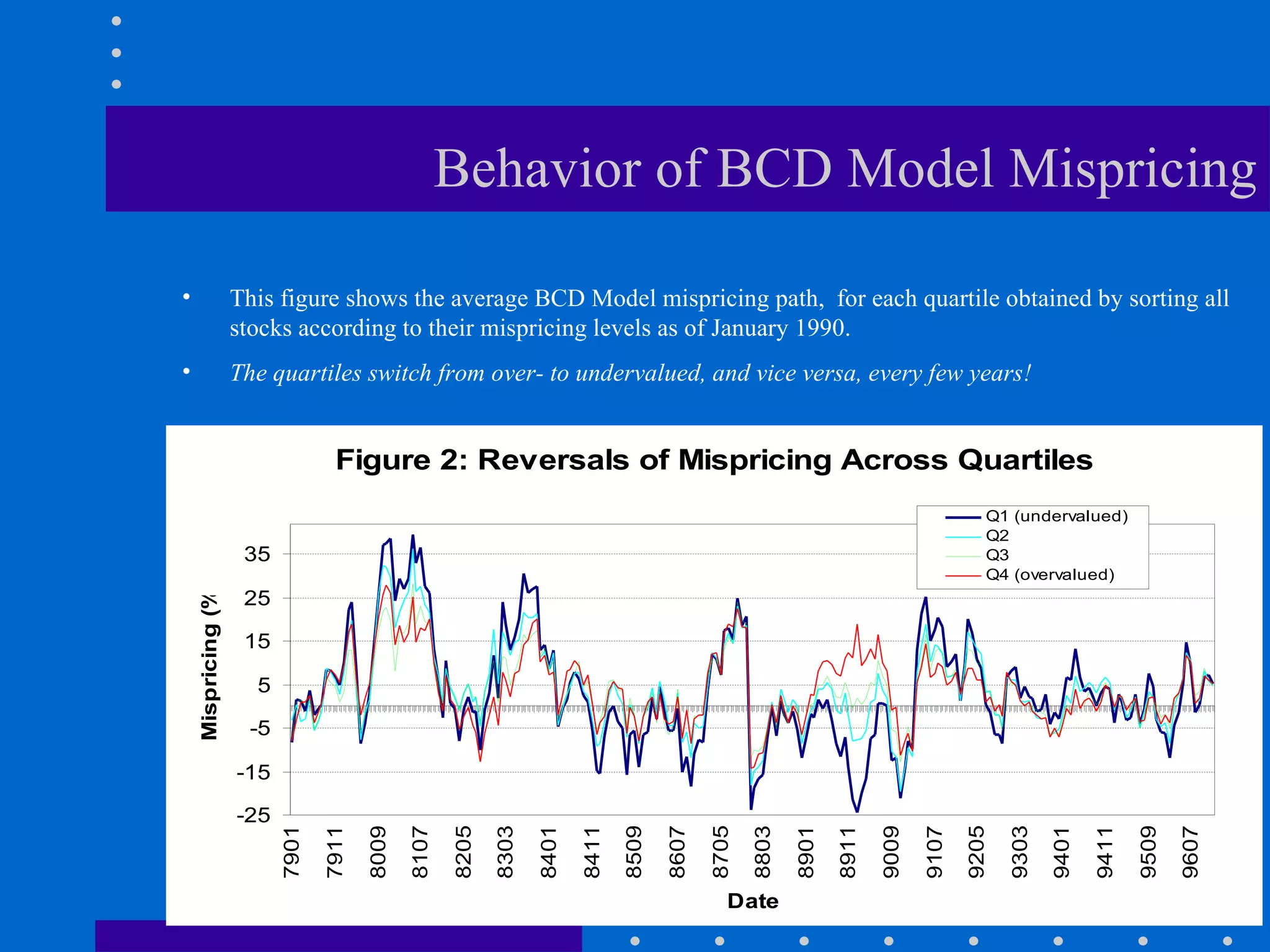

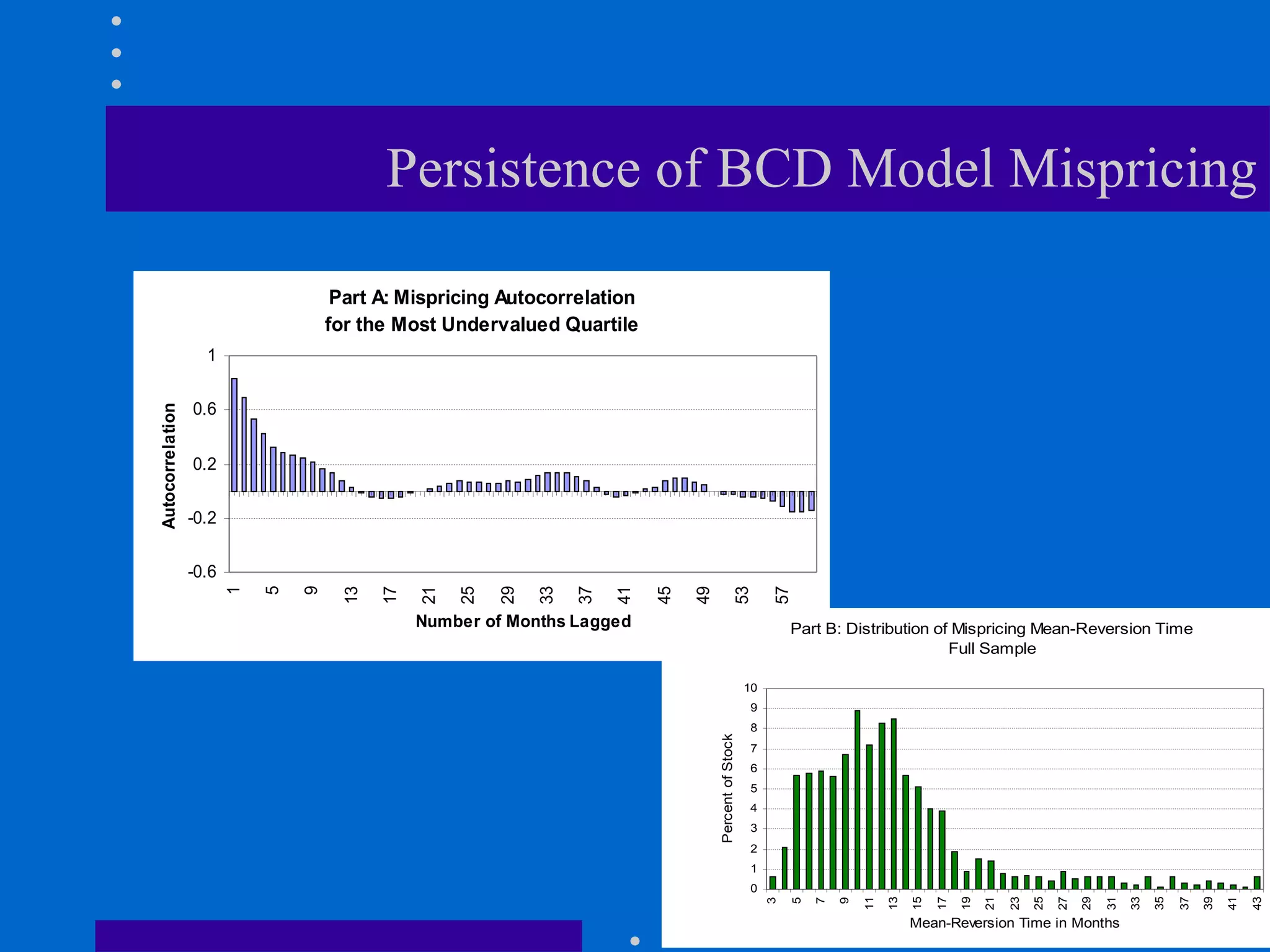

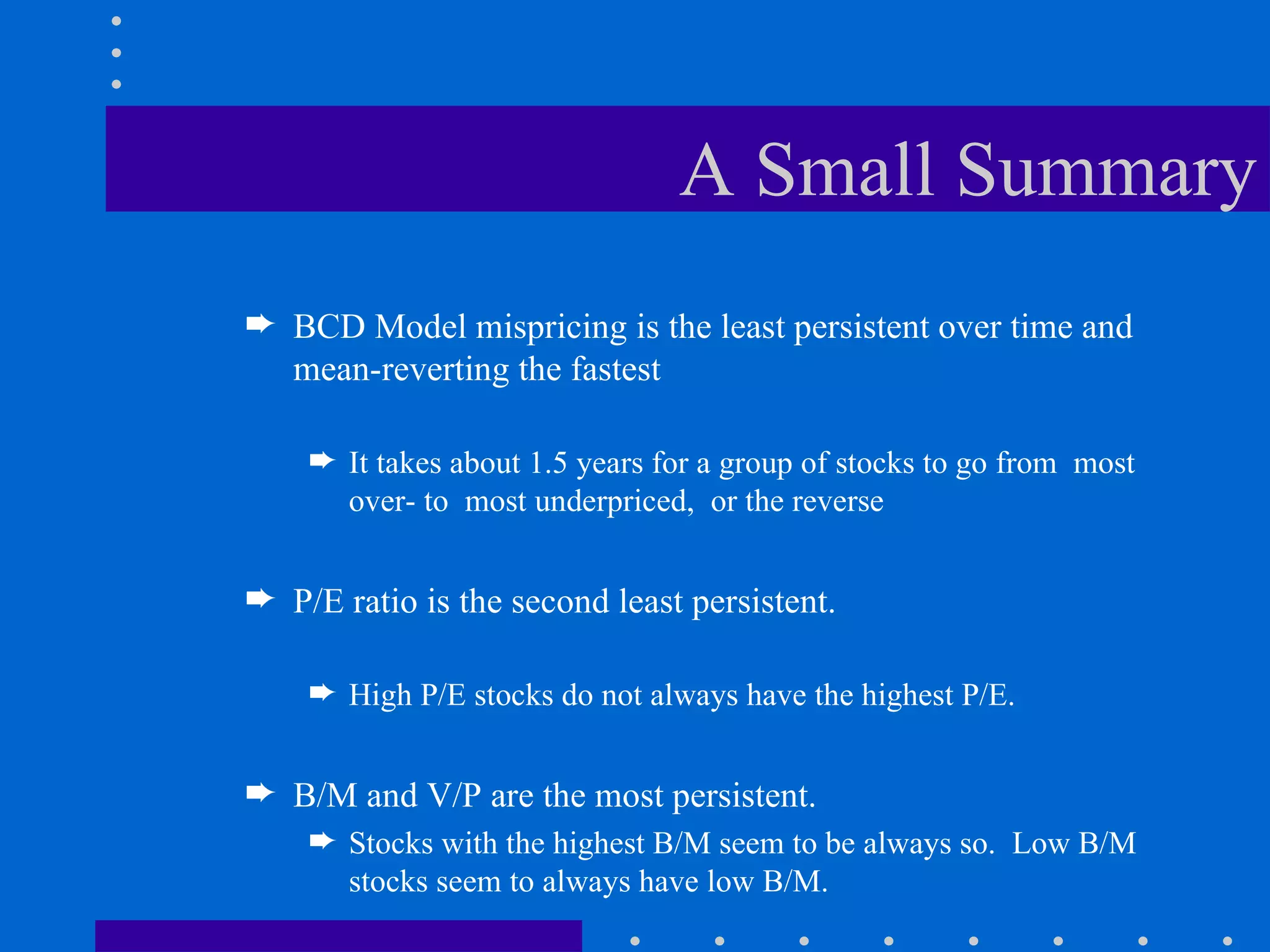

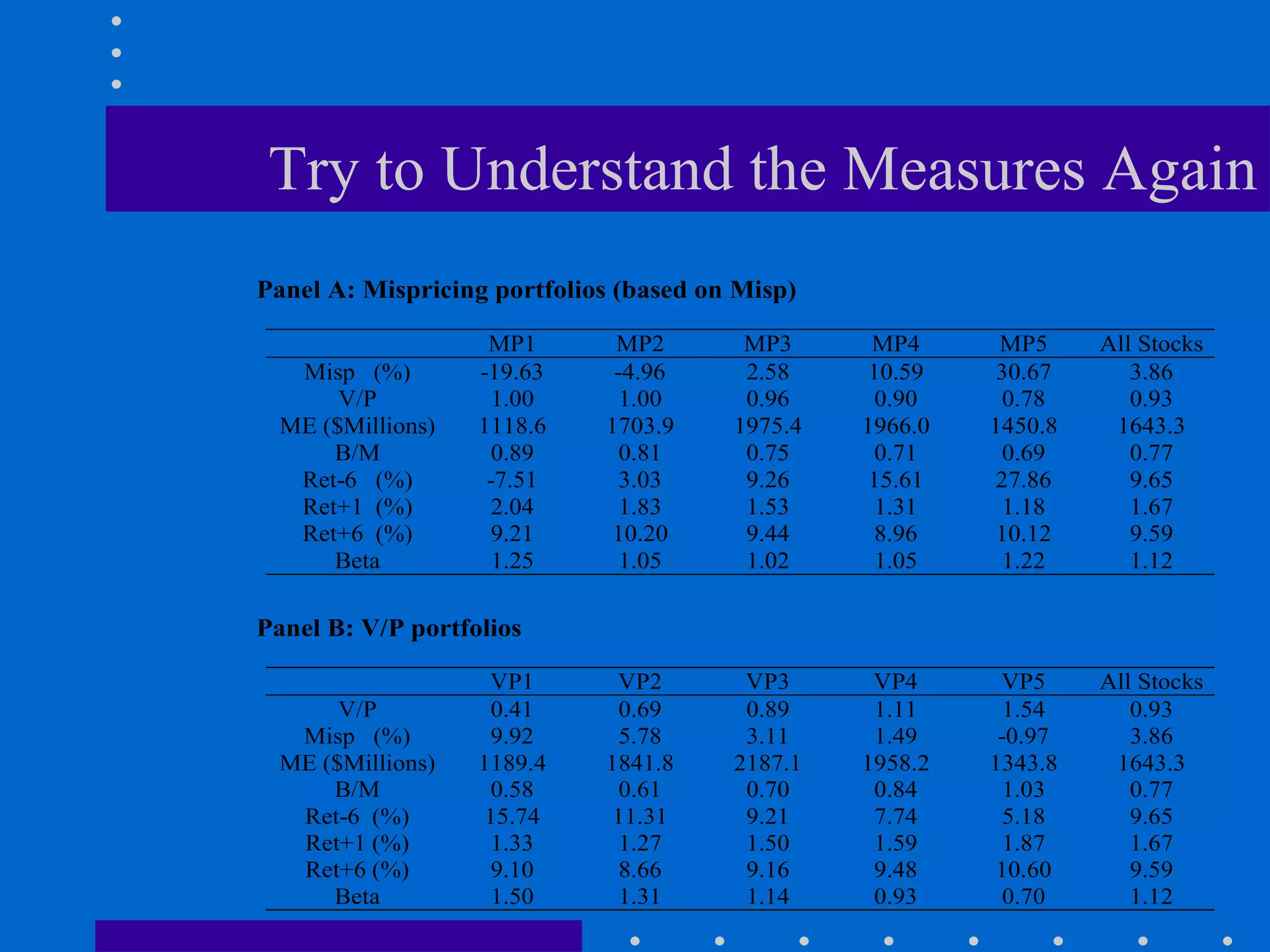

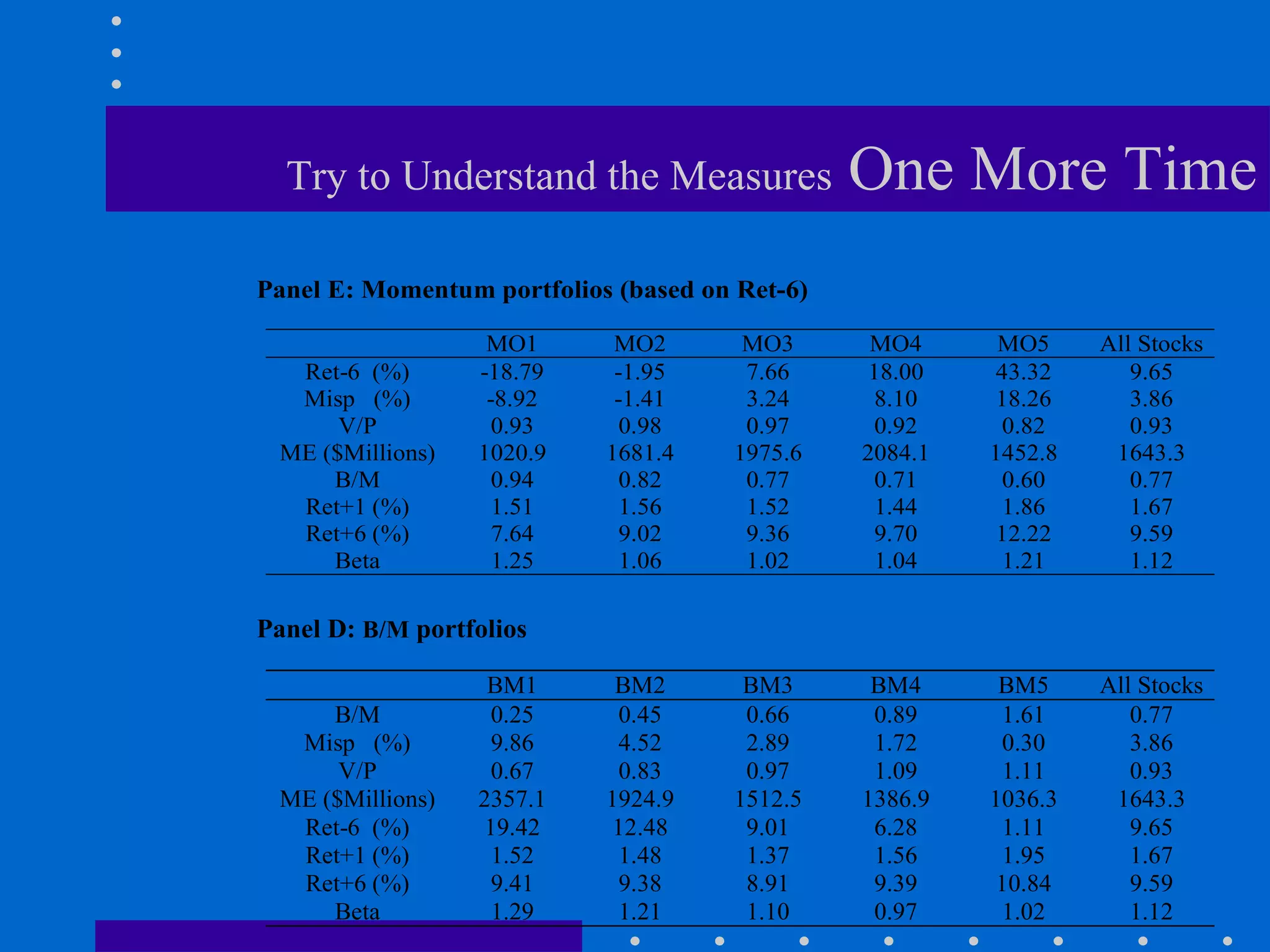

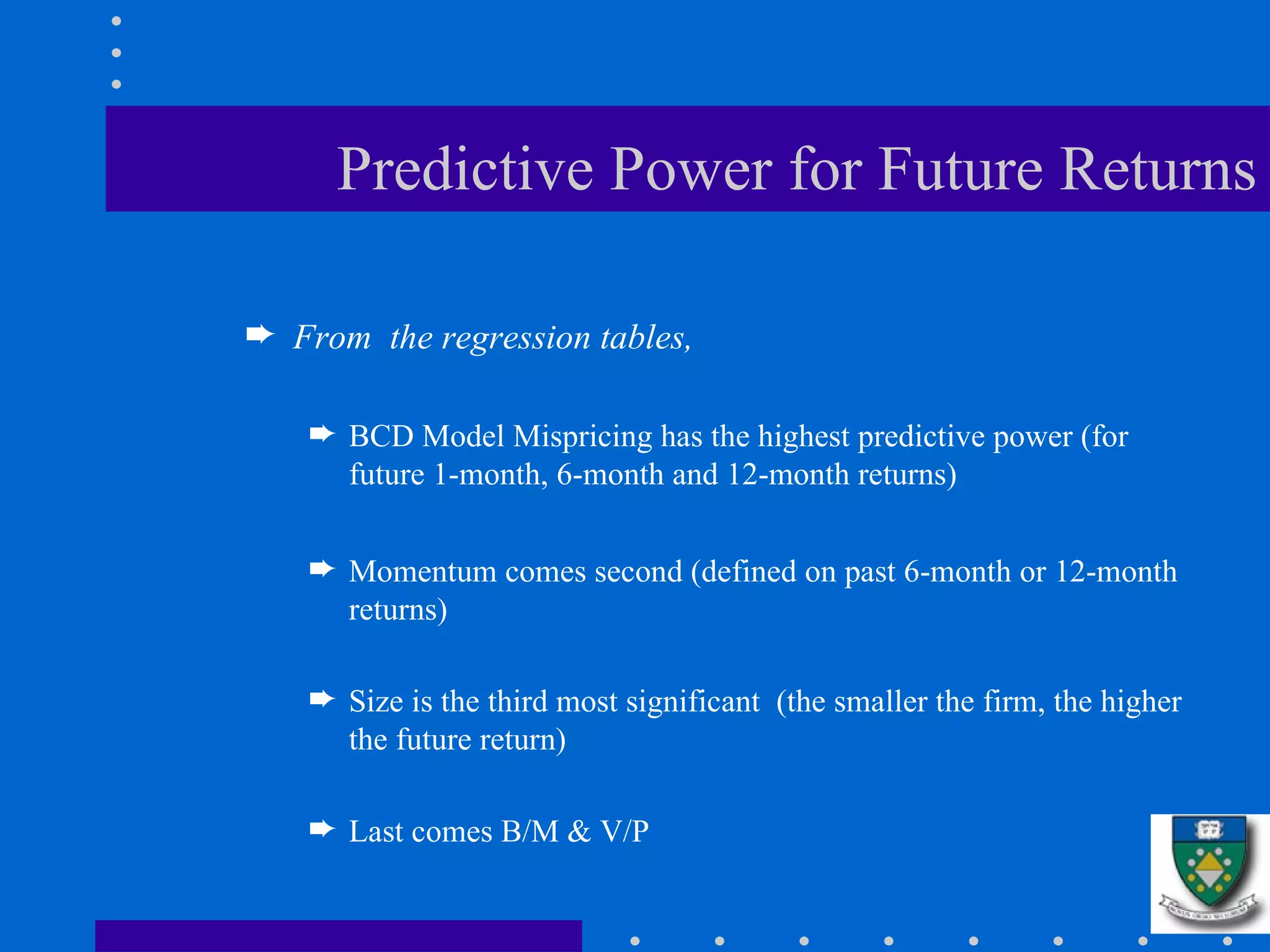

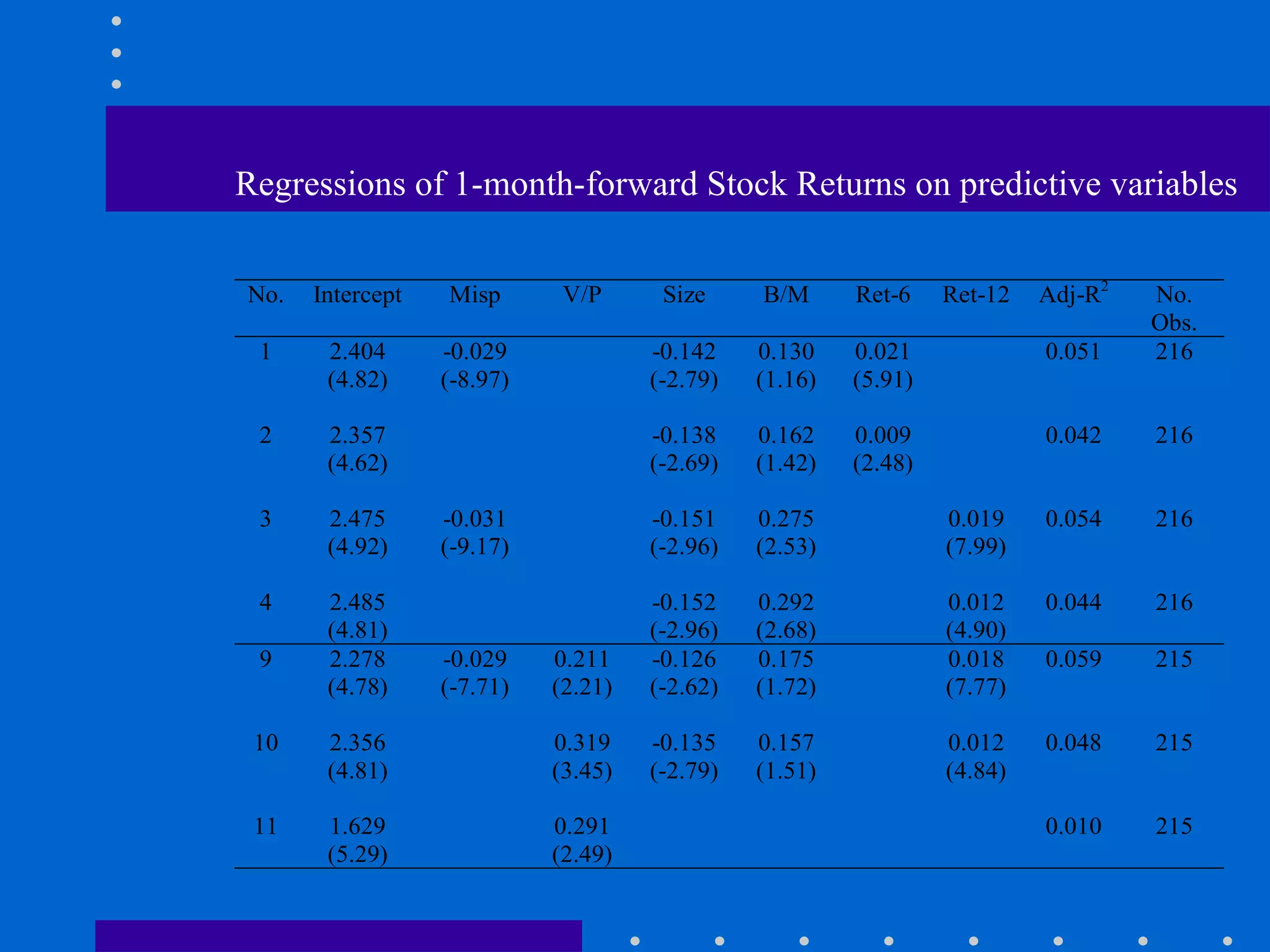

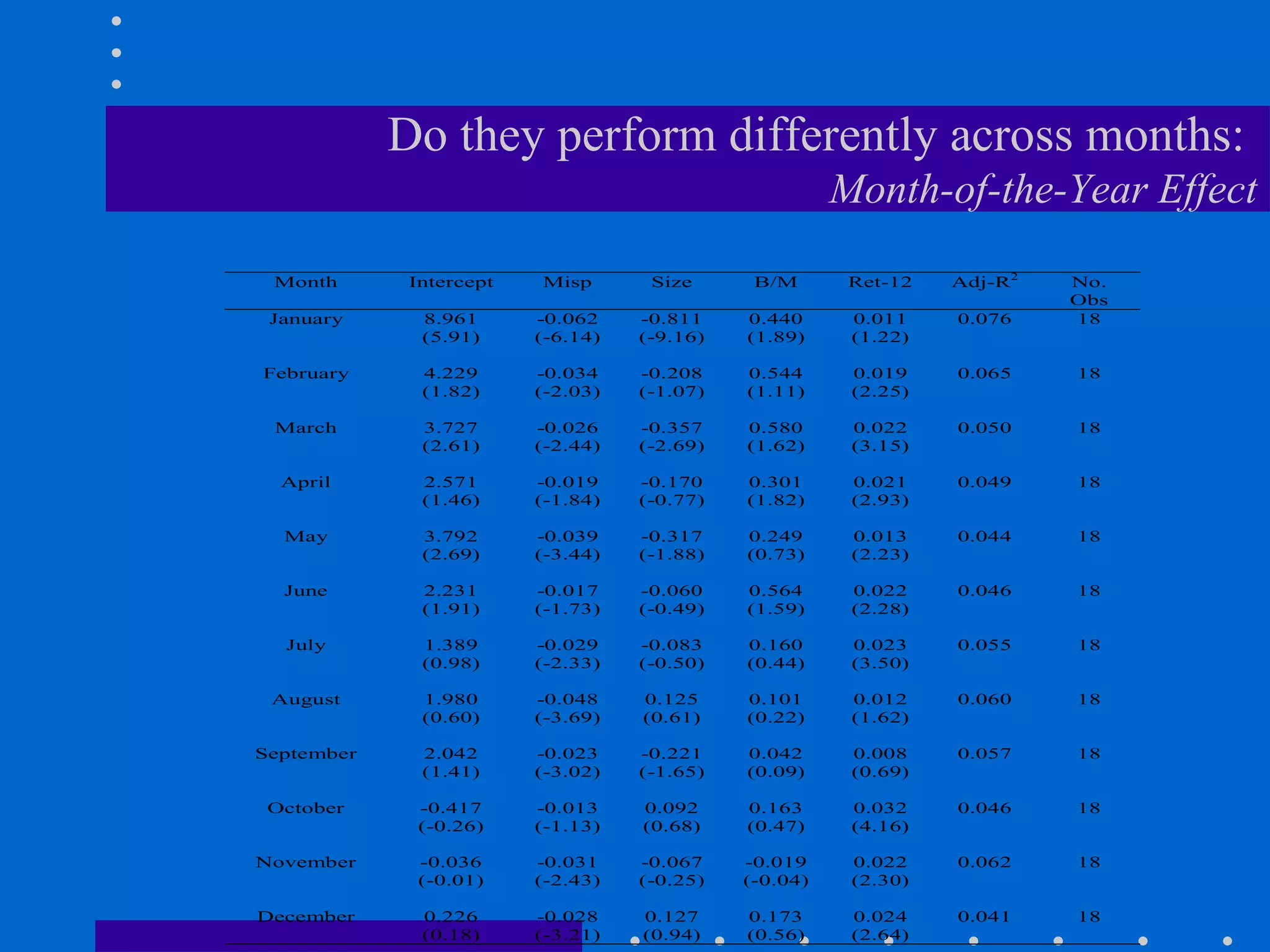

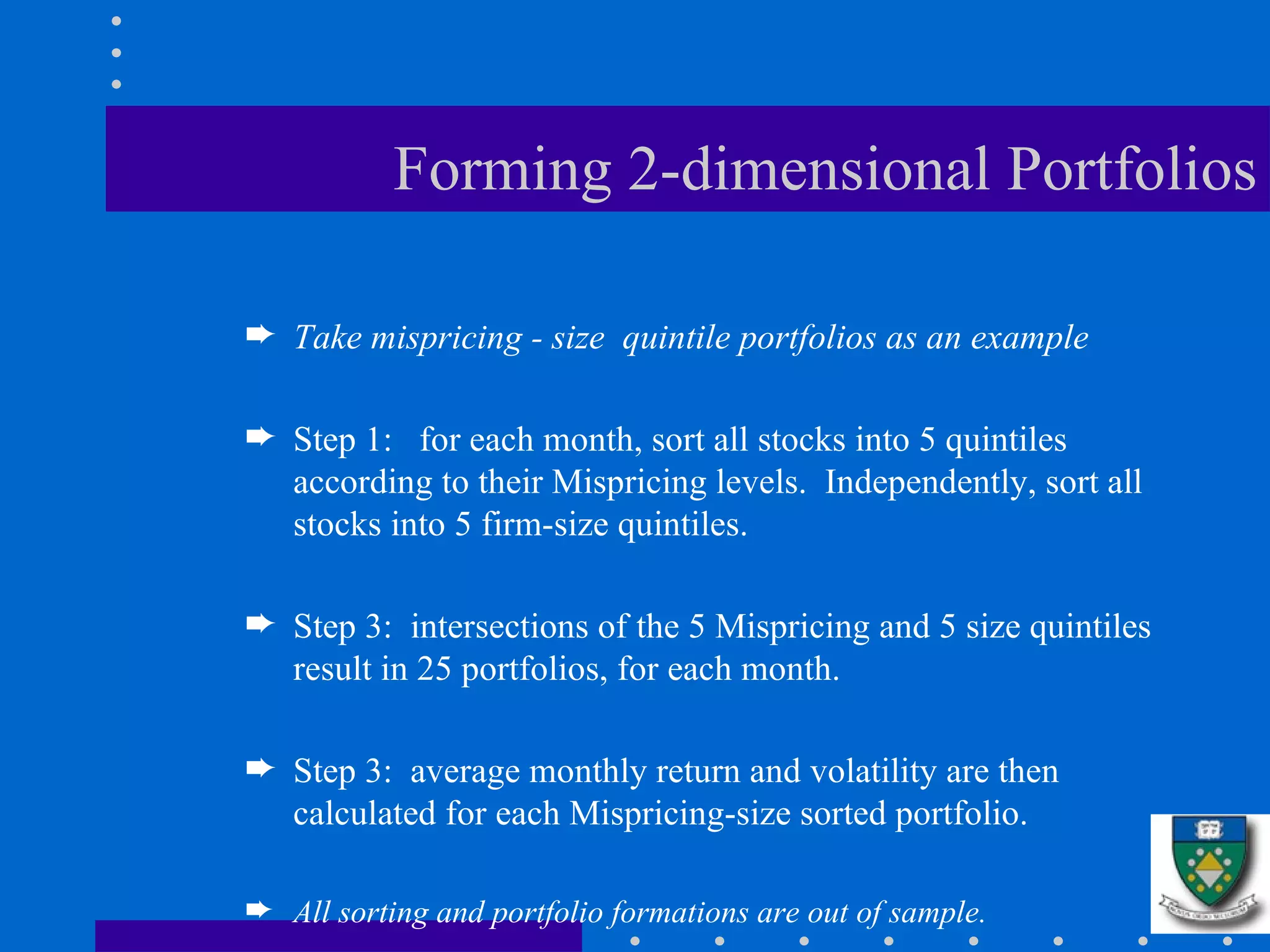

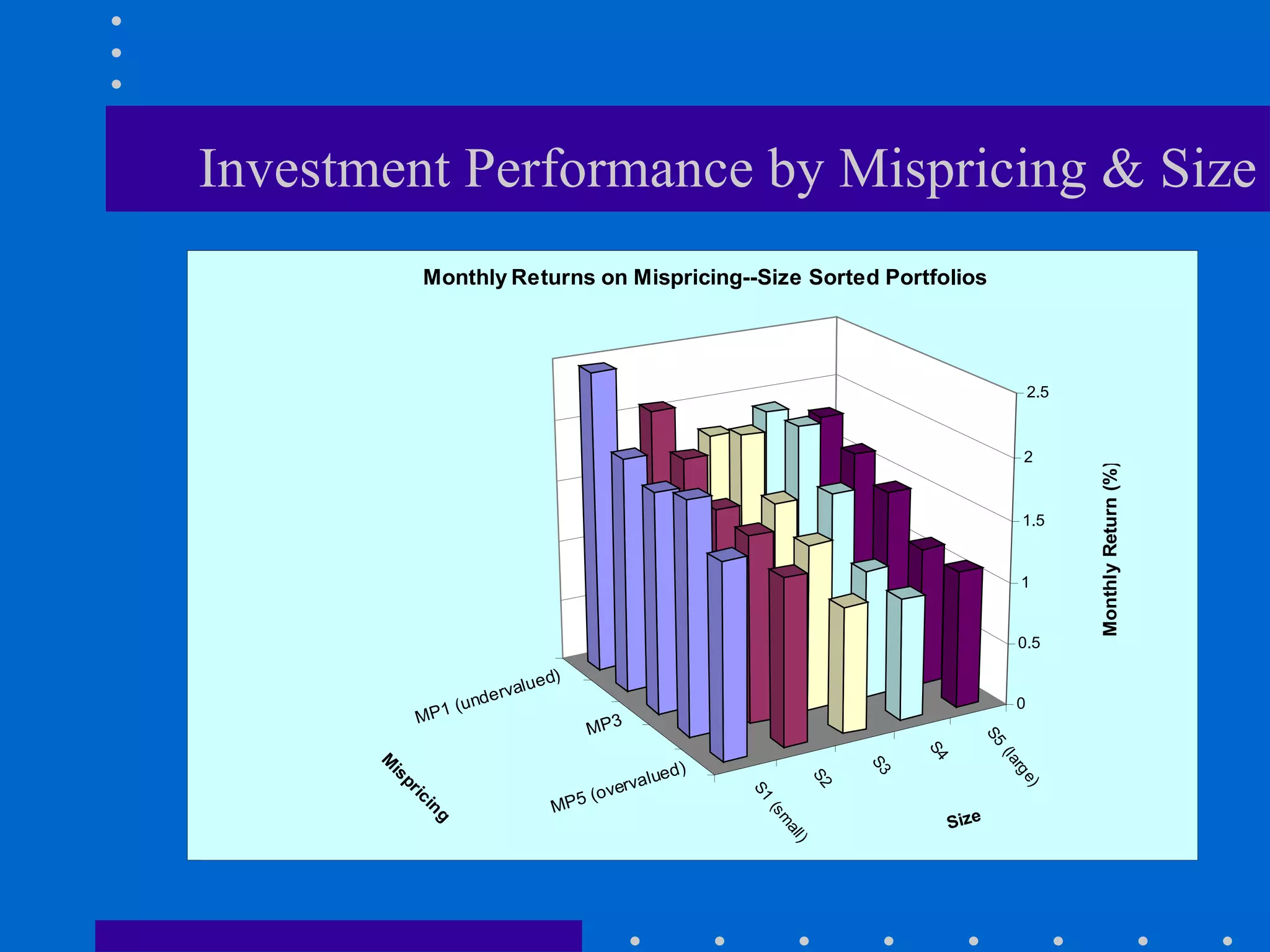

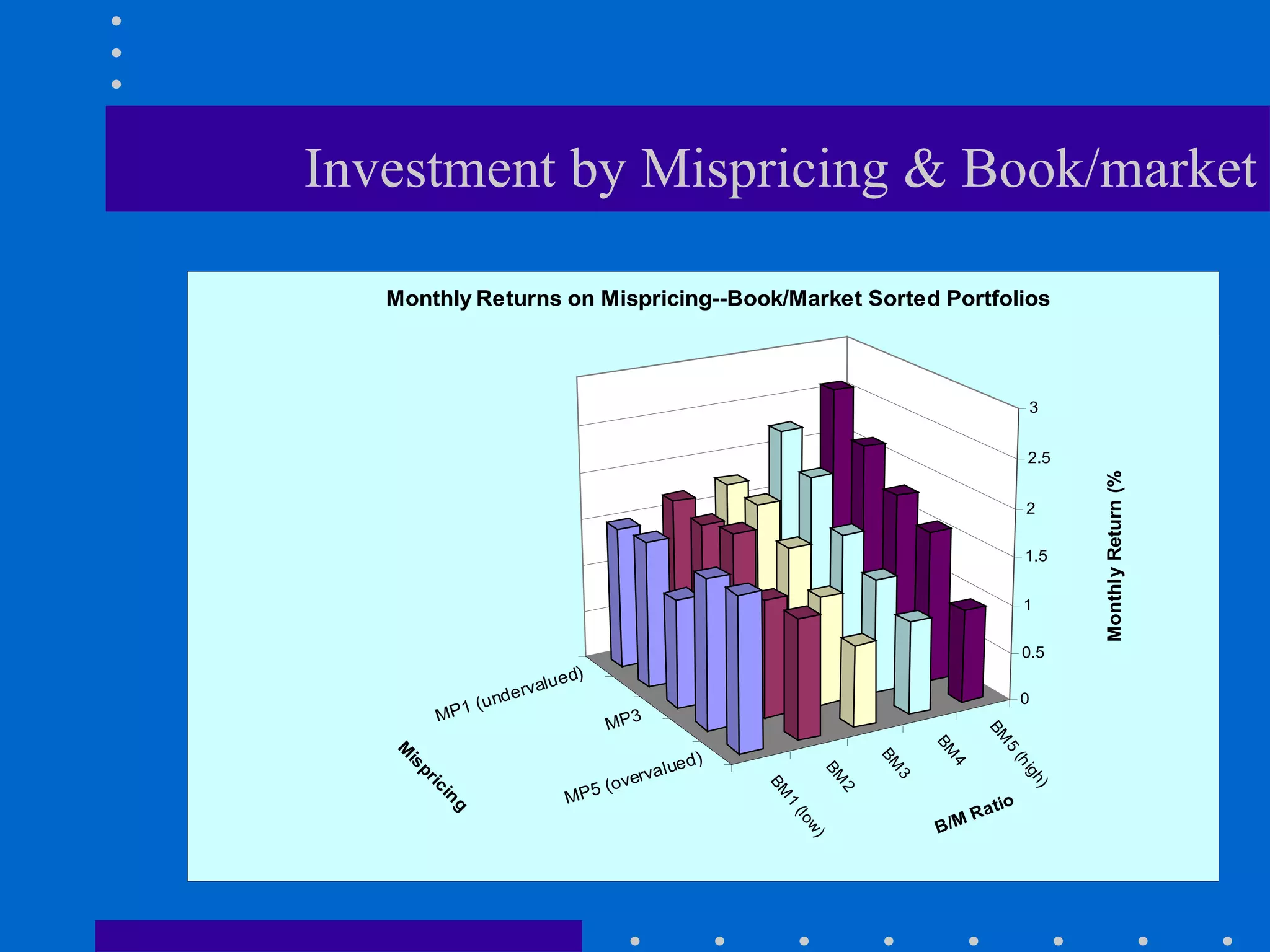

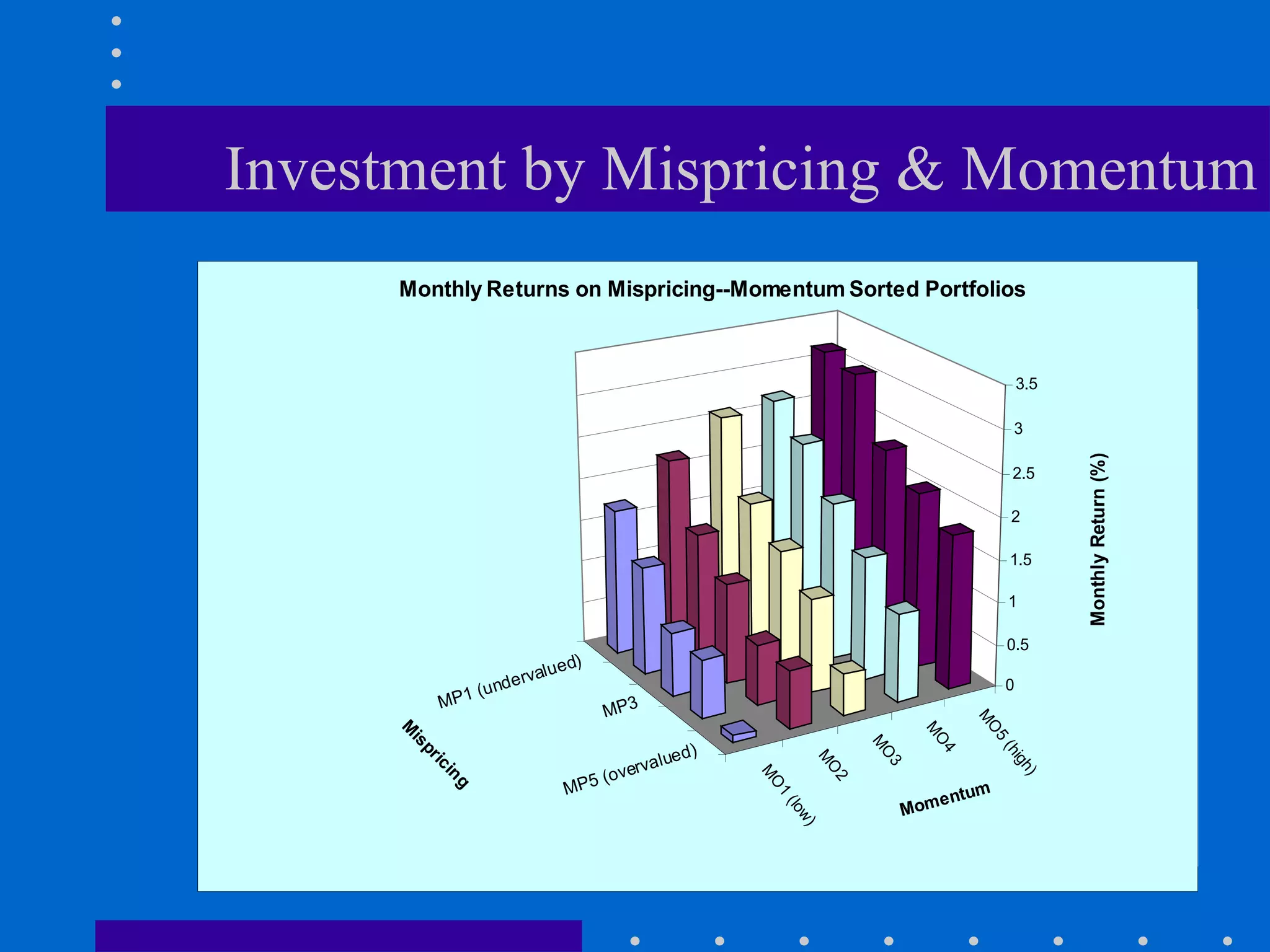

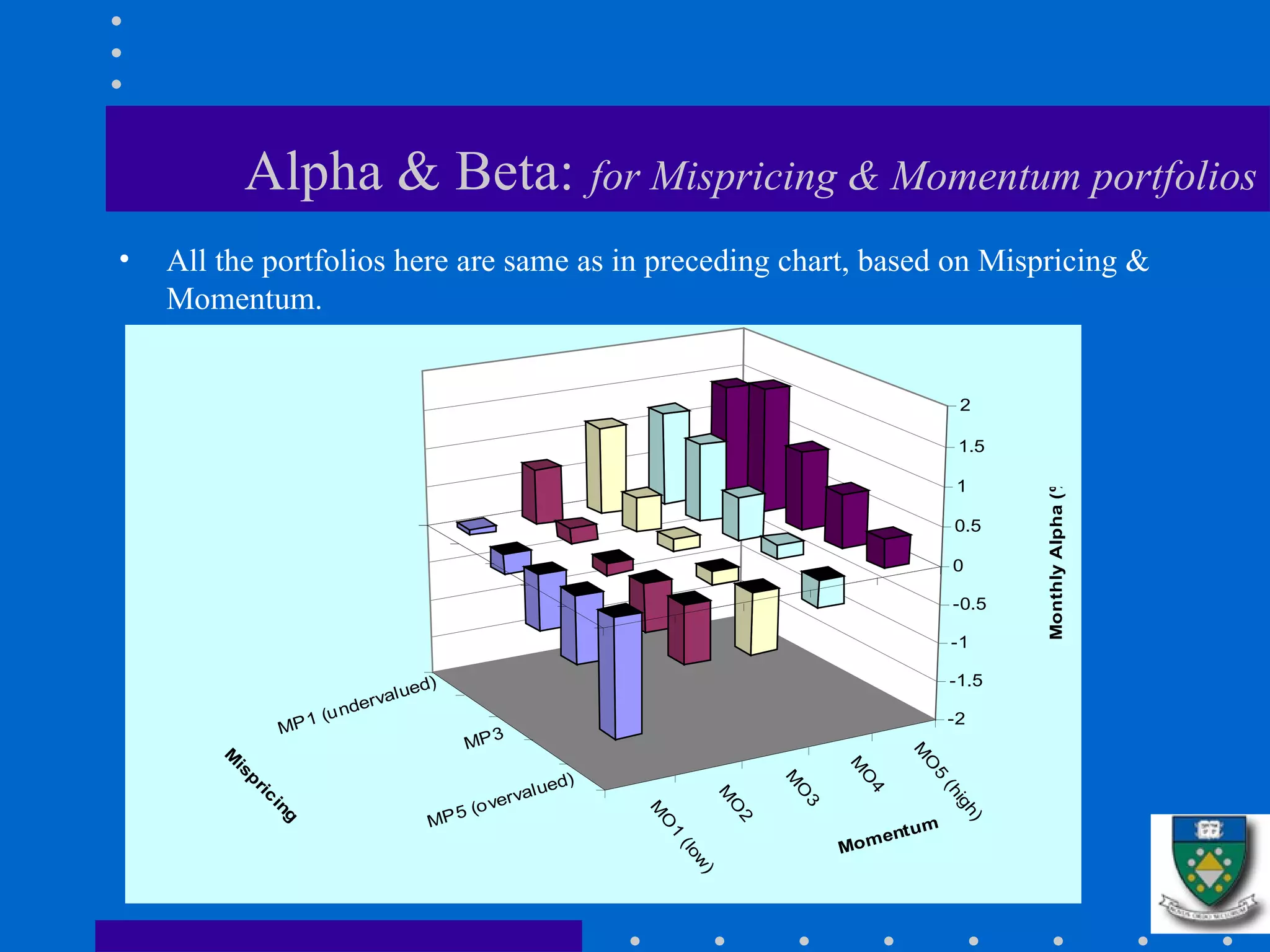

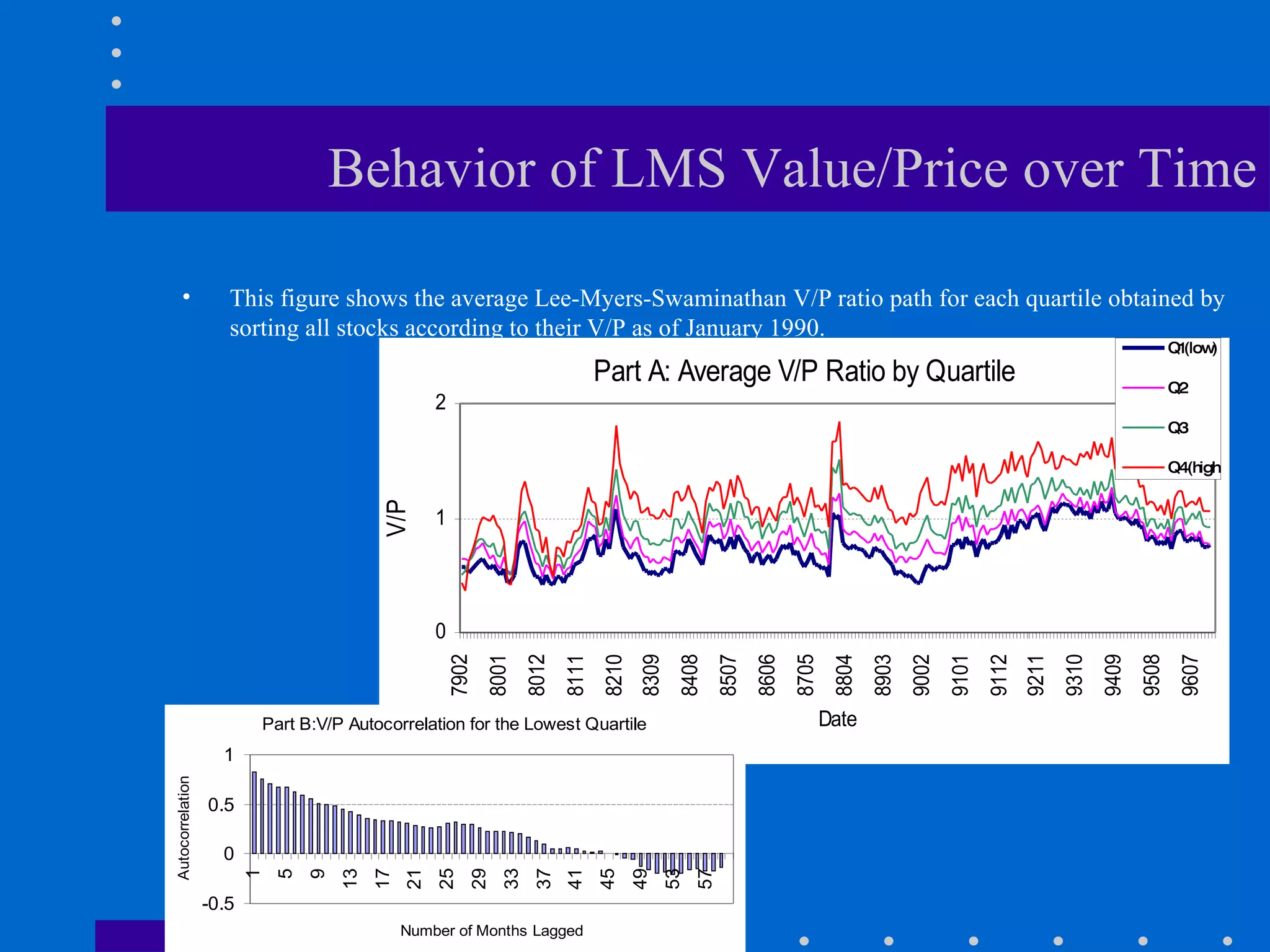

The document compares different stock valuation models and stock selection measures. It finds that the Bakshi-Chen-Dong (BCD) stock valuation model produces mispricing estimates that are highly mean-reverting, with the most and least overvalued stocks reversing roles about every 1.5 years. Combining the BCD mispricing measure with stock momentum and firm size results in the most profitable investment strategy.

![BCD Model Mispricing Step 1: use past 2-yr data to estimate model parameters for the stock Step 2 : use current EPS, 1-yr-forward EPS forecast and 30-yr yield, plus the estimated parameters, to compute the stock’s current model price (out of sample) Mispricing = [market price - model price] / model price Thus, a negative mispricing means an undervalued stock, and so on.](https://image.slidesharecdn.com/stockselectionmodelsslides-12863389986267-phpapp02/75/Stock-Selection-Models-13-2048.jpg)