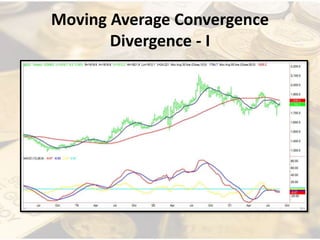

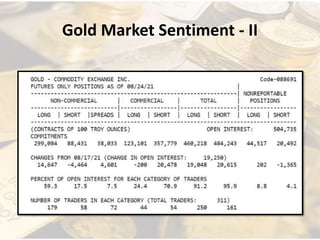

Professional gold traders use technical analysis tools like moving averages and momentum indicators to analyze gold price trends and determine entry and exit points. They also consider fundamental drivers like Treasury yields and the US dollar, as well as sentiment data from futures positioning reports. This information helps traders understand if prices are likely to trend higher or remain range-bound. Bullish traders watch for momentum signals like the RSI breaking above key levels to confirm shifts to an uptrend.