This document summarizes a research paper that uses machine learning and financial ratios to classify stocks traded on the Indian stock market as either "outperformers" or "underperformers" based on their rate of return. The study uses quarterly data from 50 large market capitalization companies over one year. A support vector machine model achieved 80% accuracy in predicting stock performance on a sector-by-sector basis. While promising, the author acknowledges limitations and outlines areas for further improvement, such as incorporating more external factors like macroeconomic data.

![Volume1, Oct-2017

Prediction of Stock Performance in the Indian Stock Market Using Machine Learning

Santosh Kumar Joshi,

Orange Business Services, Cyber City Gurgaon India

ABSTRACT

I use Machine Learning and various financial ratios as independent variables to investigate indicators that significantly affect the performance of stocks actively traded on the Indian stock

market. The study sample consists of the ratios of 50 large market capitalization companies(Nifty 50) quarterly financial data over one-year period. The study identifies and examines 14

financial indicators that can classify the companies into two categories – “Outperformer” or “Underperformer” – based on their rate of return. The paper asserts that the model developed can

enhance an investor's stock price forecasting ability. Macro-economic variables such as GDP, the unemployment rate, and the inflation rate of the Country , which also can influence the share

price, were not taken into account, however. There is always a risk of Geopolitical development which cause uncertainty globally. The paper discusses the practical implications of using the ML

to predict the probability of good stock performance. The author states that the model can be used by investors, fund managers, and investment companies to enhance their ability to select

out-performing stocks at their own risk.

Keywords: Classification of stock performance, Indian stock market, market rate of return, financial ratios, NIFTY 50

INTRODUCTION1.

It is important for shareholders and potential investors to use relevant financial information to enable them to make good investment decisions in the stock market. Predicting stock

performance is certainly very complicated and difficult. In the history of stock performance literature, no comprehensive, accurate model has been suggested to date for predicting stock

market performance. A stock’s performance can, to some extent, be analyzed based on financial indicators presented in the company’s annual report. The annual report contains a vast

amount of information that can be transformed into various ratios. Previous literature suggests that financial ratios are important tools for assessing future stock performance. Analysts,

investors, and researchers use financial ratios to project future stock price trends. Ratio analysis has emerged, therefore, as one of the key parameters used by fund managers and investors to

determine the intrinsic value of stock shares; thus, financial ratios are used extensively for the valuation of stock. ratios are used extensively in fundamental analysis to predict the future

performance of a company. Various new ratios, such as book value and price/cash earnings per share, have been included in this discipline for share valuation. Financial ratios help to form the

basis of investor stock price expectations and, hence, influence investment decision making. The level of importance given to financial ratios differs from industry to industry and from one

country to another. Thus, selecting appropriate ratios is very crucial in increasing the prediction success rate.

The objective of this paper is to apply statistical methods to survey and analyze financial data in order to develop a simplified model for interpretation. This study aims to develop a model for

classifying stocks into two categories(Underperformer & Outperformer)poor), based on their rate of return. A company’s stock is classified as “good” if its share returns perform above the

market returns provided by the National Stock Exchange composite index of India; i.e., the NIFTY.

In this study, the SVC method has been used to classify selected companies, based on their performance.

REVIEW OF LITERATURE2.

In stock performance literature, little attention has been given in the past to the Indian stock market. In recent years, however, there has been a greater focus on the market because of its

rapid growth and its increasing potential for global investors. A number of research papers predict stock performance as well as pricing of the stock index across the globe. Harvey [1995]

observes that emerging market returns are usually more predictable than developed market returns because emerging market returns are more likely to be influenced by local information

than developed markets.

Fundamental variables such as earnings yield, cash flow yield, book-to-market ratio, and size are demonstrated to have some power in predicting stock returns [Fama and French, 1992].

Studies based on European markets also demonstrate similar findings.

•

Ferson and Harvey [1993] observe that returns are predictable, to an extent, across a number of European markets (e.g., UK, France, and Germany).•

Jung and Boyd [1996], in their study of forecasting UK stock prices, suggest that the predictive strength of their stock performance models is quite significant.•

In the Japanese stock market, studies carried out by Jaffe and Westerfield [1985] and Kato et al. [1990] also demonstrate some evidence of predictability in the behavior of index returns.•

In recent literature, artificial neural networks (ANN) have been successfully used for modeling financial time series [Cheng,1996; Van and Robert, 1997]. In the United States, several studies

have examined the cross-sectional relationship between fundamental variables and stock returns.

RESEARCH OBJECTIVE AND METHODOLOGY3.

The objective of this study is to build a model using financial ratios of the firms for the purpose of predicting out-performing shares in the Indian stock market. This study aims, therefore, to

answer two questions:

(1) Can the yields of stocks be explained with the help of financial ratios?

(2) Can we analyze stock yields using a logistic regression model?

DATA COLLECTION METHODOLOGY

3.1 DATASET

The dataset was obtained from NDTV Profit. I selected stocks from Nifty Index(NIFTY50) . In total I selected 50 stocks. For each stock I obtained the stock price at the end of each quarter from

the first quarter of 2016 until the second quarter of 2017. Along the price, we have also retrieved the following financial indicators about each company in our dataset:

Book value - the net asset value of a company, calculated by total assets minus intangible assets (patents, goodwill) and liabilities.

Market capitalization - the market value of a company's issued share capital; it is equal to the share price times the number of shares outstanding.

Change of stock Net price over the one month period

Percentage change of Net price over the one month period

Dividend yield - indicates how much a company pays out in dividends each year relative to its share price.

Earnings per share - a portion of a company's profit divided by the number of issued shares. Earnings per share serves as an indicator of a company's profitability.

Earnings per share growth – the growth of earnings per share over the trailing one-year period.

Sales revenue turnover -

Net revenue - the proceeds from the sale of an asset, minus commissions, taxes, or other expenses related to the sale.

Net revenue growth – the growth of Net revenue over the trailing one-year period.

Sales growth – sales growth over the trailing one-year period.

Price to earnings ratio – measures company’s current share price relative to its per-share earnings.

Price to earnings ratio, five years average – averaged price to earnings ratio over the period of five years.

Price to book ratio - compares a company's current market price to its book value.

Price to sales ratio – ratio calculated by dividing the company's market cap by the revenue in the most recent year.

Dividend per share - is the total dividends paid out over an entire year divided by the number of ordinary shares issued.

Current ratio - compares a firm's current assets to its current liabilities.

Quick ratio - compares the total amount of cash, marketable securities and accounts receivable to the amount of current liabilities.

Total debt to equity - ratio used to measure a company's financial leverage, calculated by dividing a company's total liabilities by its stockholders' equity.

Analyst ratio – ratio given by human analyst.

Revenue growth adjusted by 5 year compound annual growth ratio

Stock Market Prediction Page 1](https://image.slidesharecdn.com/volume1oct-2017-180103084937/75/Indian-Stock-Market-Using-Machine-Learning-Volume1-oct-2017-1-2048.jpg)

![Revenue growth adjusted by 5 year compound annual growth ratio

Profit margin – a profitability ratio calculated as net income divided by revenue, or net profits divided by sales

Operating margin - ratio used to measure a company's pricing strategy and operating efficiency. It is a measurement of what proportion of a company's revenue is left over after paying for

variable costs of production such as wages, raw materials, etc.

Asset turnover - the ratio of the value of a company’s sales or revenues generated relative to the value of its assets1.

3.2 PREDICTING EQUITY PRICE MOVEMENT METHODOLOGY

I modelled out task of predicting equity price movement as classification task, in which I classify stocks that will have Nifty50 price as the benchmark. I classify Stock price in three months

period as “Outperform” when individual stock price performs better than broader Nift50 index. And “Underperform” when Individual stock underperforms nifty50. Since I collected historical

data retrieved (stock price and nifty index price)from NSE, I created a dataset which had indicator values and price 90 days in future of the recording date . I created a script in Python that was

comparing history price with the price exactly 90 days after first price was measured.

There were many stocks which did not have updated quarterly financial data on NDTV also many stocks have duplicate data. These anomalies would have cause inconsistency in data.

Therefore I dropped all those rows.

Since not all financial indicators were available for all companies in our data set, we assigned value -9999 to not present or not available values.

Analssis of SVM(Support Vector Machine)4.

“Support Vector Machine” (SVM) is a supervised machine learning algorithm which can be used for both classification or regression challenges.

However, it is mostly used in classification problems.

Results5.

Since our dataset contained 50 stocks and we needed to discard some stocks because they would imbalance our dataset, our dataset contained 29 stocks. Each stock data having 4 quarters

financial data.

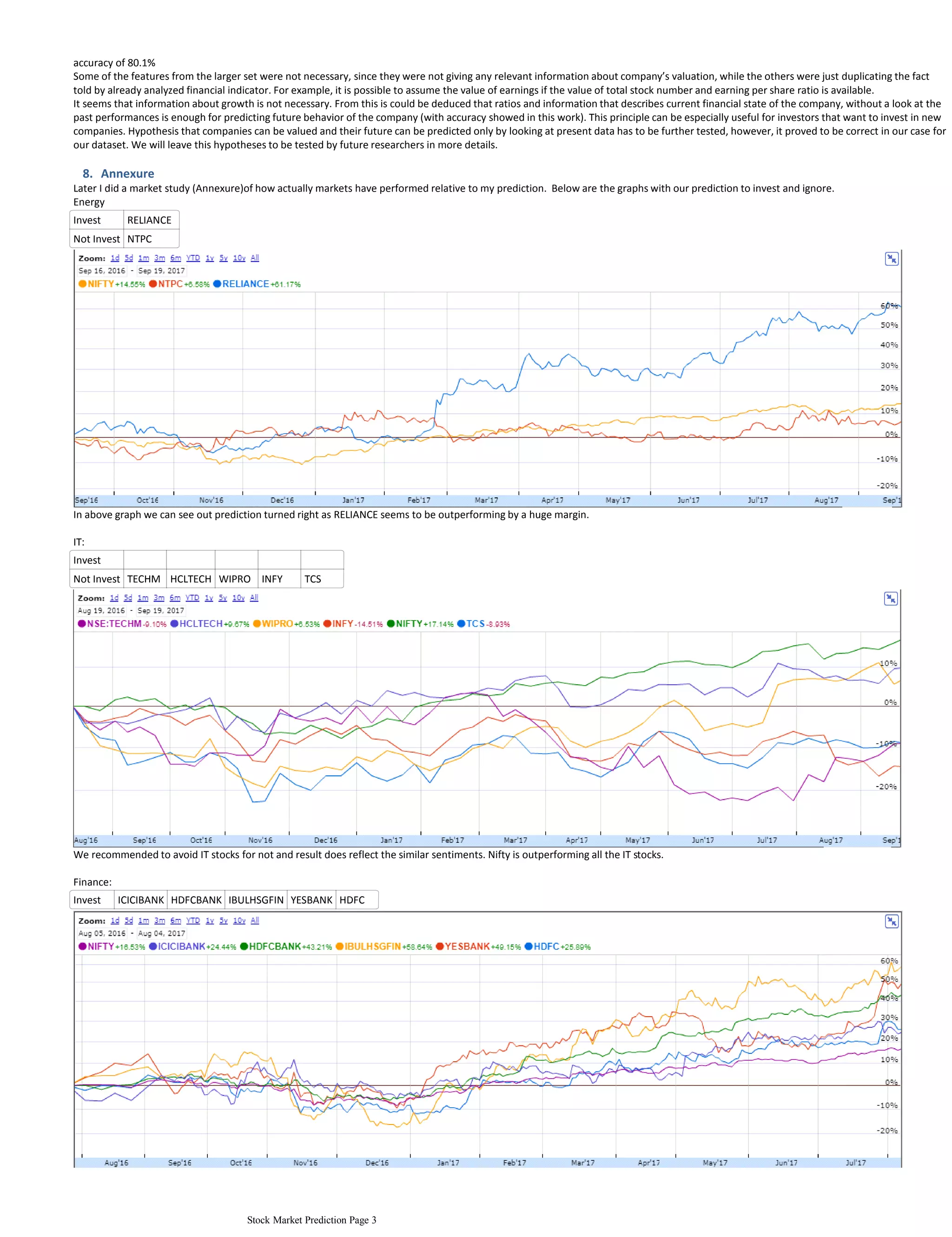

We Used Linear SVM to test our model . We adopted two approaches to see how the performance differs. The first method was to find outperformer in 29 stocks from all the sectors. Output

can be seen below with accuracy ranging from 45%-65% which was a huge variation in multiple runs.

Stocks to Invest ICICIBANK HDFCBANK IBULHSGFIN YESBANK HDFC

Stocks to Ignore All Others

As these results look highly biased towards one sector which does reflect from the accuracy percentage, I changed the approach . I decided to train and test sector wise i.e to use all energy

sector companies data to test energy sector company performance. This will give our model comparatively relative data to train and test on.

With this approach I found surprisingly good results , Our model gave 80% accuracy while it recommended 12 stocks to looking good to invest and 17 as not so good.

Stocks to Invest

RELIANCE

N/A]

HDFCBANK,HDFC,ICICIBANK,YESBANK, IBULHSGFIN

ITC,HINDUNILVR

HEROMOTOCO

INFRATEL

ULTRACEMCO

VEDL

N/A

N/A

Stocks to Ignore

NTPC

TCS, INFY,WIPRO, HCLTECH, TECHM

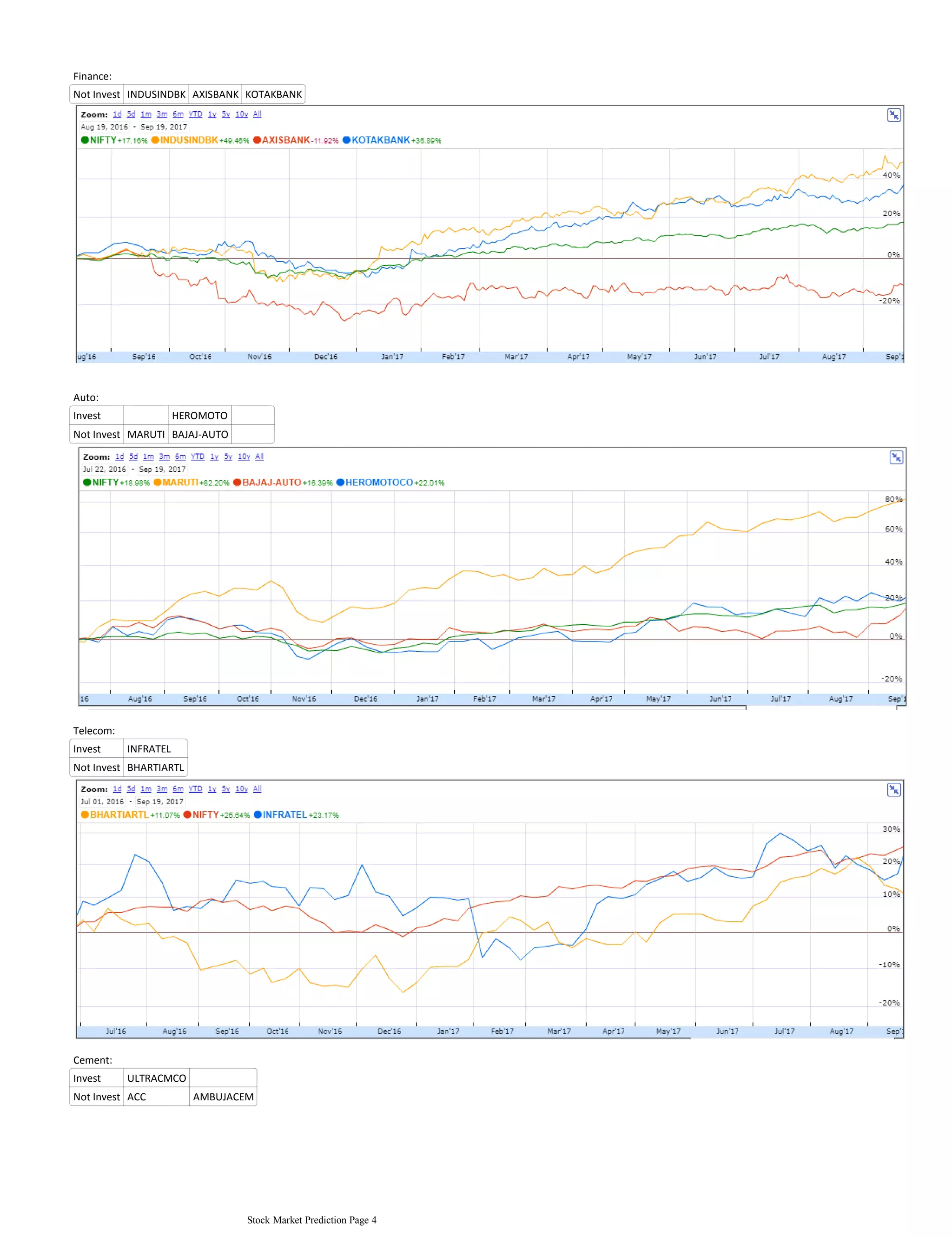

KOTAKBANK,AXISBANK, INDUSINDBK

ASIANPAINT

MARUTI, BAJAJ-AUTO

BHARTIARTL

AMBUJACEM, ACC

N/A

ZEEL

DRREDDY

Sectors

ENERGY

IT

FINANCIAL SERVICES

CONSUMER GOODS

AUTOMOBILE

TELECOM

CEMENT & CEMENT PRODUCTS

METALS

MEDIA & ENTERTAINMENT

PHARMA

Future Works6.

Future iterations on this work should first try to improve model generalization error and reduce overfitting. In this quarter we used 5 quarters data to predict latest quarter performance of

stocks. We are very excited to see the outcome of our approach. Future work should include at least 8 quarters data , we should see how our model performs with more data.

At the time of this study overall global market sentiments have been benign. I would like to test the model on volatile times.

I would like to extend the model to predict 1 year stock performance with more variables.

I shall extend the study to involve technical analysis and algo trading in my work.

Additional computing power could be used to work with network-derived data at much more granular periods of time, such as weekly or monthly data, as opposed to the quarterly splits used

in this paper.

Another avenue for further improvement involves the compilation of more external factors in my study. Geopolitical developments, macroeconomic data, sentiment analysis etc. In this paper

we targeted Nifty 50 stocks however there are about 2000 stocks in NSE.

Conclusion7.

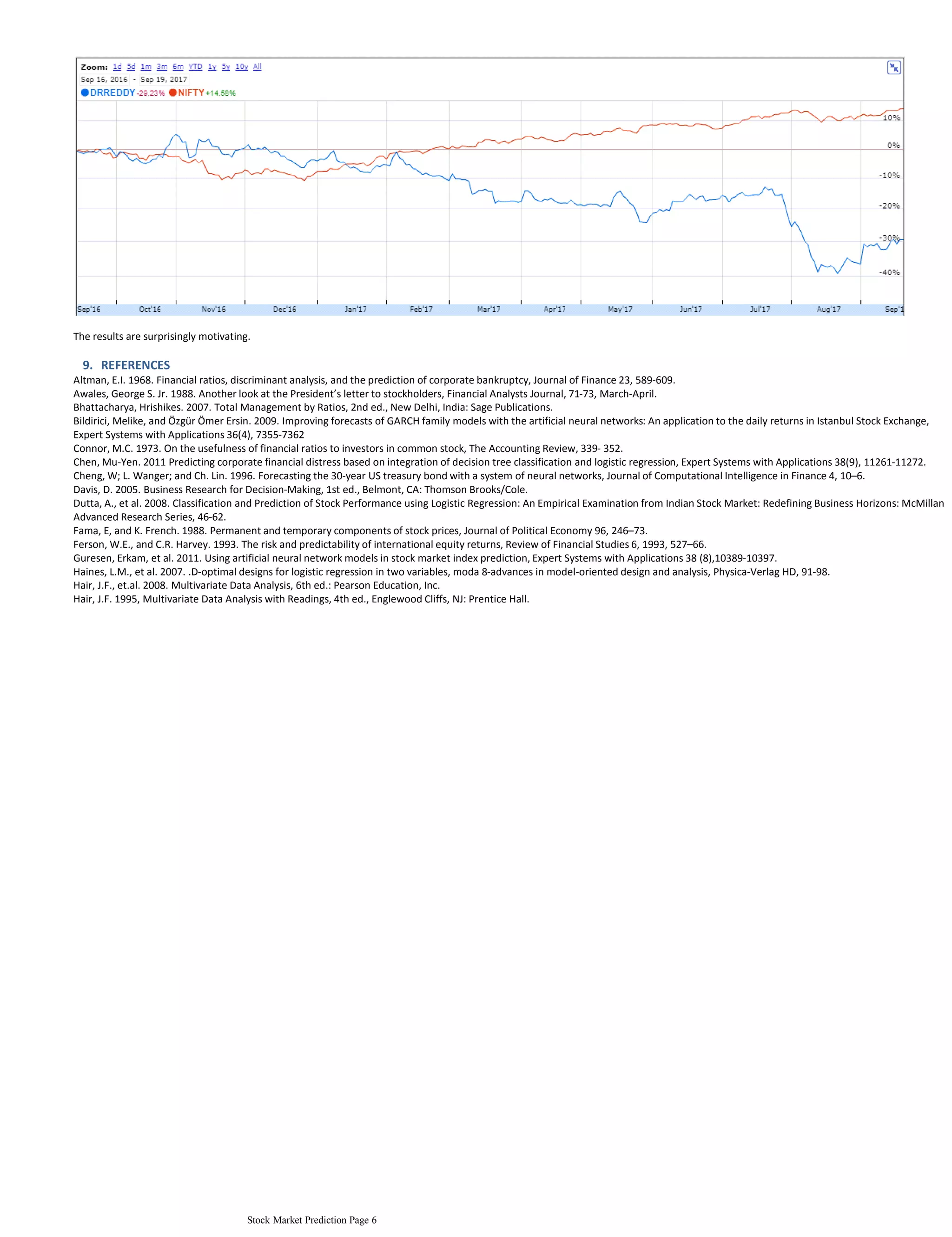

In this paper is presented a machine learning aided methodology for equity movement prediction over the long time. With all selected financial indicators, the methodology performs with

accuracy of 80.1%

Stock Market Prediction Page 2](https://image.slidesharecdn.com/volume1oct-2017-180103084937/75/Indian-Stock-Market-Using-Machine-Learning-Volume1-oct-2017-2-2048.jpg)