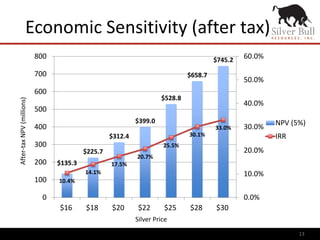

This document provides information on forward-looking statements, capital structure, board of directors, management, and the Sierra Mojada silver-zinc project for Silver Bull Resources. It discusses the project's high grade silver and zinc resource, positive preliminary economic assessment results, exploration upside potential, and favorable infrastructure and economics. Analyst coverage and targets for Silver Bull are also listed.