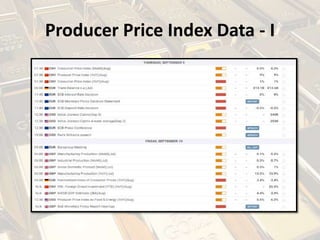

Gold prices rose following disappointing US jobs data that missed forecasts. The document discusses technical analysis showing gold in an upward momentum with resistance at $1,845. It also reviews recent US economic data releases like jobless claims and consumer confidence that missed estimates and weakened the US dollar. The author expects the ECB policy meeting this week and the Fed's Beige Book to impact gold and US dollar prices going forward.