Embed presentation

Downloaded 444 times

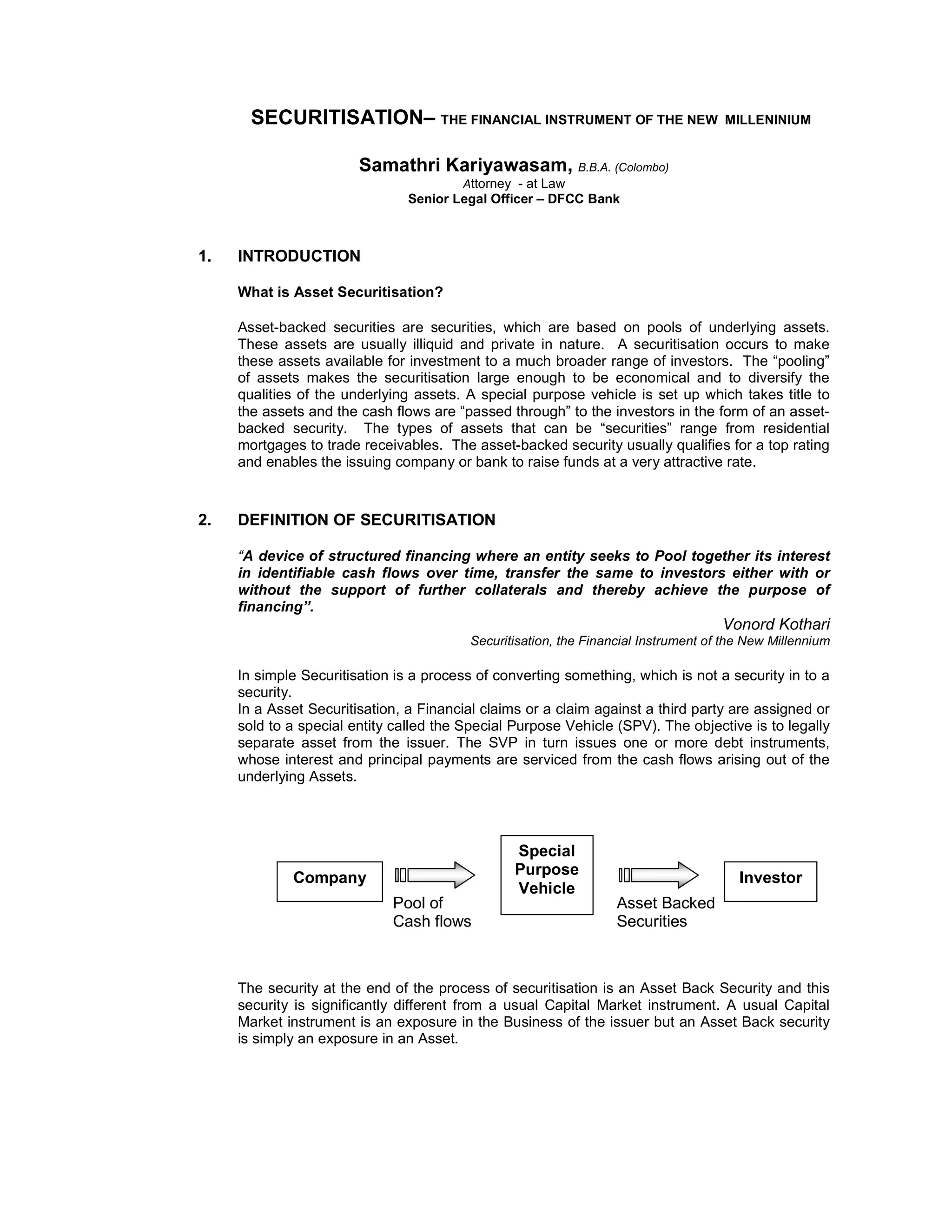

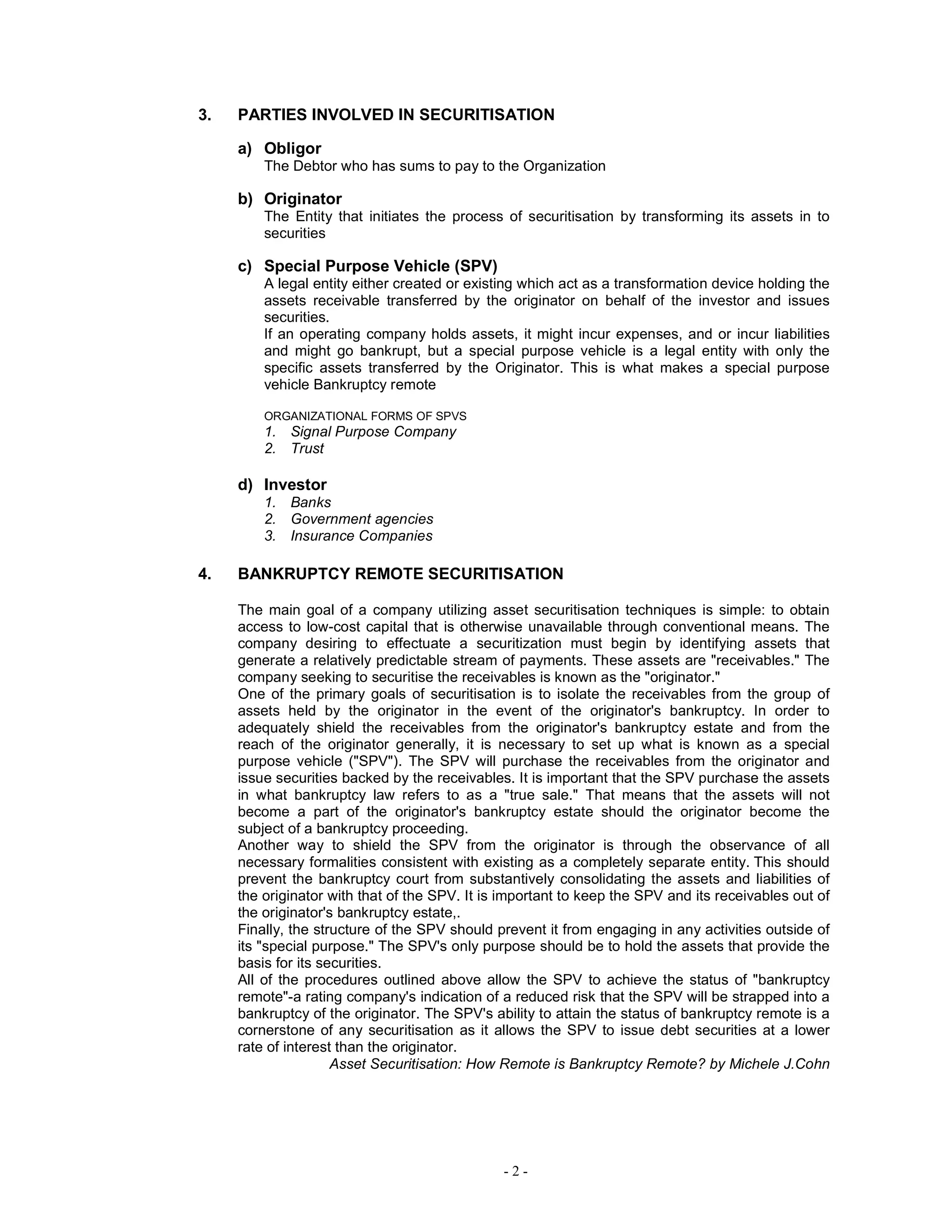

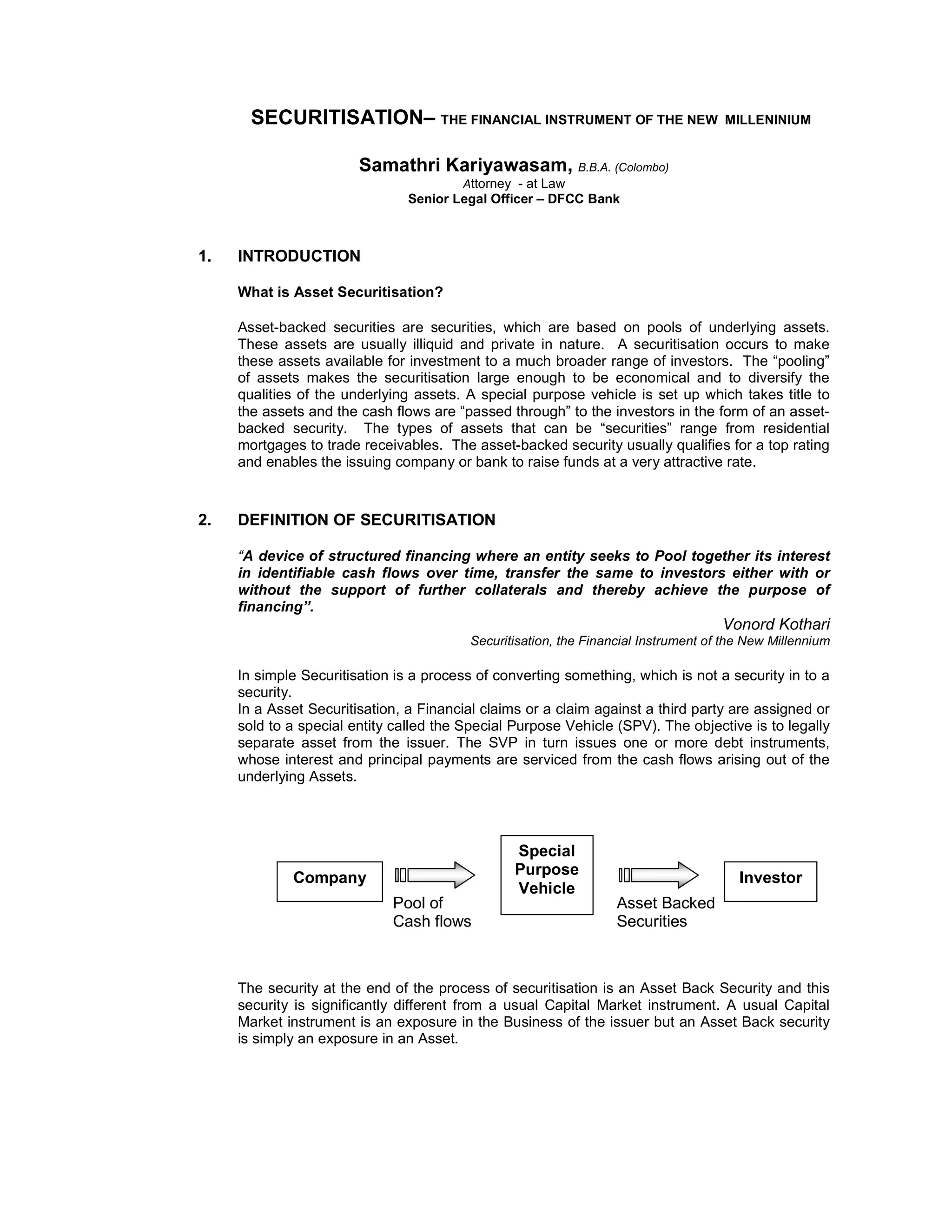

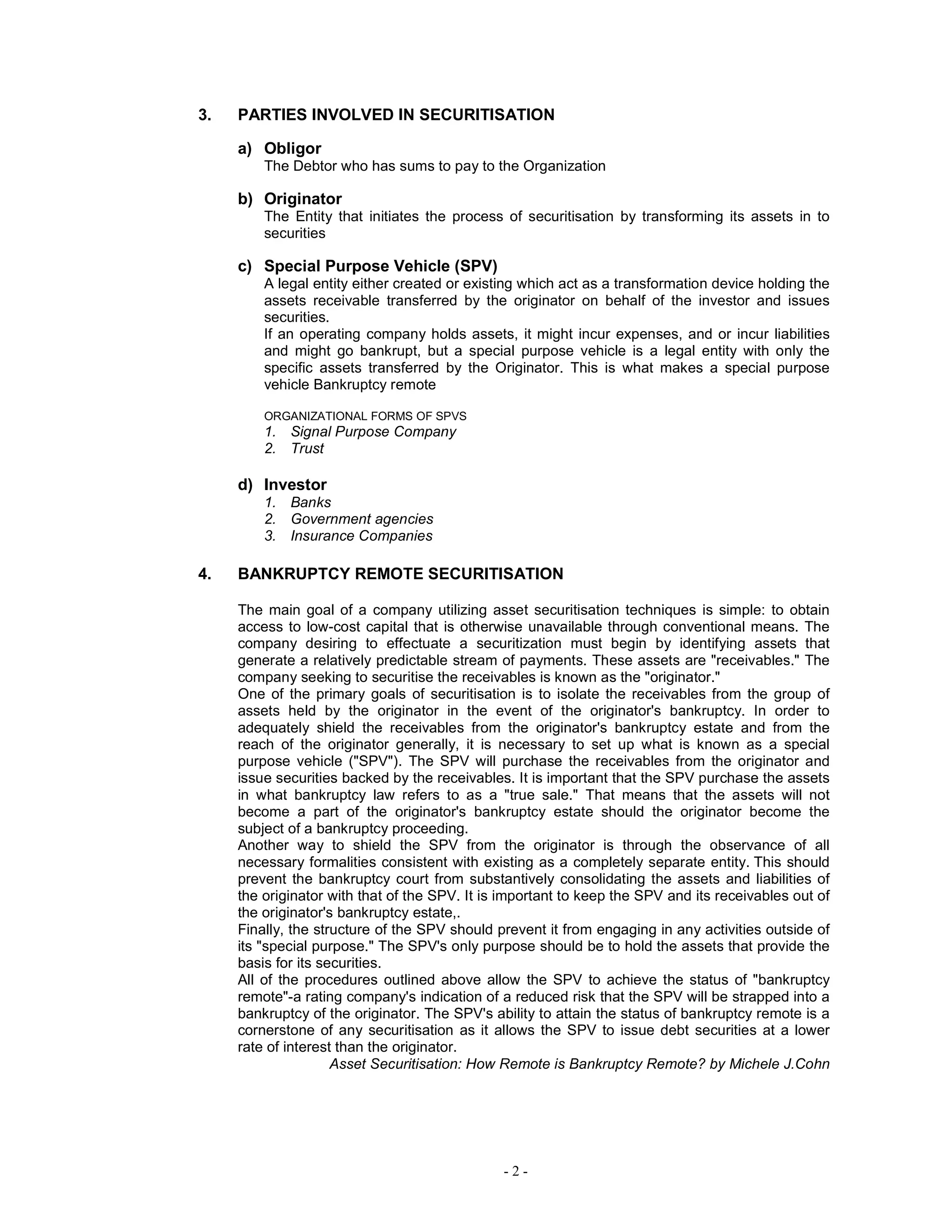

This document discusses securitization, which involves pooling various assets and converting claims on those assets into marketable securities. [1] Securitization allows illiquid assets like mortgages or receivables to be purchased by investors by pooling them into a special purpose vehicle that issues asset-backed securities. This provides the originator access to cheaper funding. [2] For securitization to be "bankruptcy remote", the assets must be truly sold to the SPV and kept separate if the originator goes bankrupt, through proper formalities and preventing commingling of assets. [3] While securitization has grown in Sri Lanka, various legal, tax and administrative issues still hinder its potential