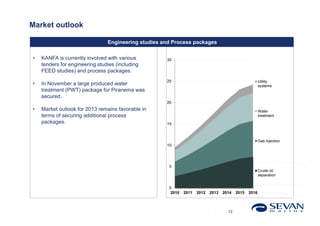

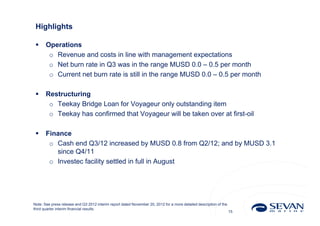

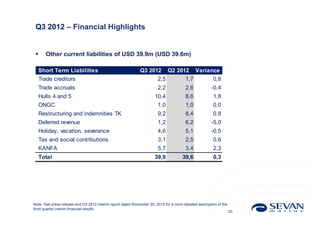

Sevan Marine ASA presented their third quarter results for 2012. They provided updates on their ongoing FPSO projects including the Sevan 1000 FPSO for the Goliat field in the Barents Sea, the Voyageur upgrade project for the Huntington field, and a concept study for the Sevan 400 FPSO for the Western Isles field. They also discussed the status of Hulls No. 4 and 5 in their fleet. Finally, they commented on the market outlook, noting they are currently involved in various tenders for FEED studies on potential redeployment and new lease applications.