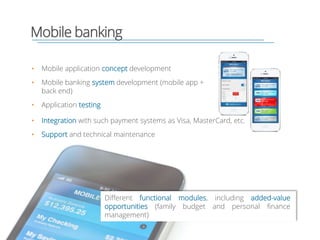

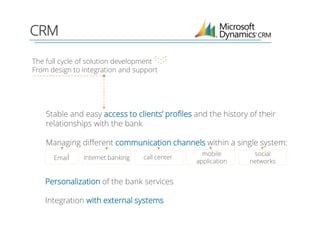

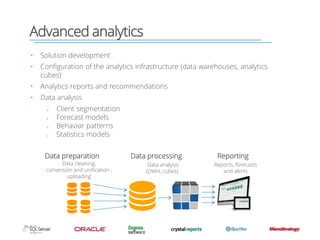

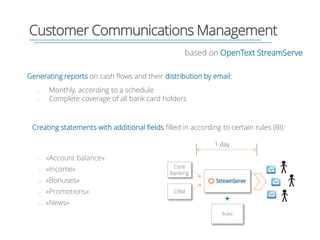

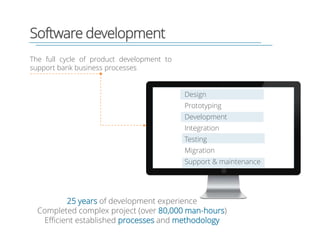

ScienceSoft is an international IT company specializing in software solutions, consulting, and outsourcing for the banking industry. It has over 450 employees and works with customers in over 25 countries. ScienceSoft's banking solutions include mobile banking apps, payment processing, loyalty programs, CRM, internet banking, analytics, portals, security services, and more. The company has developed solutions for major banks and handles projects from design to integration and support.