Section 269ST of the Income-tax Act, 1961

•

2 likes•1,958 views

- Section 269ST of the Income Tax Act aims to reduce cash transactions and move towards a less cash economy. It prohibits receiving cash amounts of Rs. 200,000 or more from a person in a day, for a single transaction, or related to one event from a person. - Cash receipts are prohibited if they aggregate to over Rs. 200,000 from a single person in a day, for a single transaction over multiple days, or related to one event from multiple people. Exceptions are made for government entities and transactions covered under other sections. - Issues around cash withdrawals from bank accounts and e-wallet transactions are discussed, as the section's intent is not to restrict normal business or individual cash needs from

Report

Share

Report

Share

Download to read offline

Recommended

Issues in cash transactions under the Income Taxt Act, 1961

This document discusses various sections of the Indian Income Tax Act relating to unexplained expenditures and cash credits. It provides explanations of Sections 40A(3), 40A(3A), 68, 69A, 269SS and 269T. For each section, it outlines the key provisions, issues that may arise in their application, and important court decisions related to their interpretation and implementation. The majority of the document focuses on Sections 40A(3), 40A(3A), and 68, explaining the conditions that trigger their application and the burden of proof requirements they impose on taxpayers.

Income Tax Implications -FY 2022-23.pdf

The document summarizes key income tax implications in India for the financial year 2022-23 based on amendments made in the Finance Act 2022.

It outlines that income tax rates, health and education cess rates, and surcharge rates remain unchanged for FY2022-23. It introduces provisions for taxation of virtual digital assets at 30% and mandatory TDS of 1% on transfer of such assets. It also allows individuals to file an updated income tax return within 24 months of the assessment year on payment of additional tax. The document provides details of various deductions available under Chapter VI-A of the Income Tax Act.

Amendment in section 147&148

Presentation is about the Amendment in the Income escaping assessment procedure under the newly amended Income Tax act 1961 (Finance Act 2021). Along with the details of section 154,263 and 264.

Assessment procedure under it act

There are four main types of assessments under the Income Tax Act: 1) Self-assessment where the taxpayer calculates their own liability; 2) Regular assessment where the tax authority scrutinizes around 2-3% of returns filed; 3) Best judgment assessment where the authority assesses tax based on their judgment if the taxpayer does not file a return or provide complete information; 4) Reassessment where the authority re-examines a taxpayer's income if they believe income was previously missed based on new evidence or records. The document then provides details on the procedures and conditions for each type of assessment.

Clubbing of income.bose

The document discusses various provisions under section 60-65 of the Indian Income Tax Act regarding clubbing of income. It summarizes the key conditions where income from assets may be taxed in the hands of the transferor rather than the transferee. This includes situations involving revocable transfers, transfers to a spouse or minor child without adequate consideration, and transfers for the benefit of the transferor's spouse or son's wife. Exceptions to clubbing are provided if the transfer was made for adequate consideration or under separation agreement.

2. assessment procedure

PPT is about the Income tax assessment procedure under the Income Tax Act 1961, updated with the amendments provided under the Finance Act , 2021

Taxation of dividend

- Dividend income received by shareholders is now taxable in their hands at normal tax rates instead of being exempt as was the case earlier.

- Deduction of up to 20% of dividend income is allowed for interest expenses incurred to earn the dividend income. No other expenses are deductible.

- For companies receiving dividends, a deduction under section 80M is available if the dividend amount is distributed to shareholders one month before the income tax return filing date.

Assessment reassessment.bose

This document discusses provisions related to assessment and reassessment under the Income Tax Act of 1961. It provides an overview of sections 147-153 which deal with assessment or reassessment of income escaping assessment. It discusses the constitutional validity of reassessment provisions, legislative developments, situations that allow for assessment or reassessment under section 147, and key considerations like "reason to believe" and time limits. It also summarizes various court rulings related to the interpretation and application of these sections.

Recommended

Issues in cash transactions under the Income Taxt Act, 1961

This document discusses various sections of the Indian Income Tax Act relating to unexplained expenditures and cash credits. It provides explanations of Sections 40A(3), 40A(3A), 68, 69A, 269SS and 269T. For each section, it outlines the key provisions, issues that may arise in their application, and important court decisions related to their interpretation and implementation. The majority of the document focuses on Sections 40A(3), 40A(3A), and 68, explaining the conditions that trigger their application and the burden of proof requirements they impose on taxpayers.

Income Tax Implications -FY 2022-23.pdf

The document summarizes key income tax implications in India for the financial year 2022-23 based on amendments made in the Finance Act 2022.

It outlines that income tax rates, health and education cess rates, and surcharge rates remain unchanged for FY2022-23. It introduces provisions for taxation of virtual digital assets at 30% and mandatory TDS of 1% on transfer of such assets. It also allows individuals to file an updated income tax return within 24 months of the assessment year on payment of additional tax. The document provides details of various deductions available under Chapter VI-A of the Income Tax Act.

Amendment in section 147&148

Presentation is about the Amendment in the Income escaping assessment procedure under the newly amended Income Tax act 1961 (Finance Act 2021). Along with the details of section 154,263 and 264.

Assessment procedure under it act

There are four main types of assessments under the Income Tax Act: 1) Self-assessment where the taxpayer calculates their own liability; 2) Regular assessment where the tax authority scrutinizes around 2-3% of returns filed; 3) Best judgment assessment where the authority assesses tax based on their judgment if the taxpayer does not file a return or provide complete information; 4) Reassessment where the authority re-examines a taxpayer's income if they believe income was previously missed based on new evidence or records. The document then provides details on the procedures and conditions for each type of assessment.

Clubbing of income.bose

The document discusses various provisions under section 60-65 of the Indian Income Tax Act regarding clubbing of income. It summarizes the key conditions where income from assets may be taxed in the hands of the transferor rather than the transferee. This includes situations involving revocable transfers, transfers to a spouse or minor child without adequate consideration, and transfers for the benefit of the transferor's spouse or son's wife. Exceptions to clubbing are provided if the transfer was made for adequate consideration or under separation agreement.

2. assessment procedure

PPT is about the Income tax assessment procedure under the Income Tax Act 1961, updated with the amendments provided under the Finance Act , 2021

Taxation of dividend

- Dividend income received by shareholders is now taxable in their hands at normal tax rates instead of being exempt as was the case earlier.

- Deduction of up to 20% of dividend income is allowed for interest expenses incurred to earn the dividend income. No other expenses are deductible.

- For companies receiving dividends, a deduction under section 80M is available if the dividend amount is distributed to shareholders one month before the income tax return filing date.

Assessment reassessment.bose

This document discusses provisions related to assessment and reassessment under the Income Tax Act of 1961. It provides an overview of sections 147-153 which deal with assessment or reassessment of income escaping assessment. It discusses the constitutional validity of reassessment provisions, legislative developments, situations that allow for assessment or reassessment under section 147, and key considerations like "reason to believe" and time limits. It also summarizes various court rulings related to the interpretation and application of these sections.

advance payment of tax-ppt.pptx

This document discusses the meaning, conditions, and payment of advance tax in India according to the Income Tax Act. It provides details on:

- When advance tax is required to be paid based on age and income amount.

- The calculation of advance tax amount and the percentage that must be paid by certain due dates (15th of June, September, December, and March).

- Interest charges for late or deferred payment of advance tax installments.

- Conditions where the Assessing Officer can issue an order requiring payment of advance tax.

- Computation of advance tax amount in cases where the Assessing Officer issues such an order.

INCOME TAX ACT, 1961.ppt

This document discusses income tax deduction at source in India. It outlines the roles and responsibilities of the deducting officer (DDO) in deducting tax from different types of income like salary, contracts, compensation, etc. It explains tax rates, thresholds, procedures for depositing deducted taxes, issuing certificates, filing returns, and due dates. Key points covered are types of income, tax deduction account and permanent account numbers, tax rates, limits, certificates, e-filing of returns, and charges payable.

Income tax return

This document outlines the 10 steps for filing an income tax return online in India. It begins by having the user create an e-filing account on the Income Tax website and then download Form 26AS and the appropriate income tax return form. The user then fills out the form with their personal and financial details, validates the information, calculates their tax liability, generates an XML file, and submits the return online. An ITR-V acknowledgement is sent via email that needs to be printed, signed, and mailed to the Income Tax Department. Finally, the user can check the status of their ITR-V receipt.

TDS filing, E-filling of returns

The document provides information about tax deducted at source (TDS) in India. Some key points:

1. TDS is a system where specified payments like salary, rent, professional fees etc are subject to tax deduction at source. The tax deducted is remitted to the government and the deductee gets credit for the tax paid.

2. Every deductor must obtain a Tax Deduction Account Number (TAN) to deduct taxes. TDS must be deducted as per prescribed rates depending on the nature of payment.

3. TDS certificates like Form 16 and Form 16A are issued to deductees stating the tax deducted. These can be used for claiming tax credits.

Presentation on advance tax

How and when to calculate and pay the Advance tax and penal provision in case of failure to pay the Advance Tax

TDS OVERVIEW FOR FY 2019-20

The document discusses various provisions related to tax deducted at source (TDS) in India. It explains the objectives of TDS which include helping report correct incomes, check tax evasion, and widen the tax net. It discusses key sections like 192 on payment of salaries, 193 on interest on securities, 194 on dividends, 194A on interest other than interest on securities, and common provisions around rate of TDS, threshold limits for deduction, and procedures.

Assessment Procedure Indian Income Tax

The document summarizes the procedures for filing income tax returns in India. It discusses:

1) Voluntary returns that must be filed by companies, firms, individuals and HUFs meeting certain income thresholds.

2) Prescribed due dates and forms for different types of taxpayers. Companies and some individuals have a due date of September 30, while most individuals have a July 31 due date.

3) Rules for filing belated or revised returns within one year of the original due date or assessment date.

4) Additional requirements for charitable trusts, political parties, and certain institutions to file by specific due dates using Form ITR-7.

5) Details that must be included in

Presentation on TCS under section 206C (1H )

In this Presentation 헗헿. 헩헶헻헼헱 헞. 헦헶헻헴헵헮헻헶헮 has shared an Overview on "TCS under section 206C (1H)"

Topics Covered in this Presentation :

1. Who is liable to collect tax at the source?

A. “Seller” is required to collect tax at the source.

2. From whom tax is to be collected

A. Tax is required to be collected from buyers of goods.

3. Time of tax collection at source

4. Rate of TCS

5. When TCS is not required

6. Lower/nil TCS certificate

7. A few clarifications

8. Case-studies

TDS 194Q vs TCS 206C(1H)

COMPARISON BETWEEN TDS 194Q VS. TCS 206C(1H) UNDER THE INCOME TAX ACT, 1961. ARE YOU A SELLER OR BUYER.. WHICH ONE IS APPLICABLE ON YOU ?

ITR filing ( Income Tax Return)

This document provides information about income tax returns (ITR) in India, including what an ITR is, why ITRs should be filed, the different types of ITR forms, and eligibility for each form. There are 7 main ITR forms - ITR1 (for individuals with certain income types up to Rs. 50 lakhs), ITR2, ITR3, ITR4 (for small businesses and professionals), ITR5, ITR6, and ITR7 (for specific entity types). The document outlines the income sources and eligibility criteria for each ITR form and provides details on how to file each form online.

S 10-Time and value of Supply

The document discusses the concepts of time of supply and value of taxable supply under the CGST Act.

It outlines various scenarios for determining the time of supply for goods and services. This includes the time of supply for reverse charge transactions, supply through vouchers, and in cases where the invoice is issued before or after the supplier's deadline.

It also discusses how to determine the time of supply when there is a change in the tax rate. Finally, it discusses what values are included and excluded from the transaction value for determining the value of a taxable supply.

TDS 194C & 194I

TDS is required to be deducted from payments made to resident contractors or sub-contractors under section 194C of the Income Tax Act if the aggregate amount exceeds Rs. 75,000 in a financial year. TDS of 1% or 2% depending on the recipient must be deducted unless the PAN is not quoted, in which case the rate is 20%. The deducted TDS must be deposited with the government within 7 days of the end of the month in which the deduction was made.

Lesson 16 advanced tax

This document discusses advance tax in India. Advance tax must be paid if tax liability is Rs. 5,000 or more. It is paid in installments throughout the previous year by both corporate and non-corporate assessees. For non-corporate assessees, installments are due on September 15, December 15, and March 15. For corporate assessees, installments are due on June 15, September 15, December 15, and March 15. Advance tax aims to collect tax revenue earlier and is also known as the "pay as you earn" scheme since tax is paid as income is earned in the previous year.

GSTR-9 (ANNUAL RETURN)

The PPT contains provision relating to GST Annual Return and form notified. (Please note the understanding is based on the law and format prevailing as on date of uploading and there are some onion and interpretation involve which may vary).

03 residential status 17 18 ay

- Residential status determines an individual's tax liability in India and depends on the number of days spent in India in the relevant fiscal year and previous years.

- For individuals, residential status can be ordinarily resident, not ordinarily resident, or non-resident depending on whether basic conditions regarding number of days in India are met as well as additional conditions for ordinarily resident status.

- For Hindu Undivided Families (HUFs), residential status depends on whether control and management of the HUF is wholly or partly located in India. Ordinarily resident status for HUFs also considers conditions for the karta or manager.

- Other entities like firms, companies, and other persons are considered

Salaries notes

- Salaries received from employment are taxable under the head "income from salaries". This includes basic pay, bonuses, commissions, allowances, perks provided by the employer, and retirement benefits like pension and gratuity (subject to exemptions).

- Certain allowances and benefits are fully or partially tax exempt such as leave travel concession, medical reimbursements, rent free accommodation, interest free loans, etc. as per specified limits and conditions.

- The valuation and tax treatment of various types of non-monetary perquisites like cars, household employees, education, etc. is explained based on factors like employee category, location, and actual usage.

- Common deductions available from salary income include standard deduction,

GST RETURNS [ TAXATION ]![GST RETURNS [ TAXATION ]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![GST RETURNS [ TAXATION ]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This power point presentation is aimed at giving you a short summary about the returns filed under GST by the various taxpayers in our country.

Assessment procedure

The document summarizes different types of tax assessments in India: self-assessment, intimation, scrutiny assessment, best judgment assessment, income escaping assessment, and assessment in case of search. It provides details on the procedures, timelines, and circumstances for each type of assessment. Key points covered include types of adjustments that can be made under intimation assessment, when a scrutiny notice can be issued, the 21-month deadline for completing scrutiny assessments, and that assessments are required for the 6 years preceding a search/requisition.

Deductions out of Gross Total Income

Deductions in respect of Certain Payments under Section 80C to 80GGC

Deductions in respect of Certain Incomes under section 80IA to 80U

Concept of residence under income tax act (with the concept of dtaa and poem)

The concept of Residence under Income tax is a very critical issue as incidence of tax differs on the basis of Residential nature of the assessee.Further the concept of POEM and DTAA is very relevant issues which are to be read with it.

269st and 271j

Section 269ST and 271J of the Income Tax Act 1961 place limitations on cash transactions and introduce penalties for professionals who provide incorrect information.

Section 269ST bans the receipt of more than Rs. 2 lacs in cash per day or transaction from a person. It also prohibits the receipt of over Rs. 2 lacs in cash for a single event or occasion from a person. Anyone who receives funds in violation of these rules will be penalized an equivalent amount.

Section 271J introduces a penalty of Rs. 10,000 for accountants, merchant bankers, or registered valuers who furnish incorrect information in any report or certificate provided under the Income Tax Act. It aims to ensure professionals conduct proper due diligence before

Section 269 st and 271j

1. The document discusses new provisions introduced in Sections 269ST and 271J of the Income Tax Act regarding restrictions on cash transactions over Rs. 2 lacs and penalties for accountants/professionals providing incorrect information.

2. Section 269ST prohibits the receipt of cash over Rs. 2 lacs and imposes penalties equal to the amount received, while Section 271J allows authorities to impose a Rs. 10,000 penalty on accountants/professionals for each incorrect report or certificate filed.

3. Exceptions to Section 269ST include receipts by government entities and banks, while reasonable cause can exempt penalties under Section 271J.

More Related Content

What's hot

advance payment of tax-ppt.pptx

This document discusses the meaning, conditions, and payment of advance tax in India according to the Income Tax Act. It provides details on:

- When advance tax is required to be paid based on age and income amount.

- The calculation of advance tax amount and the percentage that must be paid by certain due dates (15th of June, September, December, and March).

- Interest charges for late or deferred payment of advance tax installments.

- Conditions where the Assessing Officer can issue an order requiring payment of advance tax.

- Computation of advance tax amount in cases where the Assessing Officer issues such an order.

INCOME TAX ACT, 1961.ppt

This document discusses income tax deduction at source in India. It outlines the roles and responsibilities of the deducting officer (DDO) in deducting tax from different types of income like salary, contracts, compensation, etc. It explains tax rates, thresholds, procedures for depositing deducted taxes, issuing certificates, filing returns, and due dates. Key points covered are types of income, tax deduction account and permanent account numbers, tax rates, limits, certificates, e-filing of returns, and charges payable.

Income tax return

This document outlines the 10 steps for filing an income tax return online in India. It begins by having the user create an e-filing account on the Income Tax website and then download Form 26AS and the appropriate income tax return form. The user then fills out the form with their personal and financial details, validates the information, calculates their tax liability, generates an XML file, and submits the return online. An ITR-V acknowledgement is sent via email that needs to be printed, signed, and mailed to the Income Tax Department. Finally, the user can check the status of their ITR-V receipt.

TDS filing, E-filling of returns

The document provides information about tax deducted at source (TDS) in India. Some key points:

1. TDS is a system where specified payments like salary, rent, professional fees etc are subject to tax deduction at source. The tax deducted is remitted to the government and the deductee gets credit for the tax paid.

2. Every deductor must obtain a Tax Deduction Account Number (TAN) to deduct taxes. TDS must be deducted as per prescribed rates depending on the nature of payment.

3. TDS certificates like Form 16 and Form 16A are issued to deductees stating the tax deducted. These can be used for claiming tax credits.

Presentation on advance tax

How and when to calculate and pay the Advance tax and penal provision in case of failure to pay the Advance Tax

TDS OVERVIEW FOR FY 2019-20

The document discusses various provisions related to tax deducted at source (TDS) in India. It explains the objectives of TDS which include helping report correct incomes, check tax evasion, and widen the tax net. It discusses key sections like 192 on payment of salaries, 193 on interest on securities, 194 on dividends, 194A on interest other than interest on securities, and common provisions around rate of TDS, threshold limits for deduction, and procedures.

Assessment Procedure Indian Income Tax

The document summarizes the procedures for filing income tax returns in India. It discusses:

1) Voluntary returns that must be filed by companies, firms, individuals and HUFs meeting certain income thresholds.

2) Prescribed due dates and forms for different types of taxpayers. Companies and some individuals have a due date of September 30, while most individuals have a July 31 due date.

3) Rules for filing belated or revised returns within one year of the original due date or assessment date.

4) Additional requirements for charitable trusts, political parties, and certain institutions to file by specific due dates using Form ITR-7.

5) Details that must be included in

Presentation on TCS under section 206C (1H )

In this Presentation 헗헿. 헩헶헻헼헱 헞. 헦헶헻헴헵헮헻헶헮 has shared an Overview on "TCS under section 206C (1H)"

Topics Covered in this Presentation :

1. Who is liable to collect tax at the source?

A. “Seller” is required to collect tax at the source.

2. From whom tax is to be collected

A. Tax is required to be collected from buyers of goods.

3. Time of tax collection at source

4. Rate of TCS

5. When TCS is not required

6. Lower/nil TCS certificate

7. A few clarifications

8. Case-studies

TDS 194Q vs TCS 206C(1H)

COMPARISON BETWEEN TDS 194Q VS. TCS 206C(1H) UNDER THE INCOME TAX ACT, 1961. ARE YOU A SELLER OR BUYER.. WHICH ONE IS APPLICABLE ON YOU ?

ITR filing ( Income Tax Return)

This document provides information about income tax returns (ITR) in India, including what an ITR is, why ITRs should be filed, the different types of ITR forms, and eligibility for each form. There are 7 main ITR forms - ITR1 (for individuals with certain income types up to Rs. 50 lakhs), ITR2, ITR3, ITR4 (for small businesses and professionals), ITR5, ITR6, and ITR7 (for specific entity types). The document outlines the income sources and eligibility criteria for each ITR form and provides details on how to file each form online.

S 10-Time and value of Supply

The document discusses the concepts of time of supply and value of taxable supply under the CGST Act.

It outlines various scenarios for determining the time of supply for goods and services. This includes the time of supply for reverse charge transactions, supply through vouchers, and in cases where the invoice is issued before or after the supplier's deadline.

It also discusses how to determine the time of supply when there is a change in the tax rate. Finally, it discusses what values are included and excluded from the transaction value for determining the value of a taxable supply.

TDS 194C & 194I

TDS is required to be deducted from payments made to resident contractors or sub-contractors under section 194C of the Income Tax Act if the aggregate amount exceeds Rs. 75,000 in a financial year. TDS of 1% or 2% depending on the recipient must be deducted unless the PAN is not quoted, in which case the rate is 20%. The deducted TDS must be deposited with the government within 7 days of the end of the month in which the deduction was made.

Lesson 16 advanced tax

This document discusses advance tax in India. Advance tax must be paid if tax liability is Rs. 5,000 or more. It is paid in installments throughout the previous year by both corporate and non-corporate assessees. For non-corporate assessees, installments are due on September 15, December 15, and March 15. For corporate assessees, installments are due on June 15, September 15, December 15, and March 15. Advance tax aims to collect tax revenue earlier and is also known as the "pay as you earn" scheme since tax is paid as income is earned in the previous year.

GSTR-9 (ANNUAL RETURN)

The PPT contains provision relating to GST Annual Return and form notified. (Please note the understanding is based on the law and format prevailing as on date of uploading and there are some onion and interpretation involve which may vary).

03 residential status 17 18 ay

- Residential status determines an individual's tax liability in India and depends on the number of days spent in India in the relevant fiscal year and previous years.

- For individuals, residential status can be ordinarily resident, not ordinarily resident, or non-resident depending on whether basic conditions regarding number of days in India are met as well as additional conditions for ordinarily resident status.

- For Hindu Undivided Families (HUFs), residential status depends on whether control and management of the HUF is wholly or partly located in India. Ordinarily resident status for HUFs also considers conditions for the karta or manager.

- Other entities like firms, companies, and other persons are considered

Salaries notes

- Salaries received from employment are taxable under the head "income from salaries". This includes basic pay, bonuses, commissions, allowances, perks provided by the employer, and retirement benefits like pension and gratuity (subject to exemptions).

- Certain allowances and benefits are fully or partially tax exempt such as leave travel concession, medical reimbursements, rent free accommodation, interest free loans, etc. as per specified limits and conditions.

- The valuation and tax treatment of various types of non-monetary perquisites like cars, household employees, education, etc. is explained based on factors like employee category, location, and actual usage.

- Common deductions available from salary income include standard deduction,

GST RETURNS [ TAXATION ]![GST RETURNS [ TAXATION ]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![GST RETURNS [ TAXATION ]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This power point presentation is aimed at giving you a short summary about the returns filed under GST by the various taxpayers in our country.

Assessment procedure

The document summarizes different types of tax assessments in India: self-assessment, intimation, scrutiny assessment, best judgment assessment, income escaping assessment, and assessment in case of search. It provides details on the procedures, timelines, and circumstances for each type of assessment. Key points covered include types of adjustments that can be made under intimation assessment, when a scrutiny notice can be issued, the 21-month deadline for completing scrutiny assessments, and that assessments are required for the 6 years preceding a search/requisition.

Deductions out of Gross Total Income

Deductions in respect of Certain Payments under Section 80C to 80GGC

Deductions in respect of Certain Incomes under section 80IA to 80U

Concept of residence under income tax act (with the concept of dtaa and poem)

The concept of Residence under Income tax is a very critical issue as incidence of tax differs on the basis of Residential nature of the assessee.Further the concept of POEM and DTAA is very relevant issues which are to be read with it.

What's hot (20)

Concept of residence under income tax act (with the concept of dtaa and poem)

Concept of residence under income tax act (with the concept of dtaa and poem)

Similar to Section 269ST of the Income-tax Act, 1961

269st and 271j

Section 269ST and 271J of the Income Tax Act 1961 place limitations on cash transactions and introduce penalties for professionals who provide incorrect information.

Section 269ST bans the receipt of more than Rs. 2 lacs in cash per day or transaction from a person. It also prohibits the receipt of over Rs. 2 lacs in cash for a single event or occasion from a person. Anyone who receives funds in violation of these rules will be penalized an equivalent amount.

Section 271J introduces a penalty of Rs. 10,000 for accountants, merchant bankers, or registered valuers who furnish incorrect information in any report or certificate provided under the Income Tax Act. It aims to ensure professionals conduct proper due diligence before

Section 269 st and 271j

1. The document discusses new provisions introduced in Sections 269ST and 271J of the Income Tax Act regarding restrictions on cash transactions over Rs. 2 lacs and penalties for accountants/professionals providing incorrect information.

2. Section 269ST prohibits the receipt of cash over Rs. 2 lacs and imposes penalties equal to the amount received, while Section 271J allows authorities to impose a Rs. 10,000 penalty on accountants/professionals for each incorrect report or certificate filed.

3. Exceptions to Section 269ST include receipts by government entities and banks, while reasonable cause can exempt penalties under Section 271J.

Presentation on MSME - Cash Less Economy - Relevant to Direct Taxes

1. The document outlines income tax rates for individuals, HUFs, AOPs, BOIs, and AJPs in India for the fiscal year 2017-18. It provides tax slabs and rates for residents below 60 years of age, residents aged 60 or more, and residents aged 80 or more.

2. Key highlights from the tax rates include a rebate of Rs. 2,500 for resident individuals with income up to Rs. 3.5 lakh and tax rates ranging from nil to 30% depending on the income slab. Surcharge of 10-15% is applicable if total income exceeds Rs. 50 lakh or Rs. 1 crore respectively.

3. The

CICASA Bhopal E Newsletter February 2018

The document discusses money laundering and related laws and concepts. It defines money laundering as transforming proceeds from criminal acts like drug trafficking into legitimate assets. It summarizes that money laundering typically involves 3 steps: 1) introducing illegally obtained money into the financial system, 2) transferring or concealing the source through complex transactions, 3) making the money appear legitimate. The key anti-money laundering laws and Prevention of Money Laundering Act 2002 in India are also summarized along with common money laundering techniques and objectives of criminalizing such acts.

section 269ss of income tax act video conent.pptx

Section 269SS of the Income Tax Act specifies restrictions on accepting loans, deposits or specified sums exceeding Rs. 20,000 in cash. It states that no person shall take or accept from any other person loans, deposits or specified sums exceeding Rs. 20,000 through means other than account payee cheque, bank draft, electronic clearing or specified digital payment modes. The section also considers aggregate amounts from the same person on the same day or unpaid amounts from earlier loans/deposits. Exceptions include transactions with government bodies, relatives during emergencies, and loans between family members given for support rather than tax evasion. Violations are punishable under Section 271D with penalty equal to the amount accepted in cash.

Economics Banking & stock Market & credit creation ppt

The document provides information about economics, banking functions, and financial markets. It discusses:

1) The evolution of economics from its origins in political economy to its current definition as a science dealing with allocation of scarce resources. It also discusses microeconomics and macroeconomics.

2) The key functions of commercial banks which include accepting deposits and granting loans. It explains various types of bank accounts and loans.

3) Financial markets which have a capital market including stock exchanges, and a money market for short term debt instruments.

Lecture 4 commercial bank, cash reserve,credit creation

Commercial banks provide services like accepting deposits, making business loans, and offering investment products. They primarily accept deposits from customers and use those funds to issue loans. When customers deposit money, banks only keep a portion as reserves as required by law, usually 10%, and lend out the rest. This allows banks to create new deposits and expand the money supply through a multiplier effect. As deposits from one bank are deposited in other banks and those banks lend funds again, the amount of credit created can be several times the initial deposit through the process of multiple expansion.

Demonitization and its tax impacts

The document provides information on the impacts of demonetization in India. It discusses how demonetization aims to tackle black money, eliminate fake currency, and lower cash transactions. It outlines tax impacts for honest taxpayers versus dishonest taxpayers. It details the process of depositing cash in banks, potential inquiries by tax departments, and requirements to explain cash sources. It also covers proposed penalties for unexplained cash deposits, impacts of benami transactions, and details of the Pradhan Mantri Garib Kalyan Yojana tax amnesty scheme.

Commercial bank and credit

- Banks act as financial intermediaries that accept deposits from savers and lend funds to borrowers. The main types of banks are central banks, commercial banks, and development banks.

- Commercial banks solicit deposits and use those funds to issue loans. Their main objective is profit-making. They accept various types of deposits like demand deposits, savings accounts, and fixed/time deposits.

- In addition to deposit and lending functions, commercial banks facilitate payments through instruments like checks, transfer funds, provide agency services, and offer other financial services. They also engage in credit creation by lending out deposits received, thereby expanding the money supply.

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

The document summarizes steps taken in the Budget 2017 to discourage cash transactions and curb black money in India. Key points include:

1) New sections 269ST and 271DA were introduced to restrict cash transactions over Rs. 2 lakhs and impose penalties for violations.

2) Capital expenditures over Rs. 10,000 and revenue expenditures over Rs. 10,000 made in cash will not be eligible for tax deductions or investment benefits.

3) The presumptive tax rate was reduced to 6% for small businesses receiving payments through digital modes to promote cashless transactions.

banking law and precedent

This document discusses key concepts related to banking. It begins by defining what a bank is - a financial institution where customers can save or borrow money. It then outlines some of the principal functions of banks such as receiving deposits, paying interest, making loans, and more. The document also defines related terms like banking, banker, and customer. It discusses the objectives and characteristics of banking business. Finally, it covers topics like the classification of banks, the relationship between bankers and customers, and obligations of bankers.

financial intermediares

Financial intermediaries connect borrowers and lenders by accepting funds from lenders and loaning them to borrowers. They perform maturity transformation, risk transformation, and convenience denomination. Major types of financial intermediaries in India include commercial banks, the Reserve Bank of India, savings banks, life and general insurance companies, investment companies, trusts, and government lending institutions like NHB. Commercial banks promote capital formation, investment, and development. The RBI acts as the central bank that regulates other banks and implements monetary policy.

Credit creation

Commercial banks are able to lend out and create much more money in the form of bank deposits than the amount of money they hold in reserves from customers. This process of credit creation allows banks to finance sectors of the economy and promote development. When a customer deposits cash in a bank, the bank can keep a portion as reserves and lend out the rest, allowing the borrower to make new deposits and the process to repeat across multiple banks in a multiplier effect, expanding the total money supply. However, credit creation is limited by factors like required reserve ratios, the amount of cash received, and monetary policies set by central banks.

P.karthiga

Finance and banking play a key role in modern business and economic development. The document discusses various aspects of the banker-customer relationship including general relationships as debtor-creditor and special relationships as agent-principal or trustee-beneficiary. It also covers the roles and duties of collecting bankers who undertake cheque collection and paying bankers who honor cheques drawn on their banks.

Ppt cash book navneet mishra

The cash book is a special journal used to record all cash receipts and payments. It has two parts - receipts on the debit side and payments on the credit side. It serves as both a journal and ledger by recording chronological cash transactions and maintaining balances. The cash book helps ascertain cash and bank balances without physical verification and verifies the correctness of balances. It is an important book that gives daily closing cash and bank balances.

Bg.sblc procedure & guide

This document describes the leasing of bank guarantees and standby letters of credit. It states that while these financial instruments cannot physically be leased, it is possible to effectively import them through collateral transfer agreements where a provider pledges assets to issue the guarantee. The document provides details on the transaction process, fees, and documentation required. It clarifies that these transactions involve collateral transfer rather than an actual lease, and warns against purchases of guarantees which are not possible.

RBI GUIDELINES FOR BANKS

The document provides guidelines for banks on Know Your Customer (KYC) norms, branch licensing for Regional Rural Banks, cash reserve and statutory liquidity requirements for cooperative banks, and reporting fraud and maintaining deposit accounts. It outlines the objectives of KYC procedures, criteria for accepting customers, monitoring transactions, and establishing risk management policies. It also provides thresholds for reporting fraud cases to the police or CBI and relaxing conditions for RRBs to open branches in certain tiers or centers.

BANKING(3)

This document discusses different types of bank accounts including fixed deposit accounts, savings accounts, recurring deposit accounts, and current accounts. It provides details on opening each type of account, such as fixed deposit accounts requiring deposit of money for a fixed period at a predetermined interest rate. Savings accounts have restrictions and earn interest, while current accounts allow unlimited withdrawals and may provide overdraft facilities. The document also covers special considerations for opening accounts for minors, married women, illiterate persons, and lunatics.

Banking and credit

The document discusses banking and credit. It begins by explaining that banks play an important role in facilitating economic production, distribution, and business activities by accepting deposits and providing loans. It then discusses the meaning of a bank and banking, the primary functions of banks which are accepting deposits and providing loans, the meaning of credit and the process of credit creation, and the different types of banks in India including commercial banks, cooperative banks, development banks, and the Reserve Bank of India.

Fund and non fund based Business of DCCB

The document discusses various types of bank income, including interest income (fund-based income) and non-interest income (non-fund based income). It notes that interest income is generated from the spread between interest banks earn on loans and pay on deposits. The main components of interest income are income from lending money and investments. Non-interest income includes fees from services like remittances, trading commissions, and wealth management. As net interest margins have declined, banks have increasingly focused on fee-based non-interest income to diversify their revenue streams and reduce risk.

Similar to Section 269ST of the Income-tax Act, 1961 (20)

Presentation on MSME - Cash Less Economy - Relevant to Direct Taxes

Presentation on MSME - Cash Less Economy - Relevant to Direct Taxes

Economics Banking & stock Market & credit creation ppt

Economics Banking & stock Market & credit creation ppt

Lecture 4 commercial bank, cash reserve,credit creation

Lecture 4 commercial bank, cash reserve,credit creation

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

Recently uploaded

Search Warrants for NH Law Enforcement Officers

Training aid for law enforcement officers related to search warrants, the requirements needed, drafting, and execution of the search warrant.

The Work Permit for Self-Employed Persons in Italy

Learn more on how to obtain the work permit for self-employed persons in Italy at https://immigration-italy.com/selfemployment-work-permit-in-italy/.

San Remo Manual on International Law Applicable to Armed Conflict at Sea

Presentation by Justin Ordoyo

University of the Philippines College of Law

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

slide deck : Patenting innovations in 3D printing

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Presentation slides for a session held on June 4, 2024, at Kyoto University. This presentation is based on the presenter’s recent paper, coauthored with Hwang Lee, Professor, Korea University, with the same title, published in the Journal of Business Administration & Law, Volume 34, No. 2 (April 2024). The paper, written in Korean, is available at <https://shorturl.at/GCWcI>.

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

This guide aims to provide information on how lawyers will be able to use the opportunities provided by AI tools and how such tools could help the business processes of small firms. Its objective is to provide lawyers with some background to understand what they can and cannot realistically expect from these products. This guide aims to give a reference point for small law practices in the EU

against which they can evaluate those classes of AI applications that are probably the most relevant for them.

一比一原版(Lincoln毕业证)新西兰林肯大学毕业证如何办理

Lincoln硕士毕业证成绩单【微信95270640】办理新西兰林肯大学毕业证原版一模一样、Lincoln毕业证制作【Q微信95270640】《新西兰林肯大学毕业证购买流程》《Lincoln成绩单制作》新西兰林肯大学毕业证书Lincoln毕业证文凭新西兰林肯大学

本科毕业证书,学历学位认证如何办理【留学国外学位学历认证、毕业证、成绩单、大学Offer、雅思托福代考、语言证书、学生卡、高仿教育部认证等一切高仿或者真实可查认证服务】代办国外(海外)英国、加拿大、美国、新西兰、澳大利亚、新西兰等国外各大学毕业证、文凭学历证书、成绩单、学历学位认证真实可查。

[留学文凭学历认证(留信认证使馆认证)新西兰林肯大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理新西兰林肯大学新西兰林肯大学毕业证学位证信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。问山娃想买什么想吃什么山娃知道父亲赚钱很辛苦除了书籍和文具山娃啥也不要能牵着父亲的手满城闲逛他已心满意足了父亲连挑了三套童装叫山娃试穿山娃有点不想父亲说城里不比乡下要穿得漂漂亮亮爸怎么不穿得漂亮望着父亲山娃反问道父亲听了并不回答只是吃吃地笑山娃很精神越逛越起劲父亲却越逛越疲倦望着父亲呵欠连天的样子山娃也说困了累了回家吧小屋闷罐一般头顶上的三叶扇彻夜呜呜作响搅得满屋热气腾腾也搅得山娃心烦意乱父亲一的

原版制作(PSU毕业证书)宾州州立大学公园分校毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(PSU毕业证书)宾州州立大学公园分校毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

Discover how Mississauga criminal defence lawyers defend clients facing weapon offence charges with expert legal guidance and courtroom representation.

To know more visit: https://www.saini-law.com/

Matthew Professional CV experienced Government Liaison

As an experienced Government Liaison, I have demonstrated expertise in Corporate Governance. My skill set includes senior-level management in Contract Management, Legal Support, and Diplomatic Relations. I have also gained proficiency as a Corporate Liaison, utilizing my strong background in accounting, finance, and legal, with a Bachelor's degree (B.A.) from California State University. My Administrative Skills further strengthen my ability to contribute to the growth and success of any organization.

The Future of Criminal Defense Lawyer in India.pdf

https://veteranlegal.in/defense-lawyer-in-india/ | Criminal defense Lawyer in India has always been a vital aspect of the country's legal system. As defenders of justice, criminal Defense Lawyer play a critical role in ensuring that individuals accused of crimes receive a fair trial and that their constitutional rights are protected. As India evolves socially, economically, and technologically, the role and future of criminal Defense Lawyer are also undergoing significant changes. This comprehensive blog explores the current landscape, challenges, technological advancements, and prospects for criminal Defense Lawyer in India.

Lifting the Corporate Veil. Power Point Presentation

"Lifting the Corporate Veil" is a legal concept that refers to the judicial act of disregarding the separate legal personality of a corporation or limited liability company (LLC). Normally, a corporation is considered a legal entity separate from its shareholders or members, meaning that the personal assets of shareholders or members are protected from the liabilities of the corporation. However, there are certain situations where courts may decide to "pierce" or "lift" the corporate veil, holding shareholders or members personally liable for the debts or actions of the corporation.

Here are some common scenarios in which courts might lift the corporate veil:

Fraud or Illegality: If shareholders or members use the corporate structure to perpetrate fraud, evade legal obligations, or engage in illegal activities, courts may disregard the corporate entity and hold those individuals personally liable.

Undercapitalization: If a corporation is formed with insufficient capital to conduct its intended business and meet its foreseeable liabilities, and this lack of capitalization results in harm to creditors or other parties, courts may lift the corporate veil to hold shareholders or members liable.

Failure to Observe Corporate Formalities: Corporations and LLCs are required to observe certain formalities, such as holding regular meetings, maintaining separate financial records, and avoiding commingling of personal and corporate assets. If these formalities are not observed and the corporate structure is used as a mere façade, courts may disregard the corporate entity.

Alter Ego: If there is such a unity of interest and ownership between the corporation and its shareholders or members that the separate personalities of the corporation and the individuals no longer exist, courts may treat the corporation as the alter ego of its owners and hold them personally liable.

Group Enterprises: In some cases, where multiple corporations are closely related or form part of a single economic unit, courts may pierce the corporate veil to achieve equity, particularly if one corporation's actions harm creditors or other stakeholders and the corporate structure is being used to shield culpable parties from liability.

Genocide in International Criminal Law.pptx

Excited to share insights from my recent presentation on genocide! 💡 In light of ongoing debates, it's crucial to delve into the nuances of this grave crime.

Receivership and liquidation Accounts Prof. Oyedokun.pptx

Receivership and liquidation Accounts Prof. Oyedokun.pptxGodwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Receivership and liquidation Accounts

Being a Paper Presented at Business Recovery and Insolvency Practitioners Association of Nigeria (BRIPAN) on Friday, August 18, 2023.

From Promise to Practice. Implementing AI in Legal Environments

Pim Betist's presentation about generative AI in the legal sector at Lexpo.com '24

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

Human rights of LGBTQ people in India, constitutional and judicial approach

What are the common challenges faced by women lawyers working in the legal pr...

The legal profession, which has historically been male-dominated, has experienced a significant increase in the number of women entering the field over the past few decades. Despite this progress, women lawyers continue to encounter various challenges as they strive for top positions.

Recently uploaded (20)

The Work Permit for Self-Employed Persons in Italy

The Work Permit for Self-Employed Persons in Italy

San Remo Manual on International Law Applicable to Armed Conflict at Sea

San Remo Manual on International Law Applicable to Armed Conflict at Sea

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

fnaf lore.pptx ...................................

fnaf lore.pptx ...................................

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

Matthew Professional CV experienced Government Liaison

Matthew Professional CV experienced Government Liaison

The Future of Criminal Defense Lawyer in India.pdf

The Future of Criminal Defense Lawyer in India.pdf

Lifting the Corporate Veil. Power Point Presentation

Lifting the Corporate Veil. Power Point Presentation

Receivership and liquidation Accounts Prof. Oyedokun.pptx

Receivership and liquidation Accounts Prof. Oyedokun.pptx

From Promise to Practice. Implementing AI in Legal Environments

From Promise to Practice. Implementing AI in Legal Environments

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

What are the common challenges faced by women lawyers working in the legal pr...

What are the common challenges faced by women lawyers working in the legal pr...

Section 269ST of the Income-tax Act, 1961

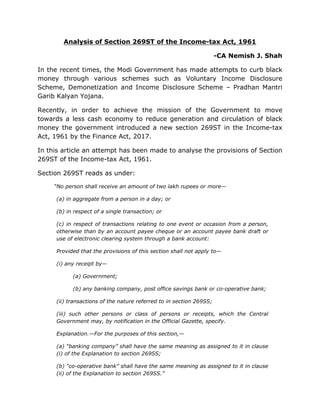

- 1. Analysis of Section 269ST of the Income-tax Act, 1961 -CA Nemish J. Shah In the recent times, the Modi Government has made attempts to curb black money through various schemes such as Voluntary Income Disclosure Scheme, Demonetization and Income Disclosure Scheme – Pradhan Mantri Garib Kalyan Yojana. Recently, in order to achieve the mission of the Government to move towards a less cash economy to reduce generation and circulation of black money the government introduced a new section 269ST in the Income-tax Act, 1961 by the Finance Act, 2017. In this article an attempt has been made to analyse the provisions of Section 269ST of the Income-tax Act, 1961. Section 269ST reads as under: “No person shall receive an amount of two lakh rupees or more— (a) in aggregate from a person in a day; or (b) in respect of a single transaction; or (c) in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account: Provided that the provisions of this section shall not apply to— (i) any receipt by— (a) Government; (b) any banking company, post office savings bank or co-operative bank; (ii) transactions of the nature referred to in section 269SS; (iii) such other persons or class of persons or receipts, which the Central Government may, by notification in the Official Gazette, specify. Explanation.—For the purposes of this section,— (a) “banking company” shall have the same meaning as assigned to it in clause (i) of the Explanation to section 269SS; (b) “co-operative bank” shall have the same meaning as assigned to it in clause (ii) of the Explanation to section 269SS.”

- 2. From the above, we would like to divide the section under three categories: a) Cash receipt from a person The provision state that no person should receive Rs. 2,00,000 in aggregate from a person in a day. That means, you cannot split receipts aggregating to more than Rs. 2,00,000 from a SINGLE person in a DAY i.e. to say that a person may receive cash aggregating to more than Rs. 2,00,000 from different persons in single day or from single person on different days. Illustration: Nature of Cash transactions Section 269ST attracted? A receives 5 installments of Rs. 50,000 each from B in a single day YES A receives 5 installments of Rs. 50,000 each from B in a different days NO A received Rs.150,000 from B and 80,000 from C in single day NO A received Rs.150,000 from B and 80,000 from C in different days NO A receives Rs. 3,00,000 from B against 10 different invoices of Rs. 30,000 in a single day. YES A received Rs. 2,20,000 in respect of invoice raised earlier from B YES b) Cash receipt in respect of a single transaction The provisions state that cash receipt is prohibited even if it aggregates to more than Rs. 2,00,000 in respect of a SINGLE TRANSACTION. i.e. to say even if cash received on different days in respect of a single transaction then it is covered under Section 269ST. Illustration: Nature of Cash transactions Section 269ST attracted?

- 3. A receives Rs. 1,30,000 and Rs. 71,000 from B against Single invoice on different days YES A received payment of more than or equal to Rs. 2,00,000 in respect of construction of building over a period of six months. (construction of building is treated as single transaction) YES c) Cash received in relation to transactions relating to one event or occasion from a person The provision widely covers all receipts from a person relating to one event or occasion such as cash gifts on the occasion of marriage, birthday, anniversary etc. Even gift received from relatives are now covered under the ambit of Section 269ST. Illustration: Nature of Cash transactions Section 269ST attracted? A receives Rs. 1,30,000 and Rs. 71,000 from B on different days on account of his marriage YES A receives Rs. 2,30,000 from B on single day/different days on account of his birthday YES A received Rs. 1,99,999 and his wife receives Rs. 1,99,999 from many people on account of their marriage NO A received Rs. 2,00,400 from many people on account of his marriage anniversary YES Exceptions carved out in Section 269ST The provisions of this section are not applicable if the amount is received by the Government, Banking Company, Post Office or Co- operative bank. Further, if a particular transaction is covered under Section 269SS (where the limit is Rs. 20,000), it will not be covered here.

- 4. Issues arising under this Section Cash withdrawal from bank account: o The provisions clearly spell out that a person shall not receive an amount of Rs. 2,00,000 in aggregate from another person in a day. o Here the main condition of application of this provision is that the person should have received an amount from another person whether on account of sale or loan repayment or gift or any other reason whatsoever. o It is worthwhile to note that when a person opens a savings account or current account with a bank, he is actually allowing the bank to safe-keep his money and the principal- agency relation is established. Thus, the money which is deposited into the bank account does not belong to the bank but the customer. The bank cannot any time deny repaying that amount to the customer. o Further, when the customer issues cheque of that bank to some another person, he actually instructs his own bank to pay his own money to the person mentioned in the cheque. o Thus, it cannot be treated as the asset of the bank. o Furthermore, bank balances are not shown in books of account as receivables or loans and advances but as separate asset alongwith cash balance. o Thus, from the above it is quite clear that balance with the bank in savings or current account is the money of the accountholder and not bank. o The provision does not apply to money received by a person from himself. o Overdraft or CC account are not covered by the provisions of Section 269ST as they are in the nature of loan and so as per the exception, it is covered under Section 269SS. (Section 269SS exempts amount received from banks) o In the conclusion, if it is interpreted that provisions of Section 269ST are also applicable to cash withdrawals from bank account, then though daily items are unlikely to be impacted but unorganized sectors may face hard time. This is clearly not the legislative intent, and if that be, the banks should have been

- 5. advised by the RBI not to allow withdrawals in excess of Rs. 2,00,000 per day. Covering of receipts through E-wallets: o This section does not cover receipts through e-wallets. o Though ideally, any amount of money can be loaded in such e-wallet through banking modes only. o Further, Encashment of the balance in e-wallet can be either done through purchase or transferring it to bank account. Thus, there is no cash involvement under such transactions. o We may wait for the clarification or notification in this regard. Dated: April 05, 2017 Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. Persons should seek independent professional advice before relying on the information in this Article. The author does not accept any liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.