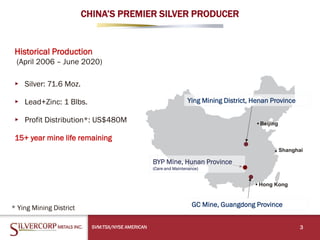

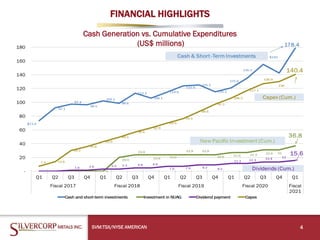

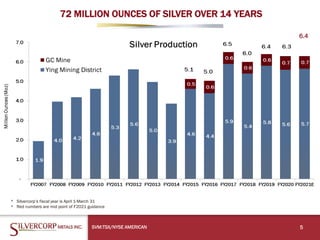

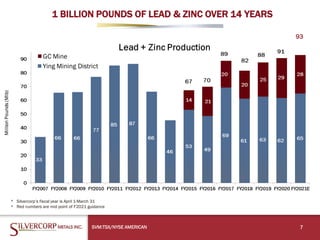

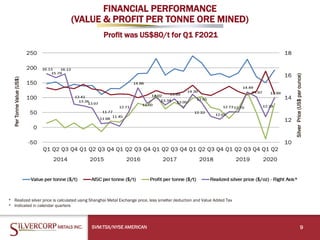

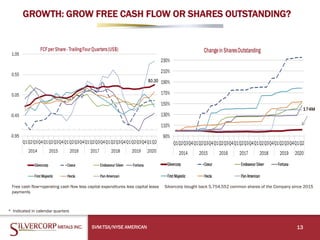

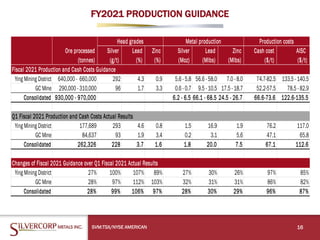

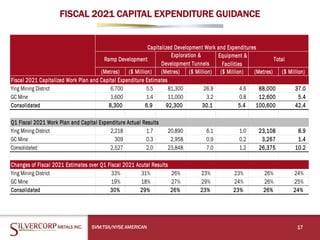

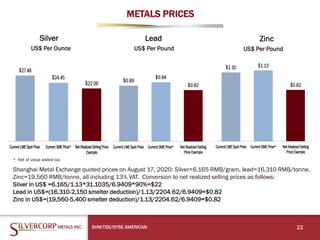

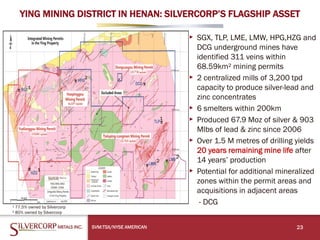

Silvercorp Metals Inc. is a Canadian silver producer with mines in China. In the first quarter of fiscal year 2021, Silvercorp produced 1.5 million ounces of silver, 16.9 million pounds of lead, and 1.9 million pounds of zinc. For fiscal year 2021, Silvercorp expects to produce between 6.2 to 6.5 million ounces of silver, 66.1 to 68.5 million pounds of lead, and 24.5 to 26.7 million pounds of zinc. Silvercorp also provided guidance on operating costs and capital expenditures for the year. The presentation highlights the company's operating performance, growth strategy, and financial position.