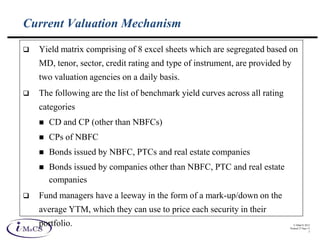

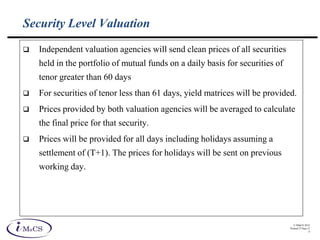

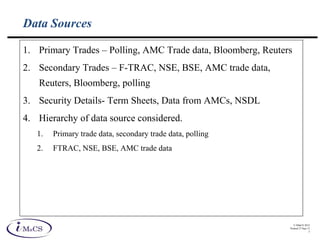

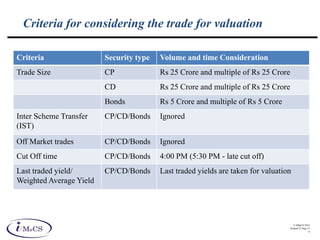

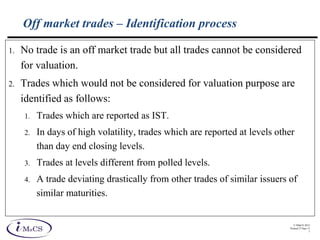

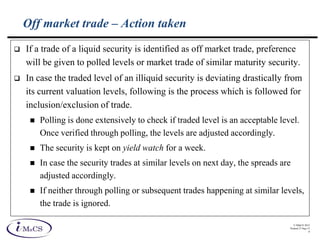

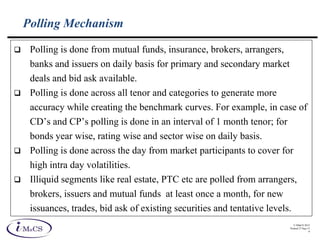

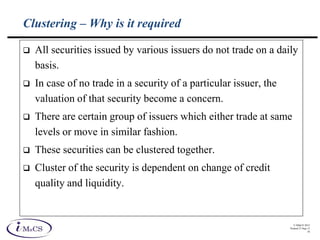

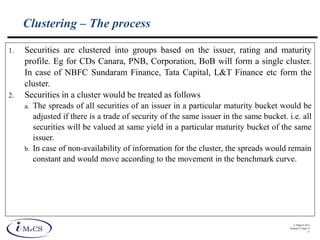

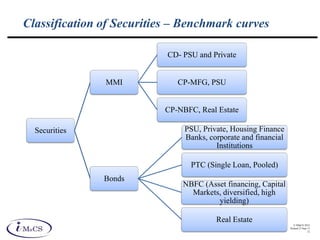

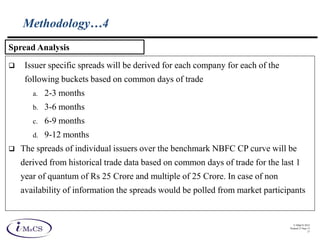

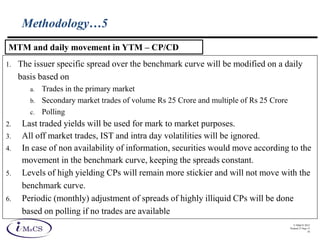

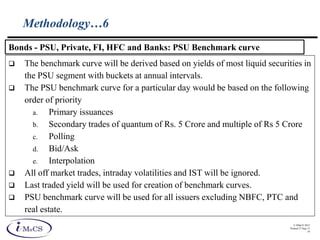

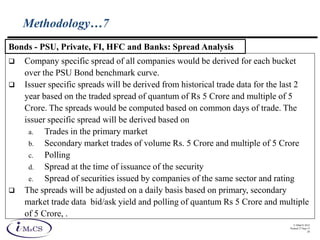

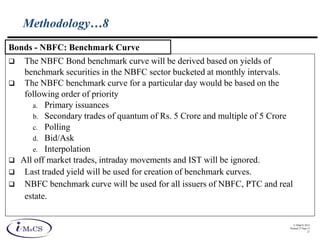

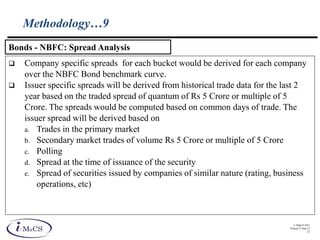

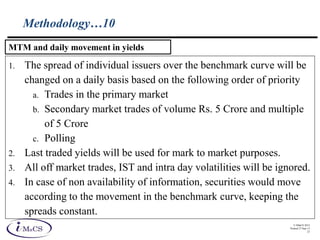

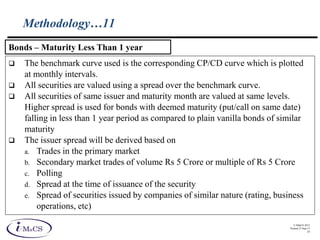

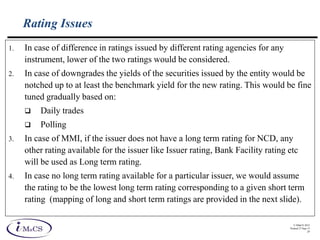

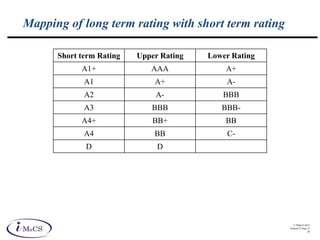

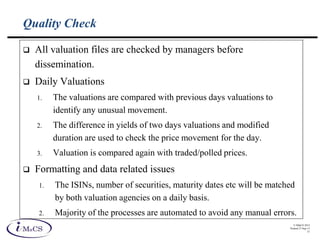

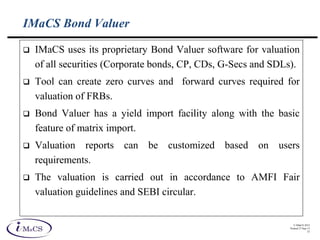

This document outlines the methodology for security level valuation of bonds, commercial papers, and certificates of deposit held by mutual funds in India. It describes the process of generating benchmark yield curves based on primary trades, secondary market data, and polling of market participants. Securities are clustered and priced relative to the benchmark curves, with adjustments made daily based on new trades and polling. Prices are averaged from two independent valuation agencies to determine the final price for each security.