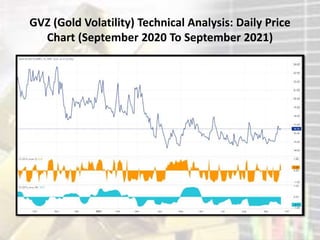

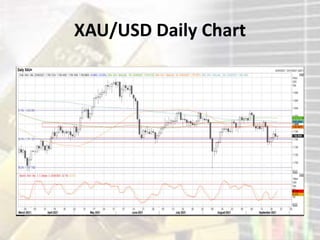

Gold prices have failed to retake key support levels and remain below former uptrends from 2019, 2020, and 2021. Fundamental conditions for gold are unfavorable in the near-term as US Treasury yields and real yields rise, acting as a headwind for gold. Technical indicators on daily, weekly, and monthly charts show gold in a bearish posture with momentum declining. While retail traders remain net-long, their positioning is less extreme than in previous weeks, suggesting the current downtrend in gold prices may soon reverse higher.