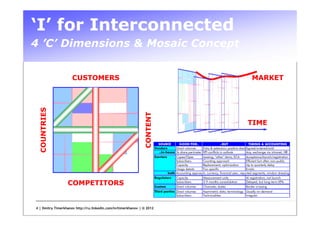

The document presents an analysis of the telecom infrastructure market, discussing market shares, competition dynamics, and consumer behavior. It highlights the challenges of measuring market performance due to various factors like timing, data asymmetry, and inefficiencies. Several tools and strategies are suggested for effective market mapping and understanding the ecosystem.

![‘R’ for Relevance

Timing, Consumers, Ecosystem

Company [A] vs. [B+C]

Market shares parity by country

40%

Highly Positive

inefficient national

NEED:

markets incumbency DESTINATION

30%

Market Share [B+C]

STRATEGIC

PRINCIPLE OF

20%

Negative incumbency PYRAMID

NEED: DIRECTION

10% Tools & Outputs:

MARKET MAPPING,

“MOSAIC” SUMMARIES

0%

REPORTABLE

0% 5% 10% 15% 20% 25%

Market Share [A]

Source: actual observation sam ple in

telecom infrastructure m arket

NEED: INDIVIDUAL STEPS

Sources: PRIMARY NEWS, STATISTICS, REPORTS…

Tools: DAILY-FED SAME-DIMENSION DATABASES

Outputs: FEEDS, “INFLECTION POINTS”, PROJECTS…

TACTICAL

3 | Dmitry Timerkhanov http://ru.linkedin.com/in/timerkhanov | © 2012](https://image.slidesharecdn.com/scipdublinv9fextsshx-121125135618-phpapp02/85/RIF2LE-Integral-Approach-to-Strategic-Intelligence-3-320.jpg)

![[F] for Fun

Don’t Make It Boring

7 | Dmitry Timerkhanov http://ru.linkedin.com/in/timerkhanov | © 2012](https://image.slidesharecdn.com/scipdublinv9fextsshx-121125135618-phpapp02/85/RIF2LE-Integral-Approach-to-Strategic-Intelligence-7-320.jpg)

![[F] for Fun

Mental Shortcuts

8 | Dmitry Timerkhanov http://ru.linkedin.com/in/timerkhanov | © 2012](https://image.slidesharecdn.com/scipdublinv9fextsshx-121125135618-phpapp02/85/RIF2LE-Integral-Approach-to-Strategic-Intelligence-8-320.jpg)