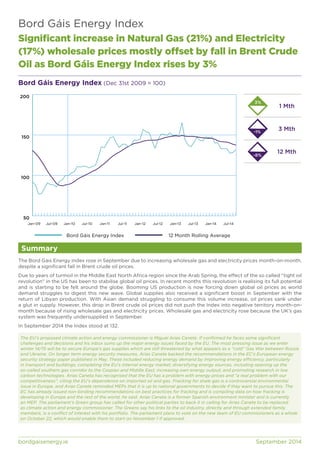

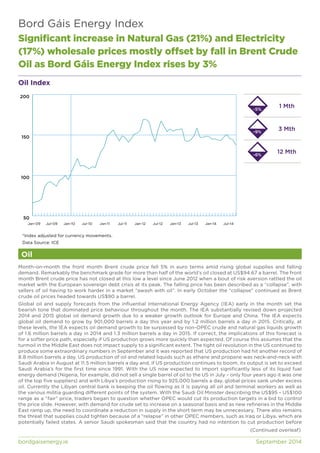

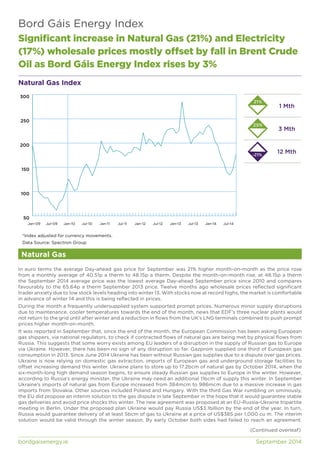

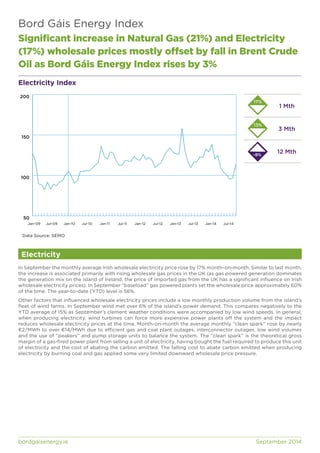

In September 2014, the Bord Gáis Energy Index rose by 3% due to significant increases in natural gas (21%) and electricity (17%) prices, despite a fall in Brent crude oil prices. This rise in energy prices reflects the undersupply of the UK's gas system, while geopolitical tensions, particularly between Russia and Ukraine, threaten Europe's gas supply security. Additionally, the document discusses proposed energy strategies by the EU's climate action commissioner, Miguel Arias Cañete, to address long-term energy issues and competitiveness in the EU.