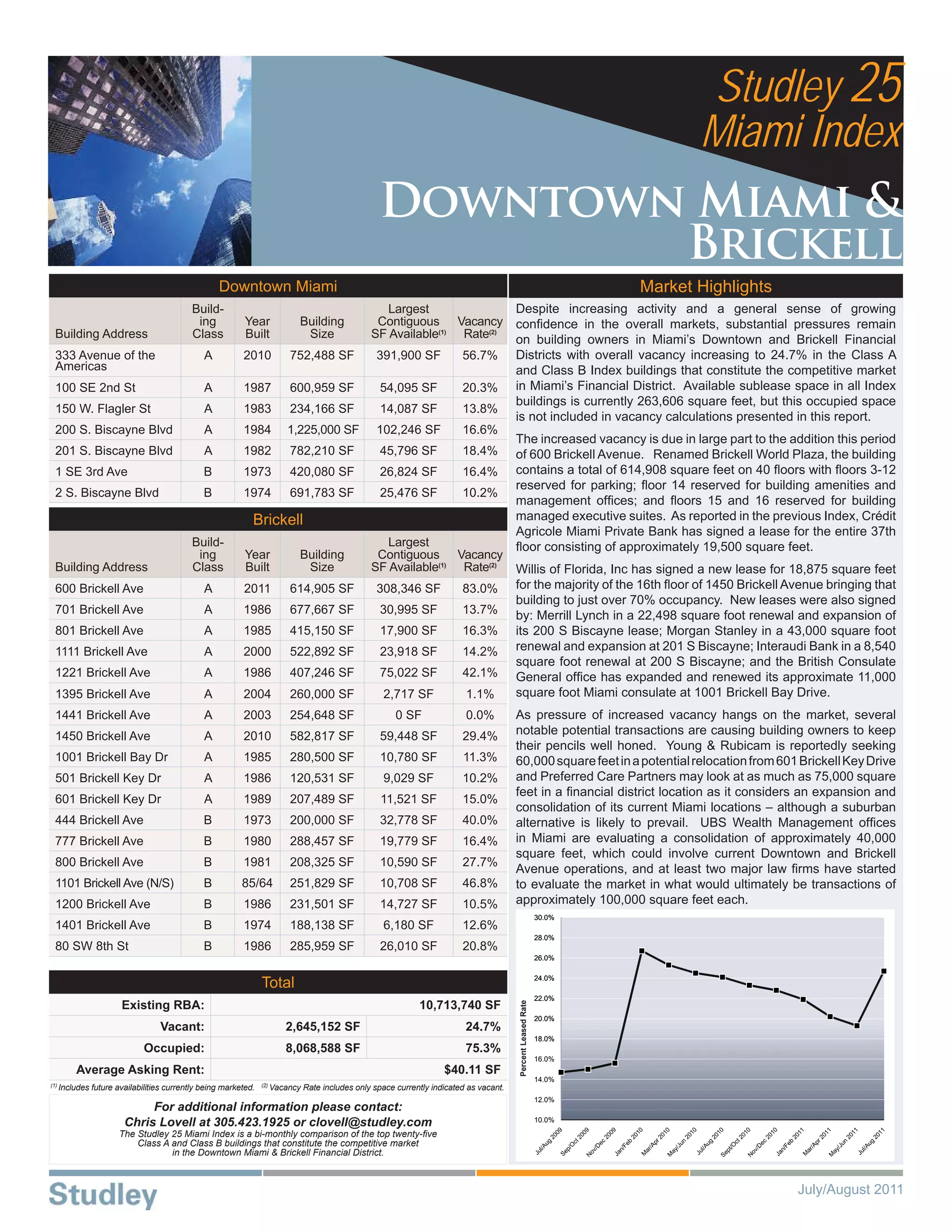

The document discusses the increasing vacancy rates in Miami's downtown and Brickell financial districts, with overall vacancy rising to 24.7%. Notable leases were signed, including by Crédite Agricole Miami Private Bank and Willis of Florida, Inc., while potential transactions are on the horizon as companies evaluate space for relocation and consolidation. The average asking rent stands at $40.11 per square foot, reflecting the challenging market conditions for building owners.