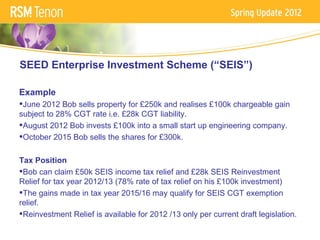

The Seed Enterprise Investment Scheme (SEIS) provides significant tax incentives for individuals investing in small start-up companies, allowing for up to 78% tax relief from income tax and capital gains tax. Investors can claim a 50% income tax relief on investments up to £100,000, with specific conditions regarding shareholding and company eligibility. The legislation has not received royal assent, but is intended to support investment from April 2012 to April 2017, potentially extending beyond that period.