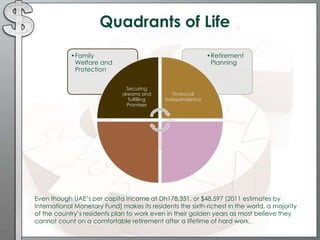

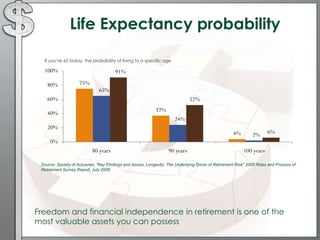

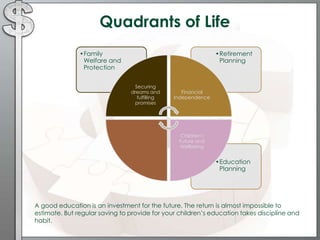

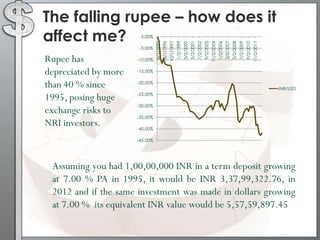

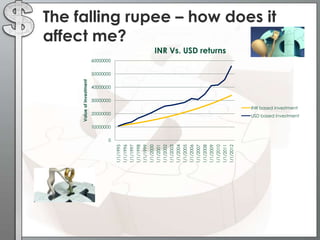

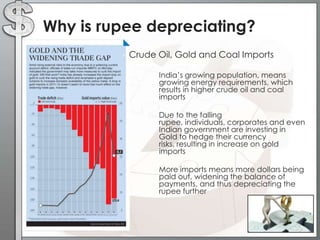

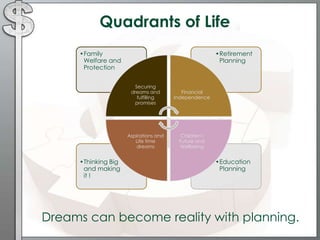

The document outlines a financial planning meeting agenda in Dubai, focusing on personal finance strategies and the services offered by Nexus Insurance Brokers LLC. It emphasizes the importance of family welfare, retirement planning, and education funding while addressing common misconceptions about saving for the future. Additionally, it discusses the impact of currency depreciation on investments and urges participants to assess their financial needs and contributions for achieving long-term goals.