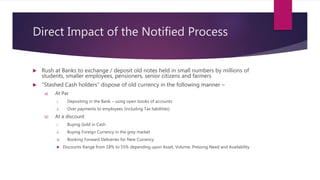

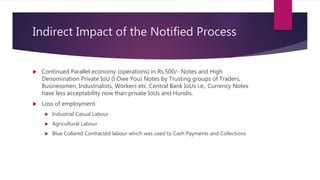

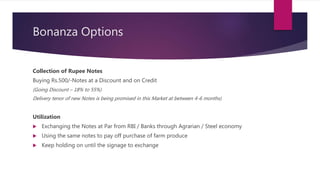

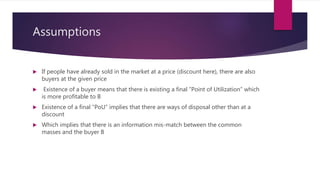

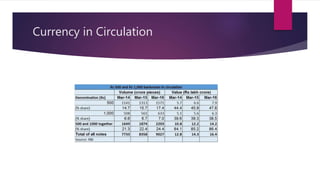

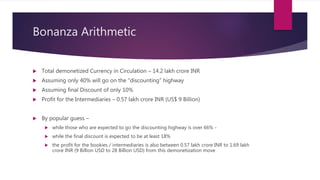

The document discusses India's 2016 demonetization of Rs. 500 and Rs. 1000 currency notes. It notes that these large denomination notes comprised 86% of currency in circulation. The government's stated goals were to reduce corruption by identifying unaccounted wealth, promote digitization of payments, and expand the banking system. However, the document argues that intermediaries were able to profit by buying the demonetized currency at a discount, estimated to be between 0.57-1.69 trillion rupees, and eventually exchanging it at banks for new currency. It recommends steps the government should take to boost production and consumption in the aftermath of demonetization.