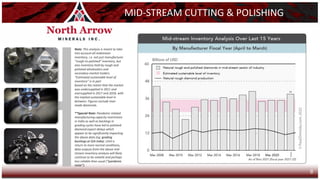

The document provides an overview of North Arrow Minerals Inc., highlighting its corporate structure, key personnel, and diamond exploration projects. It emphasizes the company's potential in the diamond market, backed by strong demand trends in the U.S. jewelry sector and recent positive project developments, particularly in its Naujaat diamond project. The document also discusses market conditions affecting rough diamond supply and pricing, as well as the company's forward-looking statements regarding exploration and production.