participating in the government securities market.

The facilities offered by the constituent SGL accounts are dematerialisation,

re-materialisation, buying and selling of transactions, corporate actions, and subscription to

primary market issues. All entities regulated by RBI [including FIs, PDs, cooperative banks,

RRBs, local area banks, NBFCs] should necessarily hold their investments in government

securities in either SGL (with RBI) or CSGL account.

3.6 PRIMARY DEALERS

Primary dealers are important intermediaries in the government securities markets introduced

in 1995. In order to broad base the Primary Dealership System, banks were permitted to

undertake Primary Dealership business departmentally in 2006-07. There are now 19 primary

dealers in the debt markets. They act as underwriters in the primary debt markets, and as

market makers in the secondary debt markets, apart from enabling the participation of a

number of constituents in the debt markets.

The objectives of setting up the system of primary dealer’s are2

:

i. To strengthen the infrastructure in the government securities market in order to make

it vibrant, liquid and broad-based;

ii. To develop underwriting and market making capabilities for government securities

outside the Reserve Bank, so that the Reserve Bank could gradually shed these

functions;

2

The following sections on primary dealers and satellite dealers have been downloaded from www.rbi.org.in.](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-37-320.jpg)

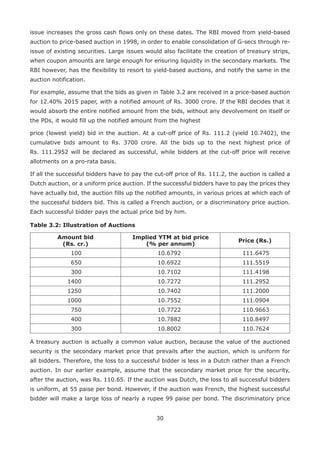

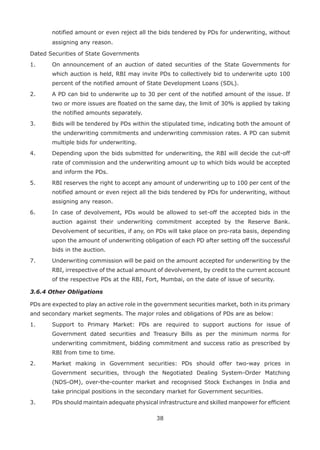

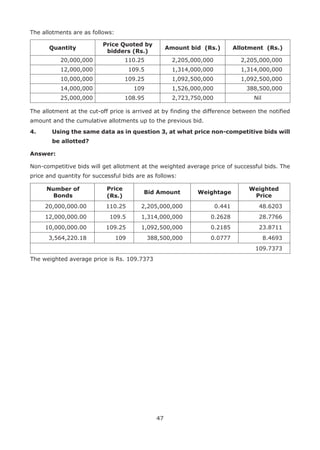

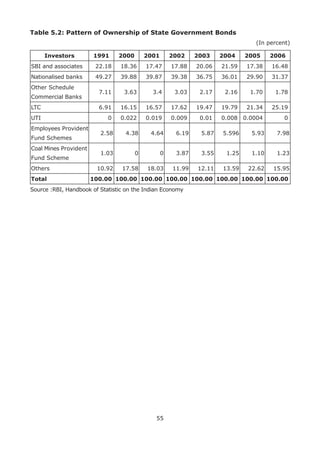

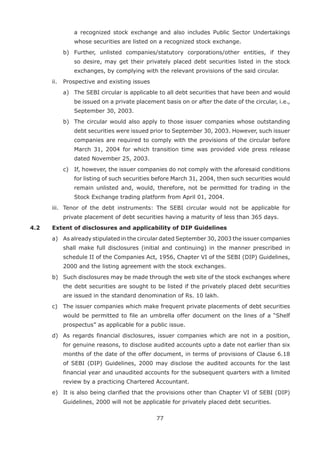

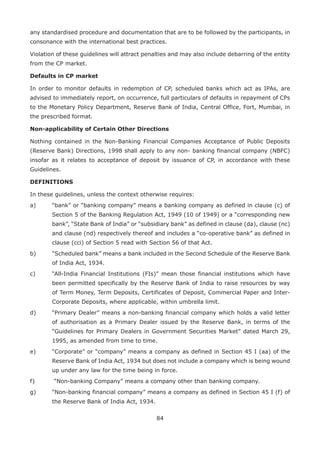

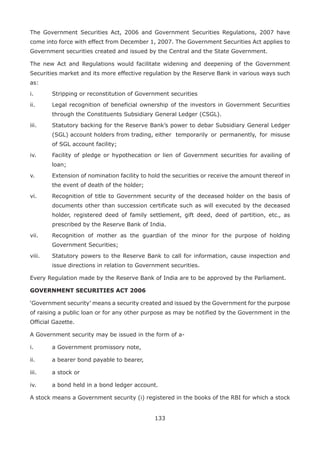

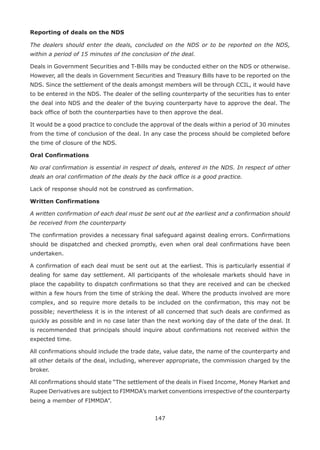

![52

Model Questions

1. A treasury bill maturing on 3-Jan-2015 is trading in the market on

28-Jan-2014 at a price of Rs. 92.8918. What is the discount rate inherent in

this price?

Answer:

The yield is computed as:

= [(100-price)*365]/ (Price * No of days to maturity)

= [(100-92.8918)*365]/ (92.8918*340) = 8.21%

2. What is the price at which a treasury bill maturing on 3rd Jan 2015 would

be valued on Jan 22, 2014 at a yield of 6.8204%?

Answer:

The price can be computed as

= 100/ {1+ [yield% * (No of days to maturity/365)]}

= 100/ {1+ [6.8204 %*( 346/365)]} = Rs. 93.9272

3. What is the day count convention in the Treasury bill markets?

a. 30/360

b. Actual/Actual

c. Actual/360

d. Actual/365

Answer: d](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-54-320.jpg)

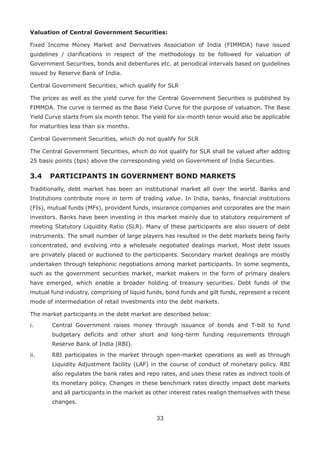

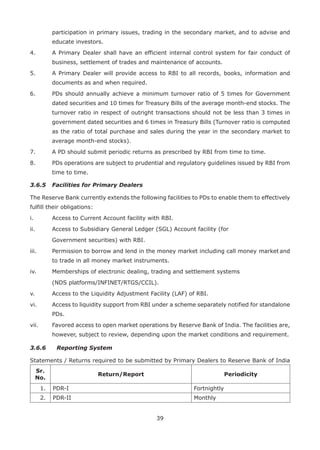

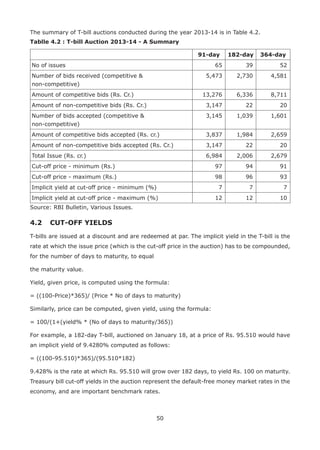

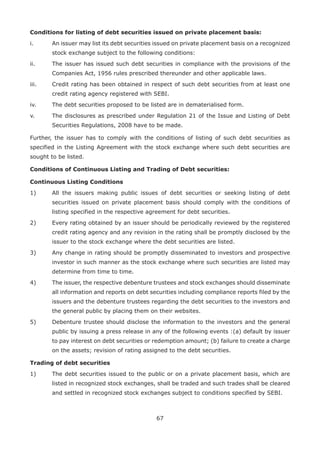

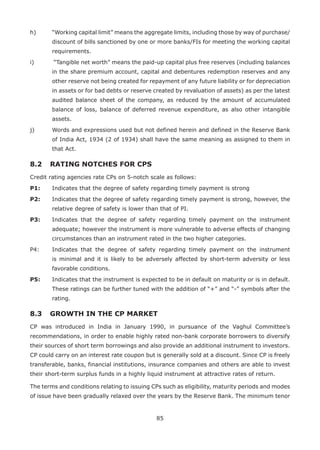

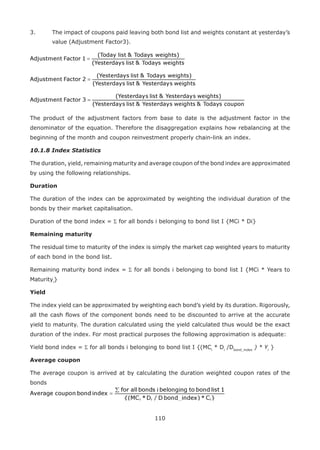

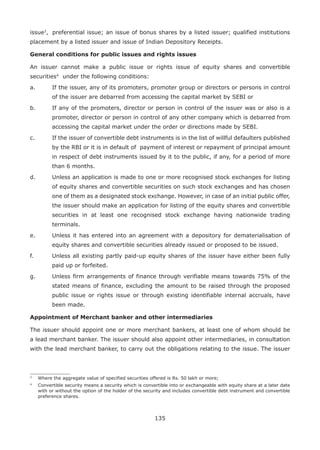

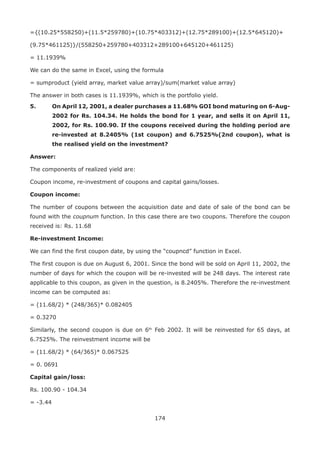

![159

Box 13.1: Coupons and Coupon days

In order to find the expected future cash flows from a bond, the dates on which these cash

flows are expected and the distances from the settlement dates, we can use the coupon

functions in Excel. The following are the coupon functions that are commonly used:

a) Coupnum: number of coupons payable between the settlement date and the maturity

date.

b) Coupdays: number of days in the coupon period, containing the settlement date

c) Coupdaybs: number of days from beginning of the coupon period to the settlement

date

d) Coupdaysnc: number of days from the settlement date to the next coupon date

In all these cases, we need to specify the settlement date, maturity date, frequency of

coupon payments per annum and the day count convention (also called basis). We can

use the yearfrac function to convert the number of days into fractional years.

(See Box 1.1)

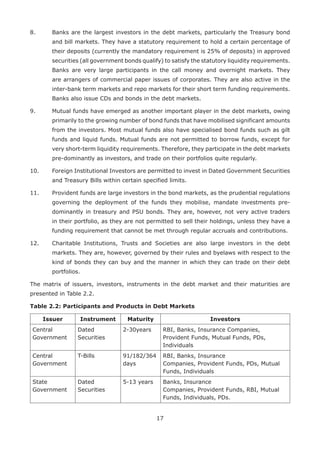

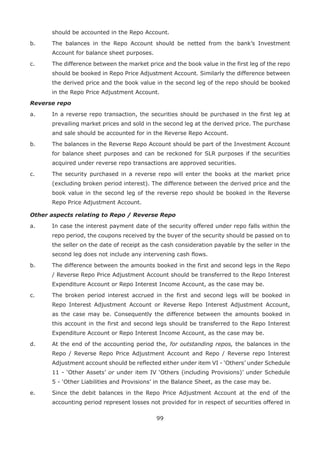

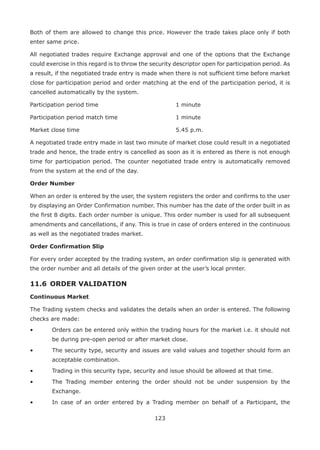

Table 13.4 provides the data using the coupon functions of Excel, for an illustrative sample of

4 treasury bonds, using the 30/360 day count convention.

Table 13.4: Coupon days for settlement date February 5, 2001

Name of the

Security

Maturity

Date

No. of

coupons

until

maturity

No. of

days

in the

coupon

period

No. of

days from

previous

coupon to

settlement

No. of

days from

settlement

to next

coupon

CG 12.5% 2004 23-Mar-04 7 180 132 48

CG 11.7% 2006 10-Apr-06 11 180 115 65

CG 11.5% 2008 23-May-08 15 180 72 108

CG 11.3 % 2010 28-Jul-10 19 180 7 173

In order to value a bond, on a settlement date that is not a coupon date, we have to re-cast

the bond valuation equation 13.1, as follows:

Where c1

c2

.. c3

, are expected cash flows from the bond. Given the redemption value, coupon

rate and frequency of coupons, we can compute these cash flows.

dnc is the number of days to the next coupon

dicp is the days in the coupon period

Since the first cash flow Ci, is only dnc/dicp periods away from the settlement date, we

discount it only for that period. For the subsequent cash flows, we can generalise the period

for which discounting is to be done, as [(n-1) + dnc/dicp]. We can use the “price” function in](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-161-320.jpg)

![180

In this equation, we know the periodic coupons as well as the market price. From the earlier

equation, we can substitute the value of 15.5. Then the only unknown in this equation would be

ri, for which we can solve. The process of thus discovering the zero rates from prices of coupon

bonds, by substituting zero rates estimated for shorter durations is called bootstrapping. The

yield curve is then drawn from the plot of these derived zero rates, in the similar manner as

we drew the par yield curve.

Bootstrapping is a very popular method with bond market dealers, for estimating the term

structure from market prices. Some of the practical considerations in estimating the zero

curve in this manner are the following:

1. The choice of bonds for varying maturities has to reflect market activity. Depending

on the bonds chosen for estimating the rates, the derived zero rates can vary. It is,

however, possible to obtain a plot of all implied zero rates for all traded bonds, and

adopt the curve fitting procedure, to overcome this problem.

2. It may not be possible to obtain zero rates for the first cash flow of a bond; if a zero

coupon Treasury bill with matching maturity is not found. For example, there could be

a bond, with the first coupon 42 days away. We, therefore, need the r1

for 42 days, in

order to value this bond. A treasury bill with exactly 42 days to maturity may not be

traded in the market. Dealers mostly use a linear interpolation to sort this problem.

Traded treasury bills for available maturities are picked up. Assume for instance we

have the rates for 2 bills, one with 40 days to maturity, and another with 52 days

to maturity. The zero rate for the 42-day bond is computed by linearly interpolating

between these two rates.

Example of linear interpolation:

If the rate for the 40-day bond is 6.542%, and the rate for the 52-day bond is 6.675%,

the rate for the 42-day bond can be found as

= 6.542 + [(6.675-6.542)] x [(42-40)/(52-40)]

= 6.56416%

3. The bootstrapping technique is sensitive to the liquidity and depth in the market. In a

market with few trades, and limited liquidity, bootstrapping is only an approximation

of the true term structure, due to simple assumptions (like linear interpolation) made

for linking up rates for one tenor and the rates for another. It is not uncommon for

some to use more sophisticated non-linear interpolations.

14.3 ALTERNATE METHODOLOGIES TO ESTIMATE THE YIELD CURVE

In the estimation of the yield curve from a set of observed market prices, the following are

important considerations:

a. The spot rates and the yield curve that is estimated should have a close fit with market

prices. That is, the prices estimated by the model and the prices actually prevalent in

the market should have a close fit.](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-182-320.jpg)

![181

b. The model must apply equally well to bonds which are not part of the sample used

for estimation. That is, if a very close fit is sought to be achieved, it may come at the

cost of the model not being able to value out-of-sample bonds. The model would have

incorporated “noise” in the estimation.

c. The estimated yield curve should be smooth, such that the spot and forward rates

derived from them do not show excessive volatility.

d. A number of mathematical techniques are used to generate a fitted yield curve from

a set of observed interest rate points. They involve optimality criteria consistent with

the assumptions regarding the term structure of interest rates.

14.3.1 NSE -ZCYC (Nelson Seigel Model)

In the Indian markets, term structure estimation has been done, and is disseminated every

day by the National Stock Exchange. The Zero Coupon Yield Curve (ZCYC) published by

the NSE, uses the Nelson-Seigel methodology.1216

The Nelson-Siegel formulation specifies a

parsimonious representation of the forward rate function given by

where ‘m’ denotes maturity and b=[ ] are parameters to be estimated.

Since the model is based on the expectations hypothesis, it develops the term structure from

the no-arbitrage relationship between spot and forward rates. The forward rate function can

be mathematically manipulated (integrated) to obtain the relevant spot rate function, the

term structure:

In the spot rate function, the limiting value of r(m,b) as maturity gets large is β0 which

therefore depicts the long term component (which is a non-zero constant). The limiting value

as maturity tends to zero is β0 + β1, which therefore gives the implied short-term rate of

interest.

With the above specification of the spot rate function, the PV relation can now be specified

using the discount function given by

The present value arrived at is the estimated/model price (p_est) for each bond. It is common

to observe secondary market prices (pmkt) that deviate from this value. For the purpose

of empirical estimation of the unknown parameters in term structure equation above, we

12

The paper (Gangadhar Darbha, et al, 2000) that describes the methodology can be downloaded from

www.nse.co.in ‘products’ zcyc. The following section is extracted from this paper.](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-183-320.jpg)

![214

SCBs and AIFIs may follow the above guidance note mutatis mutandis for accounting

of interest rate futures also. However, since SCBs and AIFIs are being permitted to

hedge their underlying portfolio which is subject to periodical mark to market, the

following norms will apply

a) If the hedge is “highly effective”, the gain or loss on the hedging instruments and

hedged portfolio may be set off and net loss, if any, should be provided for and

net gains if any, ignored for the purpose of Profit Loss Account.

b) If the hedge is not found to be “highly effective” no set off will be allowed and the

underlying securities will be marked to market as per the norms applicable to their

respective investment category.

c) Trading position in futures is not allowed. However, a hedge may be temporarily

rendered as not “highly effective”. Under such circumstances, the relevant futures

position will be deemed as a trading position. All deemed trading positions should

be marked to market as a portfolio on a daily basis and losses should be provided

for and gains, if any, should be ignored for the purpose of Profit Loss Account.

SCBs and AIFIs should strive to restore their hedge effectiveness at the earliest.

d) Any gains realized from closing out / settlement of futures contracts can not be

taken to Profit Loss account but carried forward as “Other Liability” and utilized

for meeting depreciation provisions on the investment portfolio.

vii. Capital adequacy: The net notional principal amount in respect of futures position

with same underlying and settlement dates should be multiplied by the conversion

factor given below to arrive at the credit equivalent:

Original Maturity Conversion Factor

Less than one year 0.5 per cent

One year and less than two years 1.0 per cent

For each additional year 1.0 per cent

The credit equivalent thus obtained shall be multiplied by the applicable risk weight of

100%.

viii. ALM classification: Interest rate futures are treated as a combination of a long

and short position in a notional government security. The maturity of a future will be

the period until delivery or exercise of the contract, as also the life of the underlying

instrument. For example, a short position in interest rate future for Rs. 50 crore

[delivery date after 6 months, life of the notional underlying government security 3½

years] is to be reported as a risk sensitive asset under the 3 to 6 month bucket and a

risk sensitive liability in four years i.e. under the 3 to 5 year bucket.

ix. Use of brokers: The existing norm of 5% of total transactions during a year as the

aggregate upper contract limit for each of the approved brokers should be observed by

SCBs and AIFIs who participate through approved F O members of the exchanges.](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-216-320.jpg)

![226

PVBP

Also called the Price Value of a Basis Point or Dollar Value of 01. This is one way of quantifying

the sensitivity of a bond to changes in the interest rates. If the current price of the bond is

P(0) and the price after a one basis point rise in rates is P(l) then PVBP is -[P(1)-P(0)]. This

can be estimated with the help of the modified duration of a bond, as (Price of the bond *

modified duration* .0001)

Repo

Repo or Repurchase Agreements are short-term money market instruments. Repo is nothing

but collateralized borrowing and lending. In a repurchase agreement securities are sold in a

temporary sale with a promise to buy back the securities at a future date at specified price.

In reverse repos securities are purchased in a temporary purchase with a promise to sell it

back after a specified number of days at a pre-specified price. When one is doing a repo, it is

reverse repo for the other party

Reverse Repo

See Repo

Risk Free Rate

An interest rate given out by an investment that has a zero probability of default. Theoretically

this rate can never exist in practice but sovereign debt is used as the nearest proxy.

SGL

Subsidiary General Ledger Account is the demat facility for government securities offered by

the Reserve Bank of India. In the case of SGL facility the securities remain in the computers

of RBI by credit to the SGL account of the owner. RBI offers SGL facility only to banks and

primary dealers.

SLR

This is the acronym for Statutory Liquidity Ratio. That part of their Net Demand and Time

liabilities (NDTL) that a bank is required by law to be kept invested in approved securities is

known as SLR. The approved securities are typically sovereign issues. The maintenance of

SLR ensures a minimum liquidity in the bank’s assets.

Spread

Spread is the difference between two rates of interests. It is often generalised to imply the

difference between either price or yield. Spreads can be between two risk classes or can be

between tenors in the same risk class. For example 130 bps between AAA and GOI means

a 1.30% spread between a AAA issue and that made by the Government of India. 5 paisa

spread between bid and ask means that in the two way price quoted the difference between

the buy and sell price is 5 paisa 60 bps spread between 3 month T Bill over 10 Year means](https://image.slidesharecdn.com/studymaterial-ncfmfimmda-nsedebtmarketbasicmodule-191226040706/85/Study-Material-NCFM-FIMMDA-NSE-Debt-Market-Basic-Module-228-320.jpg)