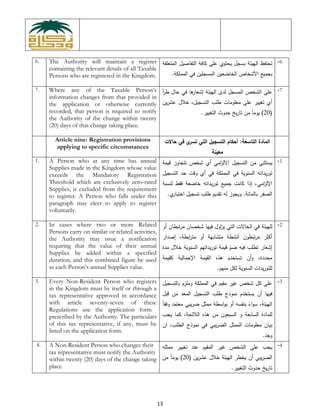

This document provides implementing regulations for value added tax (VAT) in the Kingdom. It covers definitions, rules around taxable persons and mandatory/voluntary registration, supplies of goods and services, place of supply, and exempt supplies. Key points include outlining the mandatory registration threshold, rules for taxable/non-taxable supplies, place of supply considerations for different transaction types, and noting that Chapter 5 will cover exempt supplies. The regulations provide detailed guidance for implementing VAT in accordance with the governing laws and principles.