The document summarizes Santos' GLNG project and final investment decision. Key details include:

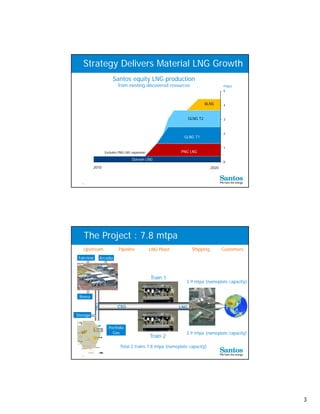

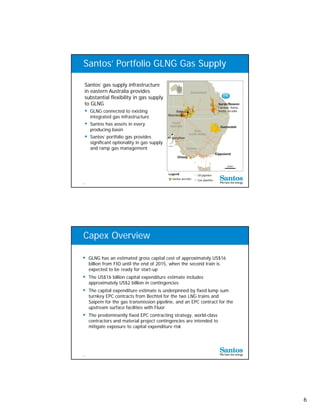

- Santos has a 30% stake in the $16 billion GLNG project consisting of two 3.9 mtpa LNG trains with first exports expected in 2015.

- The project has secured binding off-take agreements with PETRONAS for 3.5 mtpa and KOGAS for 3.5 mtpa of LNG for 20 years.

- Santos expects the project to deliver material LNG growth and establish Santos as a major global LNG producer through 2020 and beyond.