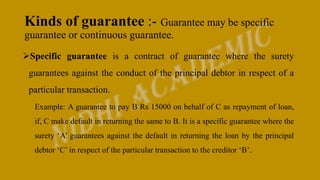

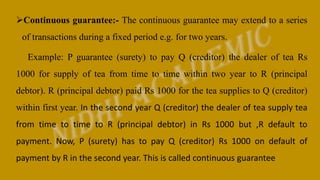

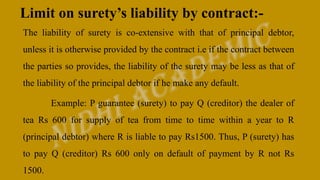

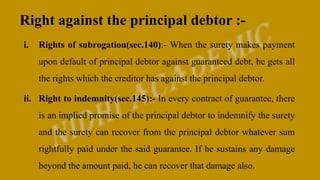

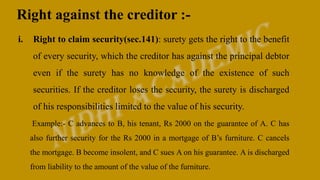

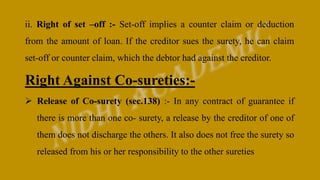

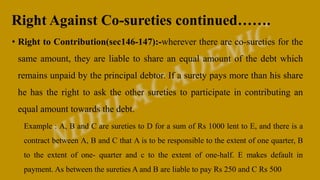

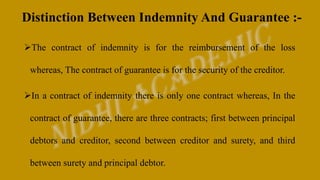

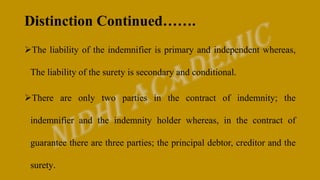

This document discusses special contracts under the Indian Contract Act, 1872, focusing on contracts of indemnity and guarantee. It defines indemnity as a promise to compensate for loss and guarantee as a promise to fulfill a third party's obligations in case of default. The document outlines the essential elements, rights, and distinctions between the two types of contracts, emphasizing their roles in protecting against financial loss.