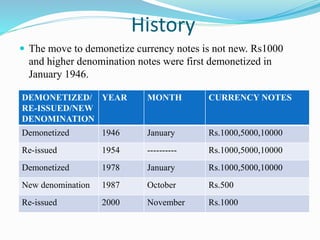

Demonetization is the act of stripping a currency unit of its status as legal tender, requiring a change in national currency. The Indian government recently demonetized Rs. 500 and Rs. 1000 currency notes to tackle black money, lower cash circulation related to corruption, counter fake currency used for terrorism funding, and scoop out over Rs. 5 lakh crore of black money from the economy. While demonetization aims to curb illegal activities funded by black money, it also causes short-term hardship for citizens and shortages in banks and ATMs during the currency exchange period.