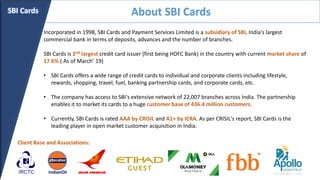

This document provides information on SBI Cards and Payment Services Limited, which is India's second largest credit card issuer. Some key points:

- SBI Cards is a subsidiary of SBI, India's largest commercial bank. It has a 17.6% market share in the credit card industry.

- The company is conducting an initial public offering to raise approximately Rs. 10,286 crores, with 44.6% of shares reserved for institutional buyers.

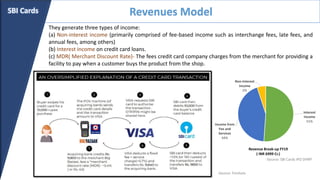

- SBI Cards earns revenue from interest on loans, fees and services, and merchant discount rates. Interest income makes up 51% of total revenue.

- While it has a large customer base and distribution network through SBI, it also faces competition