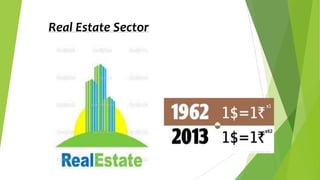

The document discusses the impact of fluctuations in the value of the Indian rupee on various economic sectors. It explains that a depreciating rupee increases costs for sectors that rely on imports, such as infrastructure, manufacturing, and IT. However, export-oriented sectors such as agriculture, pharmaceuticals, and tourism benefit from a weaker currency. The real estate and financial sectors are also affected as construction costs rise and capital becomes more expensive. A variety of short-term measures are proposed to support the rupee including raising oil import tariffs and liberalizing bank deposit schemes.