Embed presentation

Download to read offline

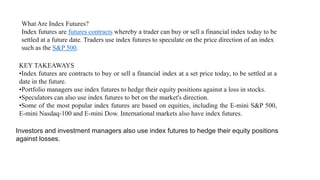

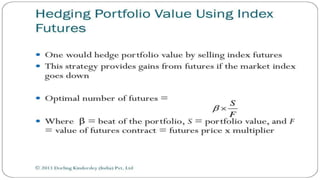

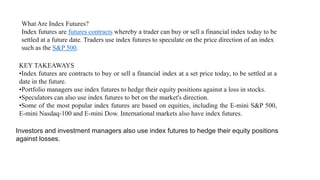

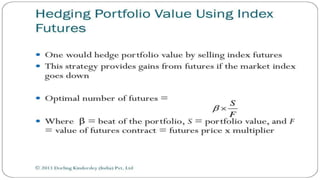

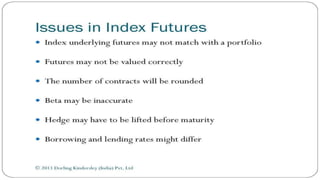

Index futures allow traders to speculate on the future price of a financial index or hedge their equity positions. They are contracts that let an investor buy or sell an index, such as the S&P 500, at a set price today for settlement at a future date. Both speculators and investment managers use index futures, with speculators betting on the market's direction and managers hedging their stock portfolios against potential losses.