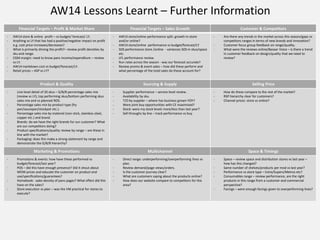

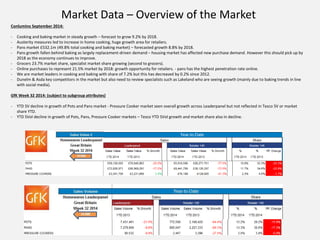

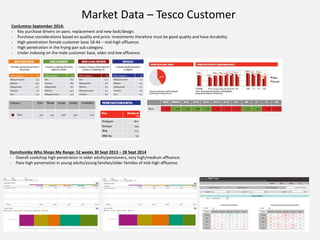

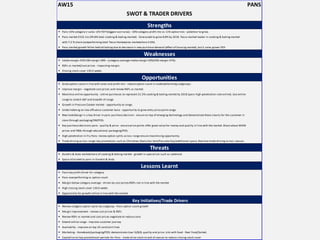

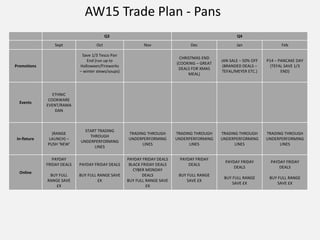

The document provides an agenda and background information for developing the AW15 strategy for pans at Tesco. Key points from the document include: pans accounted for 33% of category sales and 30% of profits in AW14; intake and CRS margins for pans were lower than the category average; closing stock levels for pans were high at 130 weeks of coverage; and opportunities exist to grow sales and profits by improving margins, reducing stock levels, and increasing the pans option count in line with its sales performance.