Embed presentation

Download to read offline

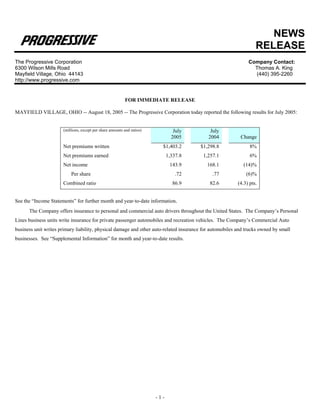

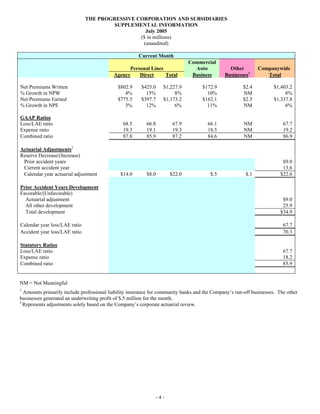

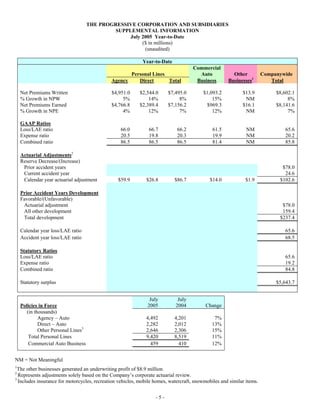

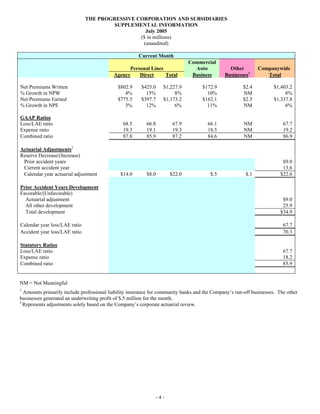

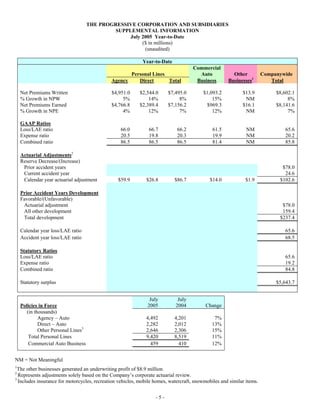

The Progressive Corporation reported its July 2005 results, including: - Net premiums written increased 8% to $1.403 billion compared to July 2004. - Net income decreased 14% to $143.9 million compared to July 2004. - The combined ratio, a measure of profitability, increased 4.3 percentage points to 86.9% compared to July 2004. - Total policies in force increased 11% to 9.42 million compared to July 2004, driven by growth in personal and commercial auto insurance policies.