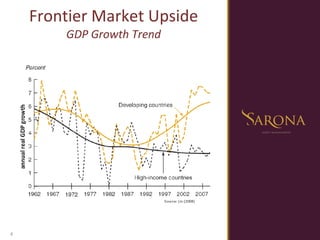

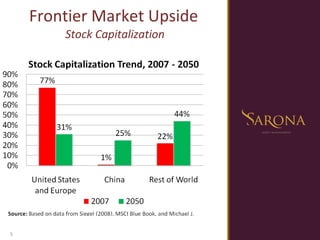

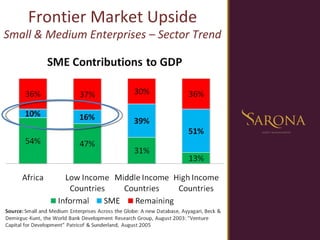

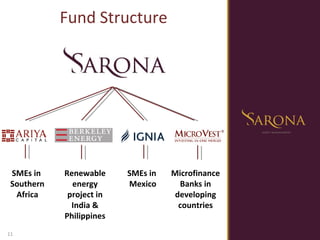

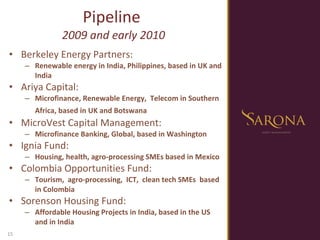

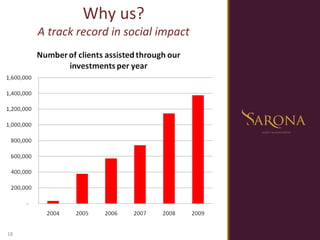

The document summarizes the Sarona Frontier Markets Fund 1 LP, a fund of funds that invests in small and medium enterprises in developing frontier markets to achieve financial returns as well as social and environmental impacts. The fund offers investors diversification across sectors and countries, targeting a 15% annual return over the long run while benefiting people and the planet. It is managed by Sarona Asset Management, which has over 50 years of experience investing in frontier markets and achieving returns that exceed targets.

![1.519.725.1633 1.204.295.9688 Saronafund.com [email_address]](https://image.slidesharecdn.com/20091116sfmf-12585200295835-phpapp01/85/Sarona-Frontier-Markets-Fund-25-320.jpg)